“Is real estate investment trusts a good career path?” the answer to this question is absolute ‘Yes.’ This business is already attracting lots of beginner investors into the market because it consists of a high return on investment.

REITs are actually companies that own finance-producing real estate across various sectors, and investors get huge benefits from this. However, there are a number of requirements to qualify as real estate investment trusts (REITs).

The main purpose of this company is to help communities grow, revitalize, and thrive. This real estate investment trust is located in every state and is considered a crucial part of the United States economy. Now, discuss this in detail.

What Is A Real Estate Investment Trust (REIT)?

As already discussed above, a real estate investment trust or REIT is an investment property that funds income-generating real estate assets. This fund is managed by a firm of shareholders who invest funds in properties such as timberlands, hotels, shopping centers, hospitals, warehouses, apartment buildings, etc.

A REIT is similar to an exchange-traded fund (ETF) or mutual fund. A mutual fund aggregates a number of securities or stocks into a single group. Then, rather than purchasing individual fund shares, investors can purchase shares of a mutual fund.

In a similar way, investors can acquire shares or partial ownership in a real estate investment trust to reap the financial benefits of investing in multiple pieces of real estate or other securities simultaneously.

An advantage of real estate investment trusts is that they offer good investment returns to the investors. This factor is attracting many to invest in this asset. Now, what do you think, Is real estate investment trusts a good career path?

How Does A Company Qualify As A REIT?

There are some requirements for a company to qualify for real estate investment trusts, and these requirements are listed below:

- You need to have at least a hundred shareholders.

- Fifty percent of the shares should not be held by five or fewer individuals.

- The company should be managed by trustees or a board of directors.

- Be an entity that is taxable as a corporation.

- The company must pay at least ninety percent of its taxable income as shareholder profits each year.

- Obtain a minimum of 75% of its gross income from rents, mortgage, or sales of real estate

- Lastly, invest at least 75% of its total assets in real estate.

How Can You Invest In Real Estate Investment Trusts? An investor or a company must buy stocks just like public stock. The investors may buy shares in an exchange-traded fund or REIT mutual fund. On the other hand, there are many jobs available in real estate investment trust, and these include asset management, property management, development, and much more.

Pros Of Real Estate Investment Trusts (REITs) – Is Real Estate Investment Trusts A Good Career Path?

There are some pros and cons of REITs that you need to consider before choosing a real estate investment as a career path.

Have a look at these below-described pros of real estate investment trusts:

i). Performance: This is proven to perform well due to the appreciation of commercial properties.

ii). Diversification: Investing in REIT is regarded as an investment portfolio where the securities and other stocks are down.

iii). Dividends: Provides a stable income stream for investors.

iv). Liquidity: You can easily buy and purchase shares in the market.

v). Transparency: This investment trust is traded on vital stock exchanges that operate under the same rules.

Cons Of Real Estate Investment Trusts (REITs) – Is Real Estate Investment Trusts A Good Career Path?

Now, let’s know the major cons related to real estate investment trusts, and these are described below:

i). Minimal Control: If you are investing in this firm, then be prepared because you cannot control operational decisions, such as plans and strategies.

ii). Management Fees: You may be charged with high transactions and administrative fees.

iii). Investment Risk: There are some factors that can affect your investment, and this includes tax laws, geography, debt, interest rates, and property valuation.

iv). High Tax Payment: The dividends can be taxed the same as normal income, and this is the drawback of REIT. Here, you may have some clarity to your question, “Is real estate investment trusts a good career path”.

V). Slow Growth: More than 90% of profits are given back to investors, and only ten percent are reinvented.

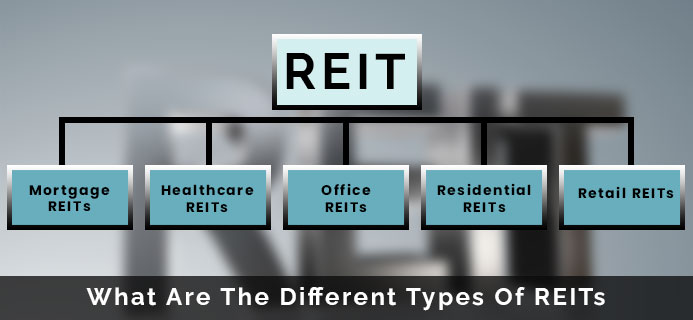

What Are The Different Types Of REITs?

There are actually five types of real estate investment trusts, and these are described below:

1. Mortgage REITs

There is only ten percent of REIT investments are in the mortgage, and this is regarded to be very less risky. For diversifying your portfolio, you must consider this investment for your firm.

2. Office REITs

The name of this investment trust itself signifies that these are investments in office buildings. Office real estate investment trusts get income from the rental income. However, there are some major factors, such as vacancy rates, employment rates, capital, etc., that you need to consider if you are interested in office rent.

3. Healthcare REITs

Healthcare REITs are an excellent choice as in the US; healthcare costs are rising rapidly. This type of trust includes nursing homes, retirement homes, medical centers, hospitals, etc. Hence, it is directly involved in the development of the healthcare system.

4. Residential REITs

Residential REITs include several kinds of rental properties like PGs, job holders, etc. However, before considering this know the economic growth, vacancy rate, job opportunities, and the population.

5. Retail REITs

It is estimated that around twenty-four percent of the total REITs are owned by retail. Therefore, investing in these real estate investment trusts can be the best decision that you can consider in 2024.

What Are The Best Paying Jobs In Real Estate Investment Trust?

Now that you know the answer to “Is real estate investment trusts a good career path,” it is time for you to know about something important!

Before you can figure out how many jobs are available in real estate investment trusts, you need to know which REIT jobs pay the best. Our research indicates that sales representatives, leasing agents, broker positions, fund managers, and a variety of other positions in real estate investment trusts (REITs) are the ones with the highest pay.

The advantages will increase more when you own your own land ventures. Presently, we should talk about the top divisions that get the most significant pay in the land venture trusts.

1. Asset Manager

The Asset Management department of REITs is in charge of monitoring the portfolio’s financial and operational performance. They manage client assets in accordance with investment preferences and goals. Additionally, these managers create, manage, and organize client portfolios.

It is quite possibly the most lucrative work, with compensations going from $70,000 to $1,000,000. They must keep an eye on the business’s financial and operational success. They are also in charge of marketing, finding investors, and checking the returns.

Asset management can be a lucrative career choice, particularly for students of investment banking, finance, and economics with strong performance. BlackRock was the largest asset management company in the world at the end of 2019, managing approximately 7043 trillion dollars in assets. Subsequently, this is actually a colossal sum!

2. Property Manager

You might be surprised to learn that there are currently approximately 15,000 property managers employed in the United States, and this number is increasing. A property manager’s duties include communicating with customers and negotiating the best prices for the sale or rental of property.

They handle everything, from leasing to collections and property upkeep. The best part is that applicants need not meet any minimum requirements to apply for this position. This job pays anywhere from $55,000 to $65,000 per year, and one of the best things about it is how quickly it can grow.

3. Acquisitions

Because they have to find and evaluate potential acquisition targets, working for this job profile requires a lot of analysis. There are many job opportunities in this sector, and the good news is that it pays well—about $80,000 per year.

They must be adept at problem-solving and aware of new revenue-generating investment opportunities. This position is one of the best in the real estate investment trust industry.

Securing divisions gives paying positions in land speculation trusts. However, this is a real estate industry position with a lot of finance.

4. Investor Relations

All communication with REIT shareholders that faces the outside world is managed by this department of real estate investment management. A typical administration financial backer procures up to $150,000. This is huge, and it is regarded as the REIT’s highest-paying job position.

This is your opportunity to work in the finance and accounting division. The best thing about it is that it pays well and has good potential for growth.

In addition, organizing and preparing for the annual meeting, which includes writing a proxy statement and an annual report for the business, is part of the job of investor relations.

Presently, to land this position, you will need a college degree with a foundation in money or bookkeeping.

5. Real Estate Investor

This is quite possibly the best work in the land venture trust industry in light of the fact that, notwithstanding the significant compensation, there are great possibilities of headway in this industry. Their primary function is to help people become financially independent by investing in real estate.

Before investing and trading, this job requires extensive market research, which takes time. It will be mentally and physically demanding because you will be required to carry out a variety of tasks, such as inspecting, maintaining, flipping, purchasing, and restoring the properties. They can increase the value of their investments as a result of all of this.

You really want a degree in bookkeeping, money, or business to turn into a genuine financial backer since you want to think of ways of improving ventures for you as well as your clients. A land financial backer procures somewhere in the range of $15,000 to $15,000 each year.

Bottom Line: Real Estate Investment Trusts Is A Good Career Path

You might have got the answer to your question, “Is real estate investment trusts a good career path”. Consider the pros, cons, and types of real estate investment trusts (REITs), and then you can decide whether it is good for your career path or not. However, according to the experts, REITs are considered a good career path!