If you’ve ever been in an accident in Fort Worth, you know the shock and confusion that follow such an unexpected event. However, there are several things you need to do immediately following any car accident in Fort Worth, from protecting yourself from injury to documenting the incident to taking steps to ensure that your vehicle undergoes repairs or adequate replacement takes place.

What are these things? Find out by reading this article on the seven things you need to do after a car accident in Fort Worth.

1. Contact Fort Worth Car Accident Lawyer

While it’s natural to be worried about your injuries or those of your passengers immediately following an accident, it’s imperative to call a Fort Worth Car Accident Lawyer as soon as possible. Even if you don’t think you were at fault or are unsure of who was, contact an accident attorney in Fort Worth. They will handle the accident scene to protect you and help you make appropriate claims.

It’s vital to preserve all evidence for your claim, such as photographs of the damages before moving the cars, tickets or written warnings issued before the accident, medical records, witness accounts. There is a two-year time limit on filing injury claims or lawsuits arising from auto accidents in Texas.

An experienced attorney can help you understand your legal rights and options as quickly as possible so that you can get proper treatment without worrying about whether or not you have enough funds to pay for it.

2. Gather Details of All Involved Parties

When there’s been an accident, it’s essential to gather all details from both parties and write them down. These details may include driver license numbers, insurance information, names of witnesses, etc. Keep everything organized and safe until your case is over.

If a witness provided their contact information, be sure to ask for their phone number or email address. You never know when you might need to get in touch with someone for more details on how your accident unfolded.

3. Take Pictures With Concrete Details of the Accident

While your mobile phone’s camera may not be as good as those found on digital cameras, it’s probably better than nothing—and it could be vital if police and insurance adjusters ever question who was at fault.

Take photos of your vehicle’s exterior before calling anyone; photos of damage can help prove what happened during an accident. Taking pictures of your body and other injuries is also a good idea since it lets you document them for any legal proceedings.

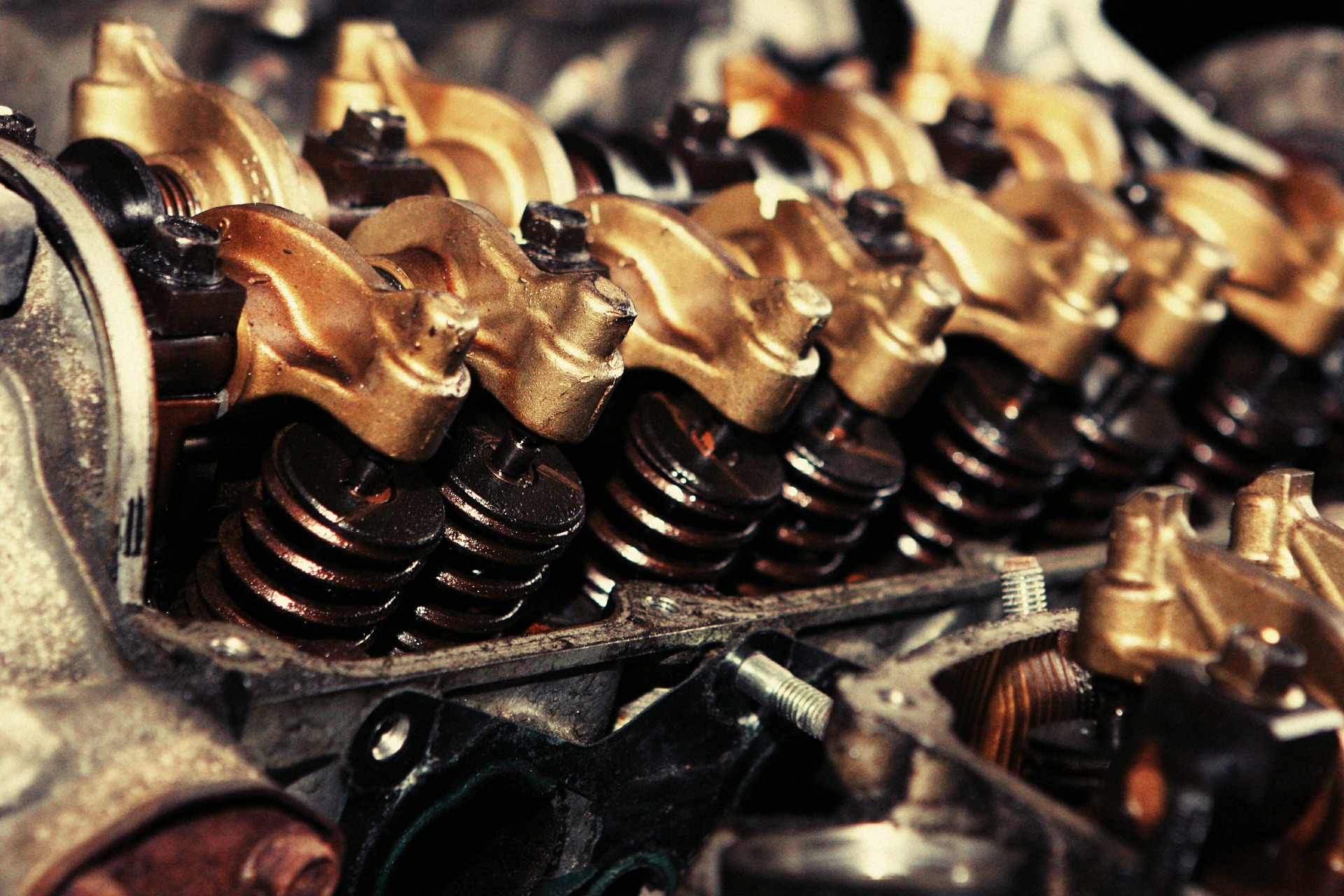

4. Contact Your Insurance Company

Another crucial thing you will want to do after an accident is contacting your insurance company, regardless of who was at fault. Since auto insurance claims can be complicated, especially if there’s another driver involved, it’s always best to talk with your carrier and let them know what happened.

Updating your auto insurance company is crucial since they can give you tips on the next steps or even assist with filing your claim with another party. At this juncture, the accident photos showing damages may help for documentation purposes.

5. Call The Police: A Law Enforcement Officer Witness

In Fort Worth, TX, it’s illegal for one driver to flee an accident scene. If you are involved in an accident with another vehicle, call law enforcers, 911, remain at your location, and wait for law enforcement to arrive. If another driver runs from the scene of an accident, report their license plate number and any other identifying details of the driver, such as hair color, length, and clothing, immediately.

If you leave the scene of a car accident without complying with the state law requirements, they may charge you with a third-degree felony if there were injuries and a second-degree felony in case of death. Therefore, it’s essential to call the police and remain within the accident scene until you comply with the legal requirements.

Consequently, it would be of great importance to contact the Fort Worth Car Accident Lawyer to help you comply with the legal requirements at the accident scene and handle the process as they keep track of the accident and the unfolding events.

6. Notify Your Family and Seek Medical Attention

If you were injured, your first instinct might be to call your loved ones and let them know that everything is okay. The move is wise—but it’s just as crucial for your family and friends to know not everything is well. They may hear about it from somebody else first, but it’s vital they hear from you and get a clear picture of what happened.

Don’t delay getting in touch with your family or close friend, more so if you suffered severe injuries or if someone died as a result of the accident.

Also, don’t hesitate to seek medical attention, even if you feel fine. Many people go wrong after an accident by not seeking medical help until tomorrow. Every minute counts when it comes to diagnosing and treating injuries!

Conclusion

When there’s an accident, our emotions can sometimes get in the way of making good decisions. Take a step back and contact Tate Law Offices if you have suffered injuries in an accident. You will protect your rights, guide you through what to do next, from dealing with insurance companies and filing claims to getting your medical bills paid and your life back on track.

Read Also: