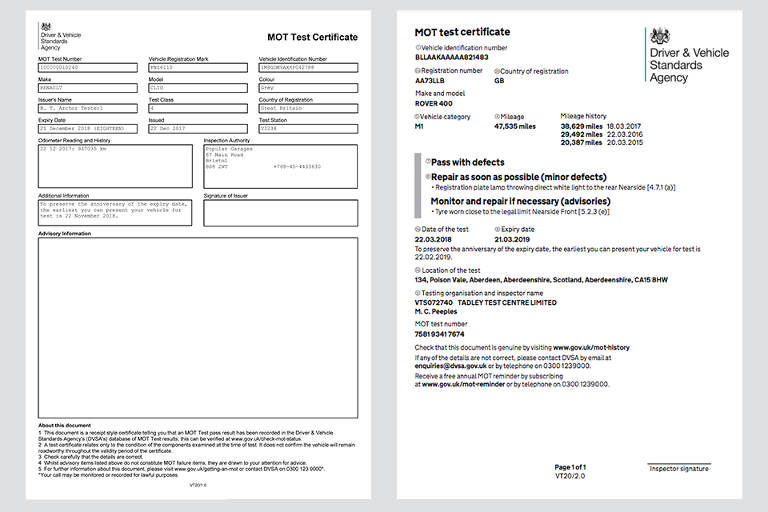

The Driver and Vehicle Standards Agency (DVSA) recently implemented a new system that allows drivers to print their own MOT certificates at home. If you consider that more than 630,000 MOT certificates were issues last year, at the cost of £10 each, the new system is set to save UK drivers an estimated £6 million a year. This new system will allow owners of cars, vans, and motorcycles to view, save and print MOT certificates issued after 20th May 2018.

The printing of the MOT Certificate by drivers can help save them from a number of bureaucratic hurdles and ease efficiency. The Ministry of Transport is already burdened with a number of problems. Saving them from such a process will help them concentrate on some other important area of business.

In terms of the drivers, it is important, as it will help save them from running around with paperwork at all times. A great number of drivers in the UK, misplace their MOT certificates routinely. The process of getting a new one is problematic and time-consuming. By enabling drivers to print their own MOT certificates, the Ministry of Transport is contributing to citizen welfare and promoting citizen responsibility.

The new system was only initially available for cars and vans, but it was made available for motorcycles and will soon become available for buses, Lorries, and coaches. All drivers who wish to use this service only need the vehicle’s registration number and the 11-digit reference number found on its VC5 logbook.

How to Get Your Free MOT Certificate:

Here’s how to get your free MOT certificate brought to you by Plateman Show Plates.

Considering that you need to show the MOT certificate if you need to tax the vehicle at the post office or change the vehicle’s tax class, this new and easy way of getting the MOT certificate may prove invaluable to some users. If you are not able to get the MOT certificate online and print it yourself, you can still get a certificate from MOT centers at £10.

According to Neil Barlow, the Head of Vehicle Engineering at the DVSA, this move was aimed at making it easier for motorists to have the “information they need to keep their vehicle safe.” It is also easy to argue that the government seeks to reduce the need for you to visit a government office for most of the documents you need.

The move is a welcome one since it means that you don’t have to spend money on an MOT certificate, but also because you are able to get one at your own time and in your own way. It is also a good way to get a replacement MOT if you happen to lose yours.

According to the DVSA website, you can use this service to replace a lost or damaged MOT certificate. The service is also very easy to use and with the right documentation, you can print out your MOT in a matter of minutes. This free service is however not available for heavy goods vehicle, trailers of public service vehicles. Owners of these vehicles have to visit an MOT center if they want an MOT certificate.

An MOT certificate verifies that your vehicle is safe and roadworthy and given that it also tests the emissions your car produces, it is a vital document to have. Now you can get it more easily which leaves no excuse for not having one.

Read Also: