Trading can be a great way to make money, but it’s also very complex and risky. Whether you’re a novice trader or an experienced investor, understanding the basics of trading is essential for success. Today, this WB Trading review will give you ten tips for trading.

Set Realistic Goals

Before you start investing, set realistic goals for yourself so that you know what kind of returns you should expect from your investments. This will help keep your expectations in check and prevent disappointment if and when things don’t go as planned.

Do your Research

It’s essential to do your research before investing in any asset class or financial product. Read up on the types of investments available and compare their features, risks, rewards, and associated costs to decide which is right for you.

Manage Risk

Risk management is critical when it comes to trading successfully. Ensure you understand the risks associated with each investment before committing any capital to them to minimize losses and maximize gains.

Start Small

When starting, it’s best to start with small trades and build up your knowledge and experience as time goes on. Once you have more experience, consider increasing the size of your transactions or taking on riskier investments such as derivatives or options contracts.

Investigate Fees

Fees can eat into profits quickly, so ensure you always investigate the costs associated with any trade before entering it. This way, they don’t cut into your bottom line too much once factored in after a completed transaction.

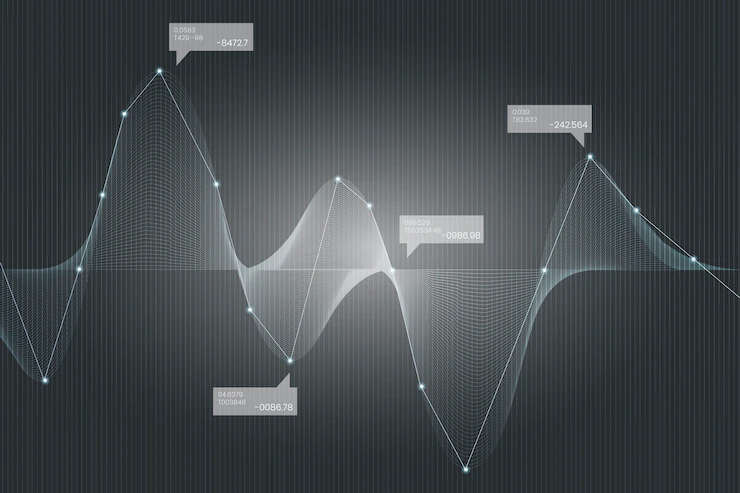

Use Technical Analysis

Technical analysis studies financial market price patterns to identify potential profit or capital gains opportunities. This type of analysis involves looking at charts of past market performance to identify patterns that could indicate future price movements, which can tell when to buy or sell an asset for maximum profit potential.

Create a Trading Plan

A well-developed trading plan should include goals, strategies, risk management plans, and entry or exit points for each trade you make to maximize profits while minimizing losses. A good plan should also include specific rules you follow no matter what happens in the market so that you stay disciplined when making your trades.

Make Use of Technology

Technology has made it easier for traders of all levels to access markets. Take advantage of online brokers or apps that allow you to monitor trends and open positions quickly and easily from anywhere at any time—this will give you an edge over other traders who are not as tech-savvy or prepared as you may be.

Seek Professional Advice

If, after studying all available trading resources, you still need help or want professional advice, there’s nothing wrong with reaching out. Qualified professionals, such as registered investment advisors or stock brokers who specialize in helping new traders, can help you get started correctly without taking on too much risk early on. They may provide insight into potential opportunities within specific market sectors that could benefit new traders looking for consistent investment returns over time.

Monitor Your Trades Regularly

Last but certainly not least, once you’ve opened up positions on certain stocks or assets, make sure that you’re regularly monitoring them. This way, if something goes wrong, you’ll know what’s happening and why those changes are occurring so quickly! This will help prevent losses from bad moves while allowing for more informed decisions when it comes time to close positions or open new ones!

Final Thoughts

Trading can be profitable if done right, but it’s also a high-risk activity that requires careful consideration at every step. By following the tips in this WB Trading review, traders of all levels can ensure that they set themselves up for success no matter what market conditions prevail at any given time. With some luck and hard work, anyone can become a successful trader!

Additional:

- 5 Best New Cryptocurrencies To Buy in 2022

- Is there a Place for Bitcoin in the Fashion World?

- How Many Types Of Entrepreneurs Are There In 2022?

- How To Invest In Cryptocurrency Without Buying Any?