The markets are always moving. The 5 trillion a day currency markets are trading hands 6-days a week, 24-hours a day. Make use of a mobile app that can make things easier for you. Traders who want to keep abreast of price action need to pay attention to market changes, especially when the markets are volatile. The best way to keep on top of market movements is to use a mobile application. These applications have several tools that can help you make your trading decisions including educational tools and technical analysis.

Test Drive a Mobile Application:

Some of the best mobile application feels like you are using a desktop. The app performs in a way that allows you to quickly navigate the platform without having to stop and think about how to execute a trade or perform analysis. Before you start to rely on your broker’s mobile app, you should test drive the application using a demonstration account. A demo account allows you to trade capital that is no real. So, if you make a mistake it will not cost you any of your funds.

Evaluate the Educational Aspects of a Mobile Application:

One of the great benefits of a mobile application is the educational material evaluate on the app. This generally includes videos and access to articles that you can read while you are on the go. If you are waiting for an appointment or have a few minutes to spare, you can pull up the videos on your broker’s mobile app and take a deep dive into different types of analysis that are offered on their mobile application.

Using Technical Analysis:

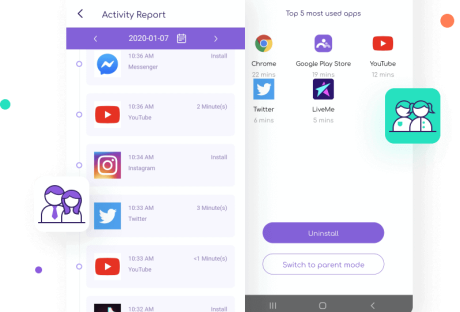

Some of the more sophisticated mobile applications provide technical analysis tools on their mobile application. This could include adding moving averages, adding momentum indicators or even oscillators. Some mobile application even provides you with the capability to draw trend lines. Its recommended that you spend some time testing your mobile app and performing some of the analysis that is offered with the mobile application.

Not only can you develop new trading strategies with your mobile app, but you can also follow the markets and perform risk management using the technical analysis tools available on your mobile application. For example, you might have a stop loss level below the 50-day moving average, but without your mobile app, you would not be able to see if the price tumbled through the average or bounced. By using your mobile app, you can evaluate the trend in the market using technical analysis tools.

Execute Trades:

One of the issues that a forex trader can face is having the ability to execute a trade while you are on the go. This is where a mobile app can be a great tool. Not only can you perform the analysis you can execute trades wherever you have access to cellular communications.

The markets are always moving. The 5 trillion a day currency markets are trading hands 6-days a week, 24-hours a day. Traders who want to keep abreast of price action need to pay attention to market changes, especially when the markets are volatile. The best way to keep on top of market movements is to use a mobile application. These applications have several tools that can help you make your trading decisions including educational tools and technical analysis.

Read Also:

- Trading Contracts For Differences

- How To Open A Forex Account And Start Trading Forex Stock

- Forex Trading Wisdom: Talk Yourself Out Of Bad Trades

- Investing And Trading 101: Investment Ideas For Newbies

- Top 9 Forex Trading Tips For Beginners That Save You Money

- Securing Mobile App Development With Blockchain Technology