The island country launched this program in 1984. The main idea behind the CBI was to attract funds for developing the local economy. There are several investment options that applicants can choose for obtaining citizenship, and investing some money in real estate is among them.

Would you like to invest your money in property to generate some income? There are lots of options available for you and not only in your motherland. Today, you can enjoy even more benefits due to special investment programs launched in many countries. One of them is the Federation of Saint Christopher and Nevis, a beautiful island country. The comprehensive info on its program allowing obtaining citizenship by investment (CBI) is available here, and in this article, you will find out the reasons to invest your money in property on this territory.

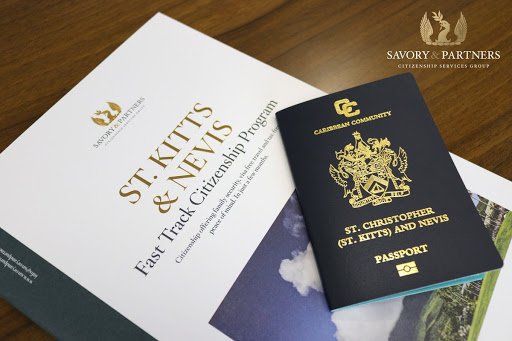

CBI Program: Investing in St Kitts Real Estate:

The island country launched this program in 1984. The main idea behind the CBI was to attract funds for developing the local economy. There are several investment options that applicants can choose for obtaining citizenship, and investing some money in real estate is among them. It would be a good choice for businesses looking for favorable taxation conditions and other opportunities as well as for individuals and families who either wish to move to this country or just need to have one more passport.

Getting a St Kitts and Nevis Passport:

The program allows purchasing property and getting a passport within only 3-6 months. There are two main options you can avail of. One of them is purchasing real estate pre-approved by the government for $400,000 or more. It is also possible to buy shares in a development project equal to the same amount. You must not sell your property for at least 5 years.

Another option you can consider is finding a business partner and investing $200,000 each in luxury resorts approved by the government. In this case, you will not be able to sell your property for seven years. Additionally, investors pay some required fees.

Why Invest in St Kitts Real Estate:

Investing in St Kitts real estate is a profitable business. In 2018, the number of tourists arriving in the country increased by 8.8%. More than one million people come to the island each year. The country has experienced significant growth over the last years thanks to the CBI program. The GDP per capita reached $17,500 in 2018. The economic growth is expected at 3.2% in 2020.

Now, the state provides tourists with high-security standards, comfortable travel, and other benefits. The real estate industry in the Federation has been developing rapidly. One of the reasons for that was the coming of the Marriott Hotel in the market. A range of significant construction projects includes Oasis Hotel and Aman Resort. Also, the number of flights to the country has increased.

The investment climate of the island is favorable. As for the prices of property, they have dropped compared to the previous year, which did not affect rental income. Moreover, the rental yield has increased to 5.11%. There are no rental income taxes for citizens and companies within the country.

Why Should You Obtain St Kitts and Nevis Citizenship?

While investing in property to generate some income, you can also enjoy receiving a St Kitts and Nevis passport. The following are the benefits that you will get:

- You can move to the island without problems in case of an unstable situation in your country;

- Having a passport of this country allows you to freely travel to over 120 countries, including Great Britain, Singapore, and Brazil;

- You will be able to take advantage of beneficial taxation.

Also, it is an amazing country with a rich culture and beautiful nature.

Conclusion:

If you have never been to this island, you may have reasonable doubts about investing in the property of this country. However, if you are looking for interesting investment opportunities, you should consider opting for the CBI available on the island.

The prices for real estate are quite low now while the rental income keeps growing. Considering the recent boom in the development and the significant interest of the tourist industry’s major players in the local property, it is likely that the prices of real estate will increase. Also, the country has a stable political situation.

Therefore, it is a favorable moment to invest your money in real estate on the island. Granted that it can also give you the Federation’s passport and plenty of other benefits, the CBI looks even more attractive.

Read Also:

All Comments

I visited multiple web sites but the audio feature for audio songs present at this web site is in fact fabulous.

Helpful info. Fortunate me I discovered your site accidentally, and I'm surprised why this coincidence didn't came about earlier! I bookmarked it.

I like it whenever people get together and share thoughts. Great blog, stick with it!

It's fantastic that you are getting thoughts from this article as well as from our discussion made here.

These are truly fantastic ideas in on the topic of blogging. You have touched some good points here. Any way keep up wrinting.

My spouse and I stumbled over here from a different page and thought I might as well check things out. I like what I see so now i am following you. Look forward to finding out about your web page for a second time.

Hello, after reading this amazing post i am also delighted to share my know-how here with colleagues.

It's amazing to pay a quick visit this web page and reading the views of all friends about this post, while I am also zealous of getting experience.

fim con heo viet nam xoilac

Normally I don't learn article on blogs, however I would like to say that this write-up very forced me to try and do it! Your writing taste has been surprised me. Thanks, very great post.

I want to to thank you for this good read!! I definitely loved every little bit of it. I've got you bookmarked to look at new things you post…

bookmarked!!, I really like your site!

Its like you read my mind! You appear to know so much about this, like you wrote the book in it or something. I think that you could do with some pics to drive the message home a bit, but instead of that, this is fantastic blog. A fantastic read. I will certainly be back.

Hello, I enjoy reading all of your article. I wanted to write a little comment to support you.

Hello, everything is going perfectly here and ofcourse every one is sharing information, that's really fine, keep up writing.

Helpful information. Lucky me I found your site unintentionally, and I'm stunned why this coincidence did not happened earlier! I bookmarked it.

Great post, I conceive website owners should learn a lotfrom this weblog its rattling user genial. So much excellent info on here.

Very good post! We are linking to this great post on our website. Keep up the good writing.

This paragraph will assist the internet users for building up new webpage or even a weblog from start to end.

I'm extremely impressed with your writing skills and also with the layout on your weblog. Is this a paid subject matter or did you customize it your self? Anyway keep up the excellent high quality writing, it is uncommon to look a great weblog like this one nowadays..

Remarkable! Its in fact remarkable paragraph, I have got much clear idea concerning from this article.

카지노사이트

Very nice article, exactly what I needed.