You might think that designing a swimming pool is an easy feat. After all, all you have to do is to dig out the ground and shape it like a rectangular prism or a cove-like space in your backyard. You can even buy an old shipping container and repurpose it into a perfectly sized lap pool. Take a look at this article for example. Even so, just like any other part of your home, you’ll surely want to give it a careful thought during the design process.

First of all, it can be a one-time project only. Pool renovations and remodeling can be pretty expensive. So, you got to nail it right from the get-go. In addition, it will be more interesting if it complements the general design concept of your home. Of course, you wouldn’t want your home details to clash against each other, right? So, take the design process seriously to avoid any regrets in the future.

1. Decide where to build the pool.

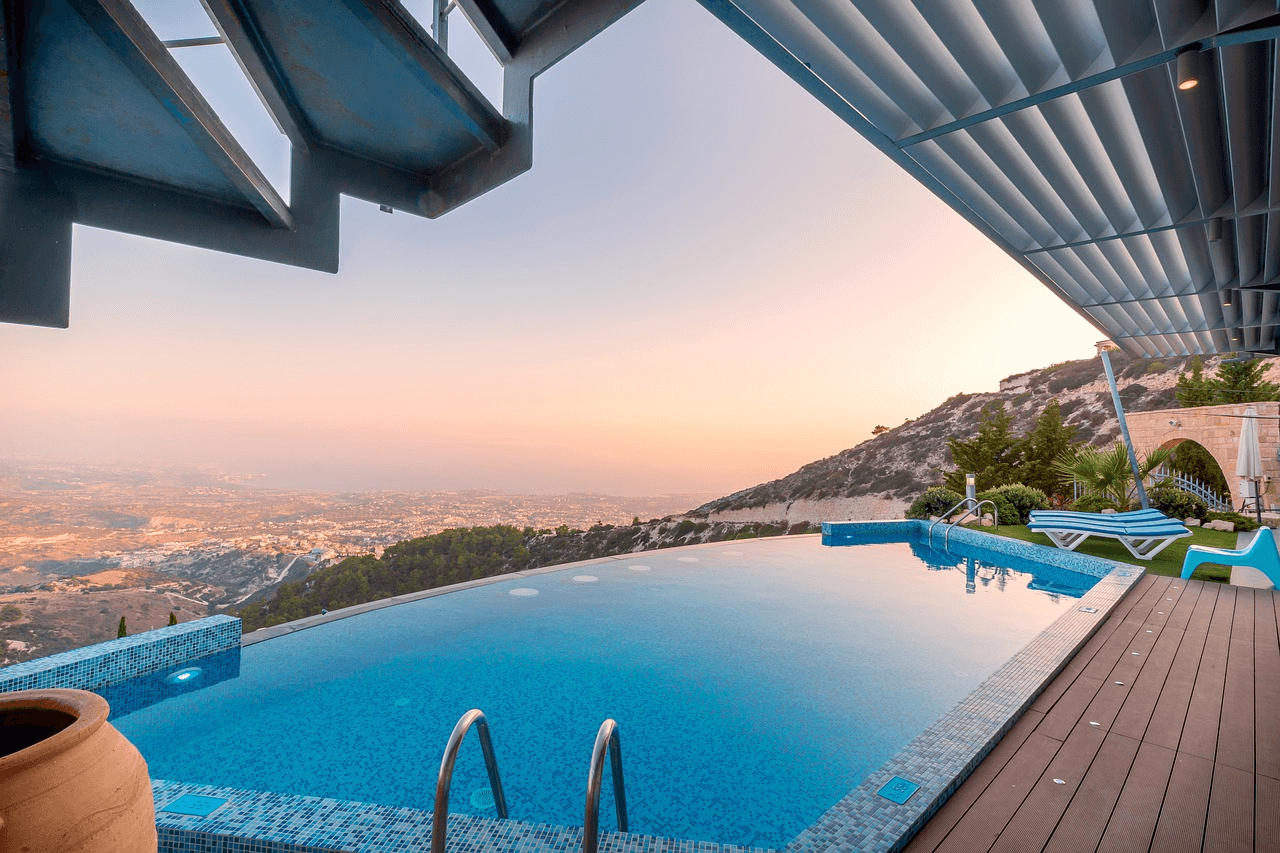

It doesn’t always have to be in the backyard, folks. So, no pressure at all. It really depends on where the ideal space is—that could be at the front of your main entrance, outside the master’s bedroom, the side of the house where great views are pretty surprising, on the rooftop or even indoors! The possibilities are endless.

To help you decide about the ideal location, try to think about some factors like what the weather’s like in your city every year and the ideal size for you. It’s also good to think about what views you’d like to see. Some homeowners don’t like seeing just a plain wall when they lounge by the pool or swim. They want to see the stunning views from afar.

And so, they aim to achieve that by placing it in the best location where they can see those views. If it’s necessary, they can also decide whether to elevate it a little.

2. Consider your lifestyle and goals.

What’s the biggest reason why you’re wishing for a swimming pool in the first place? Is it for health and fitness reasons? If so, you’d surely prefer lap pools to dip pools so that you can truly practice your swimming skills and be able to do a full-body exercise at the same time. For true swimmers, you’ll also want to increase the depth of your swimming pool so that you can practice your driving skills as well.

In addition, economical reasons will also prompt you to plan in advance for the maintenance needs of your pool. Budget-wise homeowners think long-term and talk to expert professionals like the Blue Waters Pool Services to seek for advice.

3. The needs of your family members matter, too.

If you have small children, you’ll want your swimming pool to be kid-friendly as well. You can design something with varying depths suitable to their ages. You can even incorporate a kiddie pool in your main swimming area so that there’s also a special place for them while you’re still teaching them how to swim.

4. What’s the general design concept of your home?

As mentioned already, you wouldn’t want the details in and out of your home to be clashing with one another. You’d definitely prefer to settle on a general look and feel that’s based on a theme that exudes your lifestyle and personality.

5. Communicate your needs to the contractor who will work on your project.

It’s important that you and the contractor who will work on your project will always be on the same page from start to finish. This is why it is important to always openly communicate your plans, needs, and ideas. Check out what else you need to know before building a pool.

Encourage them to ask questions in case they need clarifications. Also, it is important to ask them about the specific steps they’ll take to fulfill your expectations. You can test their expertise by asking for suggestions that will best answer your needs.

Ready to show your newly constructed pool? We’re excited to see the pictures! Do share with us!

Read Also: