Our society has seen a significant shift throughout the past decade, as the Internet and other technologies have become more essential to our society than in previous eras. In 2020, the web has become imperative for communication, media consumption, and numerous other entities that have enabled our society to undergo a dynamic transformation. There has been a digital revolution in the past 10 years, as numerous elements of our society have been revolutionized. One sphere that has had one of the most significant digital revolutions has been the economy, as the web and other technologies have impacted it so immensely. There has been a myriad of changes that our global economy has experienced due to the rise of the web, and one of the most overt has been the increasing threat from hackers and other cybercriminals. Cybercrime has become a major problem for companies throughout the globe, as the threat of data breaches and other online attacks has become more relevant. Utilizing the top cybersecurity measures is now critical for all modern companies, and learning how to protect your business is crucial. One of the most effective cybersecurity measures is threat intelligence, and understanding this facet of online protection is essential to the success of your company.

Defending Your Modern Company Through the Use of Threat Intelligence:

Outlining Threat Intelligence

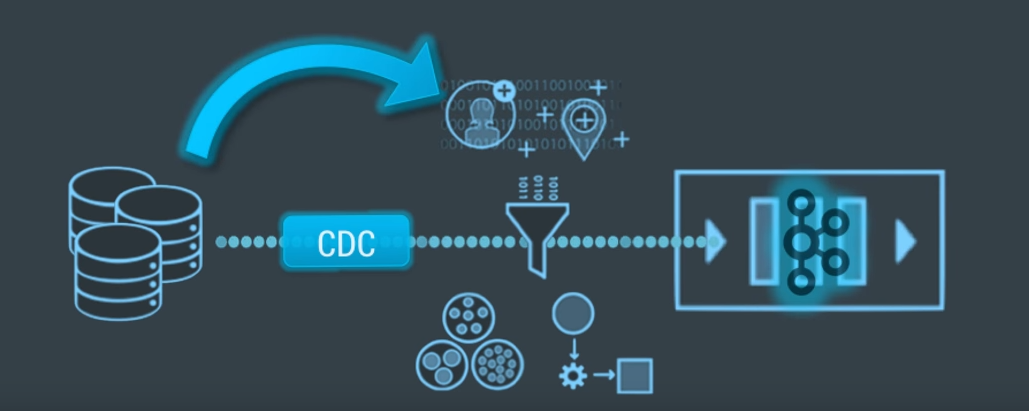

There are numerous challenges of operating a modern enterprise, and one of the most ubiquitous issues is cybersecurity. Investing in threat intelligence is one of the most proactive steps you can take towards safeguarding your business, and learning about it for your company is imperative. It is an aspect of cybersecurity where a multitude of data is analyzed and examined to figure out potential issues for your business.

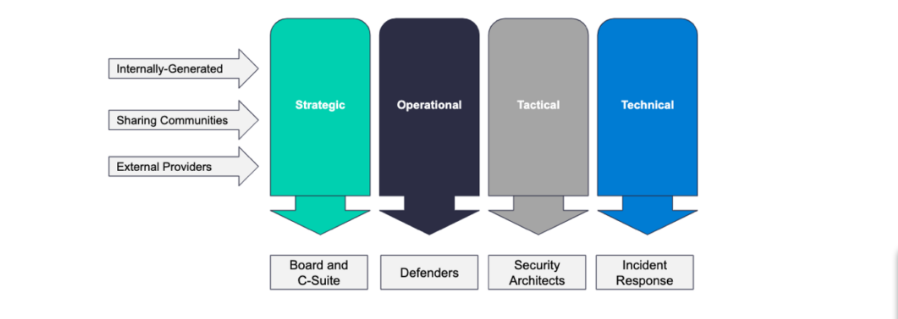

It aids in creating informed decisions and helps to eliminate many data breaches by implementing high-quality solutions. Threat intelligence is composed of tactical threat intelligence, operational threat intelligence, strategic threat intelligence, and technical threat intelligence.

Having these four elements work in tandem to create a diverse approach to mitigating cyber threats will ensure that your business is protected.

Practical Uses of Threat Intelligence

Understanding why your business needs threat intelligence protection is important, but learning how to effectively implement it into your business model is more essential. Threat intelligence aids in stopping data loss by finding and reporting security threats before they become more serious.

It also aids with direction by identifying potential threats and learning how to safeguard against them for the future. Finally, the most critical element of threat data is that helps to inform open source IT communities online about possible warnings.

This ensures that the entire web community is aware of these warnings and has information on how to protect themselves from these risks in the future.

Final Thoughts

There are numerous challenging elements to having a top-quality company in the modern era, and cybersecurity is one of the most difficult.

Learning how to eliminate threats through the use of threat intelligence and understanding how to keep your business safe is essential for a 21st-century enterprise.

Read Also: