Tag: Blockchain Technology

5 FinTech Trends to Know About

Financial technology is a trend that many businesses are finding advantageous. It does not matter what industry it is. Almost every business benefits from financial tech somehow. The field is changing, so it can be hard to know what the latest information is. Keeping you and your company up-to-date with the latest software and tech is necessary to keep your business efficient and finances secure. Traditional banking is becoming obsolete, so here are five fintech trends that you should know. 1. Cybersecurity Advances Trends and technologies that were on their way to becoming popular have leaped forward quickly in recent times. According to Swedish electricity entrepreneur Thommy Stenvik, many businesses and organizations have adopted these new and innovative solutions recently. It should go without saying that cybersecurity is one such solution and is essential for any business. Businesses need to make sure that they are using the best solutions and practices to keep their companies safe and secure from any outside attacks to remain effective. Companies need better cybersecurity protocols with so many people using online and mobile banking. Financial institutions will have to comply with these rules to keep their customers happy and avoid any issues. 2. Blockchain Technology Blockchain technology is a popular trend that is not going away anytime soon. More companies are creating cryptocurrencies, and an increasing number of retailers and banks are accepting this innovative form of money. Blockchain offers a way to have ultra-secure payments, which reduces the chances of fraud. As banks navigate this trend, they will have to use new financial technology to give them an edge over other banking institutions. However, blockchain technology implementation should not be too difficult for financial institutions, as their technology is more suited than businesses in different industries. Cryptocurrency and blockchain should be implemented by more institutions in the future, as it has the potential to hold an impressive percentage of the world's GDP. 3. Mobile-Only Banks More banks are leaning towards reducing or eliminating their physical locations and focusing solely on mobile banking. As banking applications have become more advanced, this shift will more than likely only continue. It is possible to accomplish tasks on banking apps that you previously had to go to a bank to perform. New, mobile-only banks offer many advantages, like contactless payments with no fees, paying globally, and easy transfers. Even if a bank does not plan on becoming mobile-only, their app must be secure, fast, and convenient to serve more customers. This trend demands a new approach to coding, development, and design. 4. Robotics As artificial intelligence becomes more advanced, robotics and AI will become more prevalent in banking. Many tasks can be carried out by a machine, like internal operations and customer service. It is happening now with not only banks but online shopping and other sites as well. Chatbots can help a customer, and a human usually only takes over if the question or concern is too complex. Instead of having to call customer service for every inquiry or issue, customers have the option to use a chatbot any time of the day. Robotics also can potentially take over processes like identity verification and loan processing, making these processes faster and more efficient. 5. Payment Innovations Gone are the days where cash or card were the only options for payment. Now you can choose from any number of digital wallets, PayPal, Apple Pay, and more. To keep up with new payment options, banks will have to adapt. Fewer people are carrying cash and only have cards. Because of this, digital wallets have become more of a mainstay. Instead of having to bring cards, you can use your phone. When shopping in person, many places allow contactless and digital payment options. Banks can adapt to this trend by having more flexible banking apps and different options for payments. These five trends in fintech need further research, and banks need to implement some of these. Traditional banking is no longer the most popular way to manage your money, and banks need to adapt to this. Mobile banking, cryptocurrency, and robotics are just some things that can make banking better for customers. If the customers are satisfied, they will be more likely to use your bank. Read Also: Pros and Cons of Using Fintech App Development Bitcoin’s 10th Birthday: Does Satoshi Nakamoto’s White Paper Still Hold Relevance? Ecommerce Software Development Trends

READ MOREDetails

Pros and Cons of Using Fintech App Development

Let's discuss what developments in the field of fintech will be trending in 2021 and how to use them for business. The features are widely used in fintech app development company. Expanding the functionality of applications: Financial technology services have come a long way in the last couple of years. They are created with the intention of providing customers with customized financial solutions according to their needs and requirements. Just look at the various types of payment options that are available to consumers now. From debit and credit cards to mobile and net banking, digital wallets, cash on arrival, and even payments with cryptocurrencies. Brands are looking to help consumers choose financial payment services that they are most comfortable in using. This is where fintech needs to play a major role. Business automation: Doing business requires regular complex operations and paperwork. Their automation will be another significant fintech trend in 2021. Online banking will give customers the ability to receive electronic checks and invoices. Although these are increasingly being created online. Banking apps will become a place for bookkeeping and even getting legal services. This frees you from the hassle and allows you to focus on more important things than filling out and sorting hundreds of pages of documents. Blockchain technology: In recent years, a lot of buzzes has been created around Blockchain technologies. What started as an offshoot of Bitcoin has now become an independent entity that is allowing businesses to maintain complicated digital payment records, verifying transactions, and keeping a digital record of anything and everything that can be important. Blockchain is fast, secure and one of the most efficient ways to record transactions in an authentic and honest fashion. This helps in building financial credibility and ensures that digital records, especially financial ones are not distorted. The leading companies in the world are experimenting with this technology. In the near future, the applications of Blockchain are sure to benefit a wide variety of sectors. RegTech (regulatory technologies): Government authorities and financial markets set their requirements for banking structures. There are so many of these rules that companies do not keep up with them - and spend huge sums on lawyers (at best) or on fines (at worst). Open banking: Another key area of fintech is open banking. This allows customers to safely and securely engage with financial services from the comfort of their homes. Just to give you a small example, let me ask you a question. Do you remember the last time you physically visited your bank? Chances are if you are someone like me, that period would be a long time ago. We are now using our laptops, smartphones, and tablets to do literally all the banking activities. From transferring funds to making credit card payments to even applying for loans and financial investment services. This is the era of open banking and it is intricately tied to the need of making financial services more user-friendly and convenient. Financial ecosystems: The concept of an ecosystem is gaining momentum. Large companies allow users to read news, order taxis, and listen to music without leaving their apps. In the financial arena, developers will also compete for the love of their customers. The most popular areas of ecosystem development are products for business. These are accounting services, payment management, business start-up. These are housing) and government services. There are products that correspond to the main trends. For example, we have developed the application. There the residents of the city can draw the attention of the authorities. They are attracted to the state of infrastructure, roadways, transport hubs, lighting, cleaning, and other important aspects of city life. Read Also: How a Virtual Assistant Is Beneficial to Businesses How You Can Manage Your Business with Scheduling Software? The Business Advantages of Mobile CRM Apps Why an Automated Sales CRM Platform is What Your Business Needs

READ MOREDetails

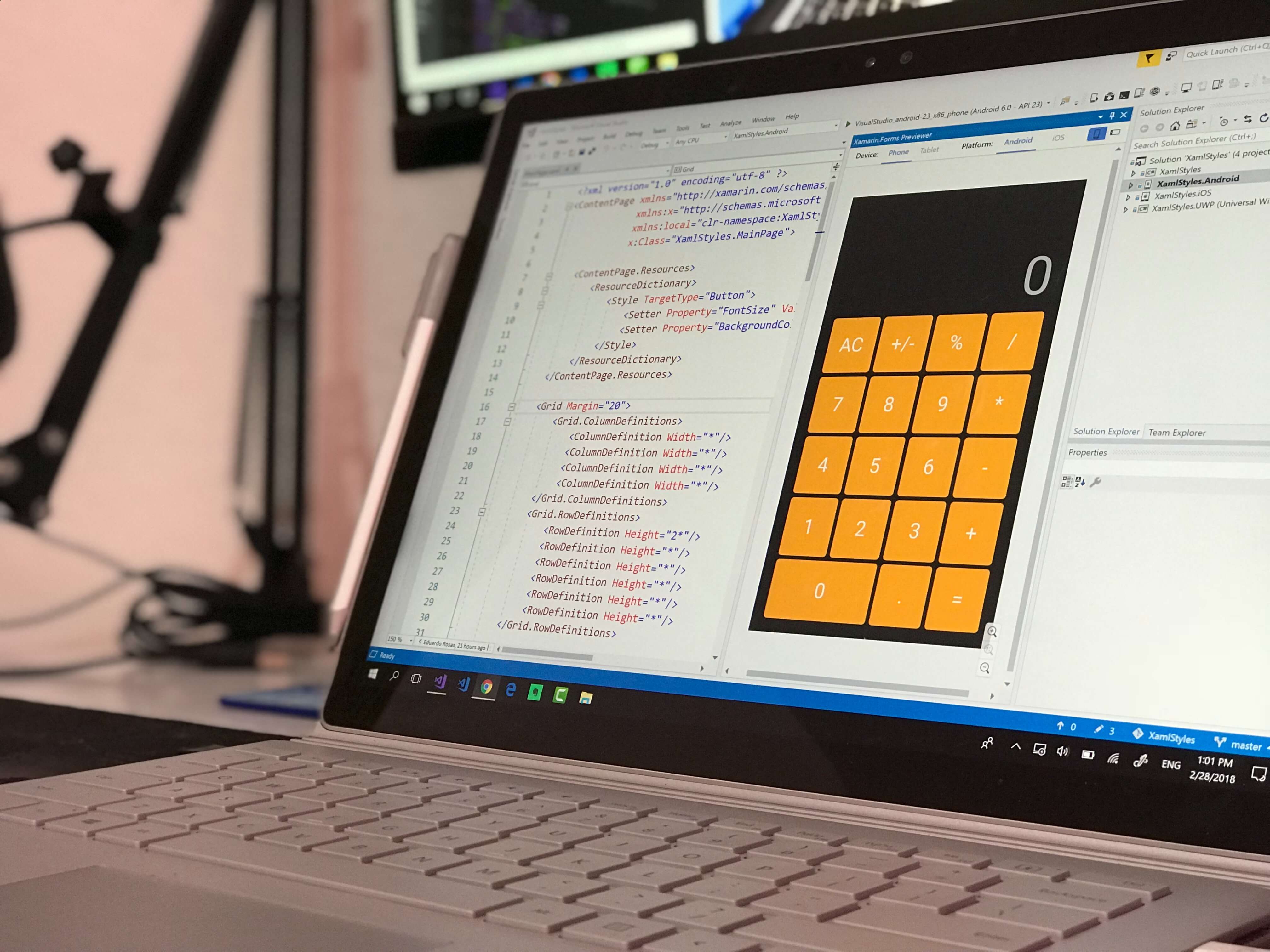

Securing Mobile App Development with Blockchain Technology

Ever since mobile app development was introduced, it has not been without its own challenges with security being the most pertinent. Developers have always seen mobile application security as a big challenge owing to increasing cyber-attacks which has made the entire process even more vulnerable. The major reason why mobile apps are the prime target of attackers is that they contain private and confidential data such as passwords and bank details. While several app development agencies have managed to come up with various measures to curtail the menace, it is, however, evident that mobile users cannot comprehensively rely on other third-party software. This is why has become relatively pivotal to consider the role of blockchain in-app security. What is blockchain? Before considering how relevant blockchain technology can be to app development, it is needful to first understand what blockchain itself is all about. Commonly referred to as the “base of all cryptocurrencies,” blockchain is generally regarded as the new big thing. In fact, there are those who consider this technology to be the next internet. Thanks to its revolutionary working principle, blockchain has not only managed to take the mobile app world by storm but it’s also influencing other sectors around the globe. Simply put, blockchain is an open-source for all databases that cannot be tampered with or rewritten. It is designed as a digital database that contains several pieces of information such as financial transactions and other records that can be shared and used simultaneously within a wide decentralized network that can be accessed publicly. Blockchain technology functions in a way that is different from every other technology in the IT world. Basically, it seeks to enhance the speed, efficiency, security, and transparency of transactions performed across a peer-to-peer network. While blockchain has been in existence long before now, it was, however, less prominent until the recent success of Bitcoin. Just so you know, Bitcoin is a product of the blockchain technology. Nevertheless, it is important to note that the usefulness of blockchain cuts beyond cryptocurrencies and can affect different other sectors. Due to the massiveness of its scope, virtually every industry is seeking to adopt the technology as their first choice, including the mobile app development sector. Securing Mobile App Development with Blockchain Technology Importance of blockchain technology in mobile app development : Apart from its relevancy in performing peer-to-peer transactions, there are several other ways blockchain technology can be employed. When it comes to mobile application development, app developers and development agencies are very optimistic about incorporating this technology into their development process. Generally, they believe that blockchain technology can help to greatly make mobile applications secure than ever due to the unaltered database it provides. Undoubtedly, this is amazingly true as there are several areas in which blockchain adoption can greatly impact mobile app development, including DNS/PKI, anonymous voting system, digital money transfer, maintaining healthcare records, managing property, accrediting the supply chain process, making online payments, and proving identity. Enhancing mobile app security with blockchain : Well, it is no more news that blockchain technology can effectively boost mobile app security. But this cannot be achieved if mobile app developers fail to understand properly the basic functionalities of blockchain and how it can affect app development. When it comes to making peer-to-peer payments (i.e. transferring funds between users on a network), there is every guarantee that such transactions are safe. This is why many mobile app development agencies are confident that technology will offer better app security. Here is how the technology can enhance mobile app security. Safe transactions : The incessant issue of hacking has made most mobile users afraid of online transactions. Obviously, there will be no more financial security worries with blockchain tech. This implies that users will enjoy the privilege of making funds transfer from and into their mobile wallets with absolute trust in the app knowing fully well that they are in safe hands. This will also help to drastically reduce the costs of making global payments as users will be enabled to make easy cross-border blockchain payments via their mobile apps. With these applications, users will be able to use the blockchain tech to make transactions on their smartphones and tablets. This implies that mobile users will not need to worry about owning a blockchain-enabled phone as every needed access will be provided on the app. Absolute transparency and protection Unlike other technologies available in the IT world, blockchain offers a unique feature that makes it uniquely different. With this technology, it is interesting to know that users’ data and information will remain securely safe as they cannot be breached. Here, absolute transparency and protection are maintained at the highest level. Even while everything on the network is carried out publicly, one thing users should know is that there is no breaching of information on the blockchain. To this end, it is imperative for mobile app developers to ensure that their development process is performed in line with blockchain’s principles so as to enable users to gain direct access to the network without having to hide anything. Secured identity : The main reason why hackers are gaining easy access into people’s account and stealing sensitive information is that many mobile users’ identity is not secure. But this is not the case in a decentralized platform. As a matter of fact, it is absolutely impossible for anyone to steal data from a decentralized system. In the blockchain, every user is provided with an encrypted private key that cannot be used by another user. To this end, it is highly difficult (if not impossible) for anyone to alter another user’s information or data on a decentralized platform. No password required : With blockchain tech, app users will no longer require a password to protect and access their mobile applications or devices. Just so you know, the technology has been designed to keep user information and data safe without the need for authentication. Read Also : App Development Benefits: Here’s Why You Should Go Mobile Top 8 Advantages Of Effective Web Design And Development Things To Look Out For While Hiring Health App Developers

READ MOREDetails