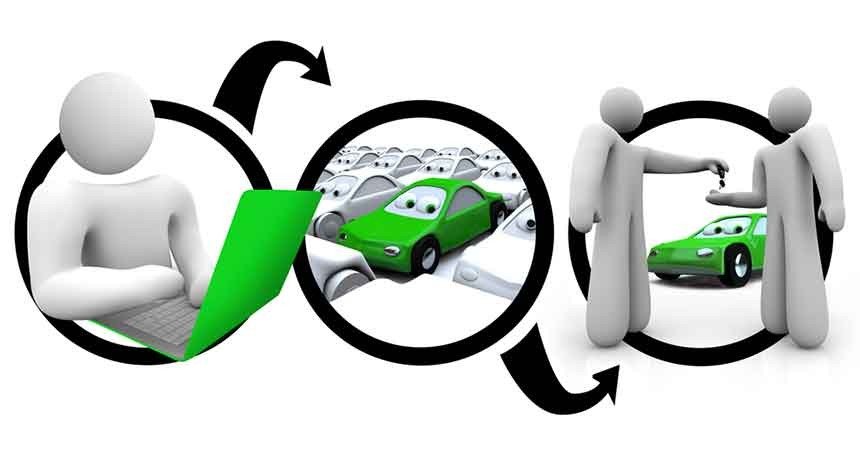

It might be easy to think about your website as something ancillary or removed from your car dealership, a splash page in which you can throw up a few pictures, link to a mostly-ignored Twitter, and slap on a phone number, address, an invitation to come to visit you in-person. Nothing could be further from the truth. In our constantly evolving digital world, your website is a legitimate extension of your physical dealership. It needs to be constantly updated with your latest stock, contains accurate information, and provide not just one or two but a variety of ways in which to get in touch with you. In short, it needs to be as accessible as humanly possible.

Customers who visit your site should leave feeling as though they have just visited your dealership in-person. All the amenities should be available to them. A full, accurate, and updated look at what you currently have in stock is of key importance. Keep a photo gallery of every single vehicle you have available for purchase for customers to peruse. Is a car model temporarily out of stock? Make sure that information is clear and let them know when you will be getting more shipped out. Is a model completely out of stock? Strike it from the site and don’t look back. Crisp, detailed photos should be a given. If you can offer a full, 3D digital view of even some of your stock, that’s even more impressive.

Another way of replicating the in-person experience is by offering a live online chat. There is some extremely impressive car dealer chat technology available today. This will offer your customers the ability to talk to a live operator 24/7. With Gubagoo’s Chat Smart technology, you give these operators access to your stock and sales information; they, in turn, present it to the customer, create a profile of them, collect their contact info, and bring it all back to you. This information is highly-customizable and extremely easy-to-use. You can even, using a dealer-only app, see live chats as they take place in real-time and hop in if you have something to add or elucidate certain points. Online dealer chat technology can also be integrated with your Facebook page, so that the popular website’s online chat function can be funneled directly to a live operator.

Another important aspect is social media. You already know, of course, about Facebook and Twitter, but these days it’s of extreme importance that your dealership is accessible through as many social media outlets as possible. Google+, LinkedIn, YouTube, Twitch, Discord, and Pinterest are just a handful of the avenues through which crafty dealerships are boosting their sales. Consider bringing on a social media expert to run your Twitter, keep your website updated, and get you in touch with potential customers in as many different ways as possible.

Did you know that 75% of car buyers say that online research was key for them in making their eventual decision? A full three-quarter! And it’s a safe bet that some of the remaining 25% at least checked websites online in addition to in-person.

Read Also: