Category: Finance

ContentRally is a leading source of reliable news and trending topics on Finance. Get hard-to-find insights and advice on Finance from industry-specific leaders.

How to Buy Bitcoin From Norway?

Need to buy bitcoin (BTC) however, don't have the foggiest idea how? In case you're new to the universe of digital currency, seeing precisely how bitcoin works and how and where you can buy bitcoin in Norway is an entirely huge test. To enable you to comprehend the language and securely get your hands on a portion of the world's most outstanding computerized money, we've assembled this present novice's manual for purchasing bitcoin in Norway. A bit by bit manual for purchasing bitcoin You can buy bitcoin in Norway in three basic advances: Pick a bitcoin wallet Before you can buy any bitcoin, you'll have to set up an advanced wallet where you can securely store your coins. Bitcoin wallets don't really hold any coins, however, rather, store the private keys you have to get to your open bitcoin address and sign exchanges. There are many alternatives to browse, including the accompanying: Equipment wallets, for example, the Ledger Nano S and TREZOR, give disconnected stockpiling to your private keys. Work area wallets, for example, Electrum and Exodus, can be downloaded to your PC and used to store private keys on your hard drive. Portable wallets, for example, Jaxx and Coinomi, enable you to deal with your BTC from your Android or iOS gadget. Web wallets, for example, Blockchain Wallet and GreenAddress, offer helpful online access to your bitcoin. Paper wallets enable you to print out your bitcoin open and private keys and utilize this bit of paper as your wallet. Pick a cryptographic money trade The subsequent stage is to choose how and where you will buy bitcoin. There are several stages to look over, and they can be isolated into three principal classes: Bitcoin intermediaries Intermediaries offer the speediest and most effortless approach to buy bitcoin, enabling you to pay for your computerized coins utilizing fiat cash (like NOK or EUR). Specialists offer easy to understand stages and enable you to buy bitcoin utilizing natural installment strategies like a charge card or a bank move. Their primary drawback is that they regularly charge higher expenses than different choices. Cryptographic money exchanging stages These steps, for example, enable you to buy bitcoin utilizing different digital forms of money. They will, in general, offer lower expenses than agents and give access to an increasingly assorted scope of coins. Notwithstanding, you'll, for the most part, need to effectively possess another cryptographic money so as to utilize this kind of trade, so they're not fit to amateurs. Distributed (P2P) bitcoin trades Distributed trades cut out the go-between and enable clients to exchange straightforwardly with each other. The vender has the opportunity to indicate the cost they need and their acknowledged installment techniques, and this strategy enables you to exchange with expanded protection. Be that as it may, you may need to make do with a value higher than the market swapping scale. Instances of distributed trades incorporate LocalBitcoins and Paxful. Buy bitcoin The last advance is to present a request through your picked stage. For most amateurs, the least demanding and most advantageous alternative is to utilize a bitcoin intermediary. Regardless of which kind of trade you pick, you'll ordinarily need to pursue a record first. Contingent upon the trade you use and the administrative necessities it is dependent upon, you might have the option to join essentially by giving your email address or you may need to give your complete name, contact data and confirmation of ID before being permitted to exchange. When your record has been confirmed, you'll have to enter the measure of BTC you need to buy, pick your installment strategy, survey the expenses and the all-out expense of the exchange and after that settle your buy. The precise advances you'll have to pursue fluctuate contingent upon the installment strategy and sort of stage you pick, so continue perusing for more subtleties on the various ways you can buy bitcoin. Read Also: How To Make Money From Bitcoins In 2019? Millennial Investors Will Drive Bitcoin Price Growth In 2019 Bitcoin Profit Review 2019

READ MOREDetails

5 steps to take if your personal loan application is rejected

Ever applied for a loan, only to get rejected? Having your loan application turned down can be a discouraging experience, especially for first-time borrowers. Or, you may have taken loans in the past and wondered why your recent application wasn’t approved. The truth is that there are a variety of reasons that can affect your personal loan eligibility. Often times, it’s just one main issue, but other times, it can be a combination of reasons. If you aren’t sure why your loan application got rejected, you can use a personal loan eligibility calculator to check what was the shortcoming in your personal loan application. Read on to find out what you should do to increase your chances of approval in the future. 1. Check the lender’s eligibility criteria All banks and lenders have a basic criteria that determine whether a borrower qualifies for a loan. The main reason why most people’s loan application gets rejected is that they did not meet all the lender’s criteria. The eligibility criteria for a personal loan include age, income, location, credit score, employment, and other factors. Lenders will clearly mention this eligibility on their website or app. Generally, banks have stricter eligibility criteria and only accept applicants with a higher salary and excellent CIBIL score, whereas digital lenders have wider eligibility criteria. If you have read through the lender’s eligibility criteria but still aren’t sure whether you qualify, use a personal loan eligibility calculator. 2. Improve your CIBIL score CIBIL score is a summary of one’s creditworthiness based on their credit history. Although the minimum CIBIL requirement varies from lender to lender, one of the reasons that your application may have been rejected is because your CIBIL score is too low as per the lender’s eligibility criteria. Check your CIBIL score from the CIBIL website. If it is less than 650, you should work on improving your score by using a credit card. Spend responsibly and pay your card in full before the due date. This will help increase your credit score. 3. Make sure your outgoing expenses are low One of the reasons that lenders will reject a personal loan application is because the applicant has too many existing debts, and for such a borrower, taking on another financial burden would increase the chances of default. Take a look at your finances and see if there are any expenses you can cut back on. If you have a lot of existing debt, work on repaying them off before you apply for a new loan. 4. Provide the correct details Loan applications can get rejected if there is even a small error or a signature mismatch. Ensure that the details you provide in the form are clearly written/typed out, and most importantly, correct. Providing false details about your income, identity or credit score will certainly be detected by lenders, and this is another reason why many applications get rejected. Be honest in your application form, as some lenders are willing to accept applicants with less than perfect CIBIL scores or incomes. 5. Apply for a lower loan amount Due to your current financial capacity, you may not be able to take on the responsibility of paying back a huge loan. If you’re still in desperate need of a loan, aim for personal loans singapore as it makes the best offerings in financial capacity. Aim for around 40% or less of your net monthly income. Conclusion Don’t feel disheartened if your loan application got rejected. Follow the tips above in case your loan wasn’t approved this time, and re-apply after 90 days. If you aren’t sure whether or not you qualify for your desired loan amount from a lender, be sure to check the eligibility criteria for more information. You can also use a personal loan eligibility calculator to check for your loan eligibility. Read Also: 3 Factors That Determine Your Personal Loan Interest Rate 7 Reasons To Apply For A Loan Online 5 Questions To Ask When Deciding On An SBA Loan

READ MOREDetails

Investing In Bitcoins: 5 Things You Need To Know

Ever since Bitcoin was announced to the world, it has generated hype and frenzy unlike any other financial commodity in the world. However, Bitcoin is much bigger than just a digital currency. It is a system of finance. Many people make the mistake of assuming Bitcoin as a sole entity. It is not. It is part of a larger financial structure or medium known as Blockchain. In this article, we will look at how any individual can easily acquire, invest and trade in Bitcoin. We will also look at the top 5 things individuals need to keep in mind before undertaking any Bitcoin or Blockchain adventure. Bitcoin and Blockchain: What is it? Bitcoin is a digital currency, which seeks to remove finance from the hands of governments and international financial institutions. In many ways, Bitcoin is a democratic, peer-to-peer payment structure, which aims to reduce costs, makes payments faster and eases the entire network. Founded by the anonymous Satoshi Nakamoto in 2009, the digital currency hit a high of over $17000 USD in late 2017. From then on, the volatility and speculation surrounding it have made it jump up and down in terms of evaluations. However, as of now, one Bitcoin has reached nearly $8000 USD once again. Bitcoin has emerged as one of the strongest financial investment products over the past few years. However, this means that there are many nuances, risks, and rewards out there for Bitcoin trading. It also means that there are manipulators out there who are tricking and cheating people when it comes to Bitcoin trading. Here are 5 Things to know before Investing in Bitcoins: 1. Do your research before selecting on a Bitcoin Trading Platform Many unscrupulous people and websites out there are cheating unsuspecting individuals of thousands of dollars by offering Bitcoins. Please do your research before you try to make a payment for purchasing Bitcoins. One of the best ways to ensure safety is to be part of Bitcoin Trading Platforms, which have their own bitcoin trader login as a point of entry. This ensures professionalism and safety for all your transactions. 2. Try to make Small Bitcoin Investment Options initially If you are someone who is looking to just step into the Bitcoin investment game, it would be wise to tread cautiously. This means that you do not need to purchase one Bitcoin at one go. This would be too expensive and complicated. Bitcoins can be broken down into one-millionth of a trade. This means that you can make small purchases as investment options. This will help you familiarise yourself with the market and enable you to work towards bigger investments. Nowadays, you can also use this cryptocurrency trading platform bot that determines when the price will rise and you can make great profits as a result. 3. Do not reveal your identity to third parties at any costs It would be foolish to assume that digital transactions of investments cannot go wrong. The same goes for Bitcoins. It is important that you do not reveal your Bitcoin Address, Bitcoin Wallet or your cell phone numbers to outside parties. There are hackers who are much more technologically advanced than you are. By being safe, you can ensure that your investments will keep growing in a safe and secure environment. 4. Do not invest every penny you have into Bitcoins In other words, do not take loans from people, just for the sake of investing in Bitcoins. There are speculations out there that result in many fluctuations. It is important to ride out these volatilities. If you are someone who is not on a strong financial footing, investing in the present might not be a good idea. Try to be secure before taking the plunge. As with all financial products, investments can be risky. 5. Select the Right Bitcoin Trading Platform Many experts out there have been following Bitcoins and Blockchain technology right from its inception. Some of them have taken the leap and established their own trading platforms, which offers help, guidance, and expertise on Bitcoin trading. It is best to select a trading platform, which is backed by expertise and experience. Aligning with amateurs who do not understand the market might be too risky. Conclusion: In recent years, more and more people who are trading in Bitcoins are using the best software to boost their chances of earning profits. From using complex algorithms to Artificial Intelligence, the advanced nature of the software makes it very easy for people to make complex decisions. One such software is the Bitcoin Evolution. Many critics are skeptical of Bitcoin Mining as it involves high costs and investment expenditure. The Bitcoin Evolution software is trustworthy, legit and very affordable. While there are many who make millions from investing in Bitcoins, several others lose quote a lot of money. It is important to follow the five steps mentioned above to ensure that your investments in Bitcoin return a healthy profit. Read Also: How To Make Money From Bitcoins In 2020? Bitcoin Profit Review 2019

READ MOREDetails

How To Make Money From Bitcoins In 2020

Bitcoin is a Digital Currency that first burst out into the scene in 2009. The world-famous, yet highly anonymous Satoshi Nakamoto created a computer script/algorithm, which helped in generating Bitcoins once when people were able to solve complex mathematical equations. Over the last few years, Bitcoin mining has become quite impossible for the vast majority of the people interested in Bitcoins. This is because it involves huge computational systems and unbearable power tariff costs. Even though there is a consensus about Bitcoin being a credible platform to invest in for the future, there are debates about how to make money from it. In this article, we will look at the top three ways in which you can make money from Bitcoins. The processes range from mining to trading, to something much more innovative and new in the crypto currency world. How To Make Money From Bitcoins In 2019: 1. Bitcoin Mining: The One for the Experts If someone would have asked me to write this article in 2014-15, I would have stated that Bitcoin mining is the only way to make money from Bitcoin. However, in the past few years, Bitcoin mining is becoming far too expensive for normal human beings to undertake. With the top computer systems or ‘rigs’ as they are called going upwards of $10000 USD and power tariffs of $3000-5000 USD for a single bitcoin, mining is not too high on the list of many interested in Bitcoin. Many tech experts are willing to invest and create proper mining farms or ‘cloud mining’ facilities to extract Bitcoins. While the complex problems, expertise, and skills might appear to be easy for certain individuals, most of us would want to explore other alternatives. 2. Bitcoin Trading: A Smart Alternative to earn money As we all know, Bitcoin is a financial product. As with all financial products, they can be valued, traded and speculated upon. Bitcoin Trading Platforms work in the exact same manner as stock and share trading platforms. All you need to do is create an account on one of the better trading platforms, deposit a trading fee, which will be used by you to make trades and let the platform’s algorithm guide you on the best trades of the day. The best platforms like the BitcoinEra help in easy, secure and expert advice that is processed through millions of algorithms. They work to bring to clients the best decision-making that can be made. The majority of the population who want to make money from Bitcoins use Bitcoin Trading Platforms. You can log in today to start earning to become the next millionaire. Login here: Bitcoin Era Login 3. Pursue Etherium and Litecoin instead of Bitcoin According to the popular Crypto site, Investing, there are more than two thousand cryptocurrencies in the world. Bitcoin is definitely the oldest and most popular crypto in the world. However, miners are also turning to Ethereum and Litecoin as they work on the same principles. Ethereum is valued at over twelve billion dollars, with Litecoin touching nearly two billion dollars as of 2019. However, Bitcoin continues to be the undisputed leader of the cryptocurrency world. This is why most people concentrate on Bitcoin rather than any other cryptocurrency. Conclusion: Even though digital and cryptocurrencies are thought to be the future of the world, there still exists volatility and uncertainty in the markets. Governments and international financial institutions frequently raise alarms against cryptocurrencies, with some governments even banning them altogether. Cryptocurrencies like Bitcoin have also been accused internationally of helping and aiding in deep web arms, drugs and human trafficking illegal activities. As most of it is too complicated and untraceable, cryptocurrencies like Bitcoin are being used to fuel terrorism, sex trade and destabilize countries and economies. Which according to you is the best way to make money from Bitcoins? Do let us know in the comments section below. Read Also: Bitcoin Profit Review 2019 Millennial Investors Will Drive Bitcoin Price Growth In 2019

READ MOREDetails

How to Choose the Best Merchant Account for Your Burgeoning Insurance

In the modern era, there is numerous business that has seen immense changes. From newer fields like web design and IT to industries that have existed for decades, the 21st century has certainly proved that all fields are subject to change. One of the fields that have seen some of the most changes in the modern world has been insurance. No matter the type of insurance company you run, you have to ensure that your business has the best tools at its disposal to ensure that your business runs effectively. The top insurance companies understand this concept and have chosen the best merchant accounts available to ensure that their businesses run effectually. Merchant accounts are incredibly important in the insurance field, so it is crucial to utilize the ones with the most useful features, especially when your business is growing. Learning about merchant accounts will certainly aid you when growing your insurance company. Merchant Accounts for Insurance Companies Insurance companies are essential to our society, and as the industry is constantly changing, it is important to understand how to ensure that your company stays ahead of the competition. No matter the size of your insurance company, it is essential for you to invest in a high-quality merchant account in order to attain success. Insurance is a difficult industry to operate a business in, so an excellent merchant account will certainly alleviate some of the challenges. Insurance companies utilize their merchant accounts on a daily basis, so it is essential for them to invest in the best ones available that are stocked with a multitude of essential features. Learning about these features is crucial to attaining success. What Do Insurance Companies Need in a Merchant Account? In order to be successful, insurance companies need a merchant account that can provide them with the most benefits and that have the most applicable features. Top-tier merchant accounts come equipped with a multitude of facets, but the most important of these is safety. When investing in a merchant account, you have to ensure that the one you choose has a reputation for security as well as ethical business practices. If you use a low-quality merchant provider with poor safety features, you will find yourself in serious trouble if any breaches occur to your financial data. Other features besides security that you should look for include interchange-plus pricing, which enables you to save money on credit transactions. You should also search for all-in-one payment processing – this will allow you to merge your in-person and online transactions in a single convenient location. Other top features that you should look for include availability of activity records, batch and deposit reports, and cumulative custom reporting. Final Thoughts Running an insurance company is certainly a very challenging task. Between dealing with customers, complying with regulations, and so much more, it is an incredibly difficult business. However, in order to be successful in this industry, especially as your company is growing, it is essential to invest in a top-quality merchant account in order to ensure that your business will attain immense success. Read Also: 5 Tips For Transport & Logistics Business Owners Before Investing In Insurance How To Choose The Best Auto Insurance Company?

READ MOREDetails

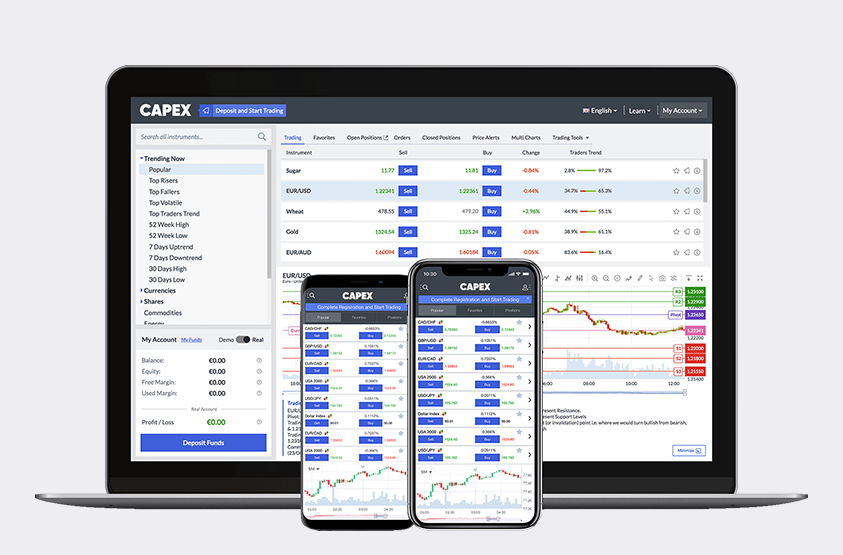

Capex Trading Platform Review

Brokerage companies are constantly launching proprietary and new platforms, as some of their clients look to use other software rather than just the traditional MT4 or MT5. Capex is one of the brokers that had developed its own Web-based platform and today we’ll get a close look at some of the features it offers. Capex Trading Platform Review: User-friendly and improved design Investing in proprietary trading solutions means a company can come out with an improved platform tailored toward clients’ needs. The Capex trading platform comes with dedicated instruments & account panels, which give you complete control over activities like order management, deposits, and withdrawals. With refined asset monitoring, you’ll have access to insightful data on each instrument you want to trade, no matter whether it is a rising or falling market. The layout also includes enhanced functionalities for a one-stop trading experience, all of them organized in menus easy to navigate. Improved decision-making: If you are at the beginning in your trading journey, or if you simply want to put your own trading ideas to the test by seeing what other experts think about the market, the Capex trading platform includes several powerful decision-supporting tools. The DAR (Daily Analyst Recommendations) is one innovative tool integrated into the platform, which enables a free-flowing trading experience by offering access to a service that evaluates public stock recommendations made by financial analysts. DAR also comes with several features that help you see the expert average return or statistical significance, in order to find out which experts provide the best trading ideas. Trading Central is another important technical analysis tool built into the Capex platform. Currently available for Signature account holders, it provides complex technical indicators for a wide range of assets: currency pairs, ETFs, bonds, shares, and commodities. Trading Central is a Certified Member of three Independent Research Providers Associations (Investorside, Euro IRP, and Asia IRP) and 38 of the top 50 banks have already subscribed to its services. Trading filters: It is much easier to spot top-ranking instruments with the filters provided by the Capex trading platform. Top Risers & Fallers, Top Volatile, Top Traders Trends, 52-week high & low, Uptrend & Downtrend, as well as 30-day high & low will help you spot the exact assets fitting to your trading strategy. As a trader, you’ll need volatility and managing to find fast the most active instruments is a very important part of your trading process. Read Also: Brief Mobile Trading Apps Comparison How Financial Trading Can Give You The Life You Want How To Use Your Mobile App To Improve Your Trading

READ MOREDetails

Why Buying or Selling Gold Online is a Wise Move

Buying or selling gold has an element of risk involved, and it does make sense to minimize these risks as much as is practically possible. Rather than spending half the day driving around looking for gold dealers, the Internet offers a quick and easy way to make contact with a reputable gold dealer and they will help you out there how to buy precious metals. However, you do need to be sure that you can visit the dealer's offices, at least one time, to ensure that they are actually an established gold dealer. Why Buying or Selling Gold Online is a Wise Move: Save Time: Using Google, you can compare the spot price of gold with as many dealers as you wish and that would take you only a few minutes. If you wish to buy & sell gold jewellery in Adelaide, there is a long-established gold bullion dealer with offices in the CBD, where you can visit their offices and carry out the transaction. Once you have found a respectable gold dealer, you can visit their offices any time that you wish to buy or sell gold, safe in the knowledge that you are dealing with a reputable organization. Taking the Best Deal: Gold prices change by the minute and by using the Internet, you can quickly ascertain which dealer is offering the best deal, whether you are buying or selling. There are some online organizations that offer a seemingly good deal to buy gold, and they ask you to mail it to them using the pre-paid envelope they send you. Some of these are scams and they will accept your gold, then pay you a lot less than it is worth. These organizations are called ‘mail-in gold dealers and they should be avoided, as there is a chance that you will be cheated. You are strongly advised to visit a reputable gold dealer’s office, where you can take possession of the gold you are buying, or receive the right amount of cash for the sale. Credibility: Whether you are buying or selling gold, credibility is something you look for in a gold bullion dealer, and taking a look at their website can help you identify the dealers that are, in fact, reputable. They would obviously display the address and location of their registered office, and this is something you can check on very easily using Google Maps or any other online map application. Taking Physical Possession of your Gold: When buying gold in any format, it is important to take physical possession of the gold at the time of purchase and providing you stick to that rule, you should always be sure that you are getting the purity and the weight that you are expecting. One should always establish that the gold bullion dealer is everything he claims to be. Once you have done that, you can deal with an online gold dealer with the confidence that all is above board. Read Also: Gold: Choose Your Jewellery Carefully Make Your Savings Goals Come True With Gold

READ MOREDetails

5 Tips For Transport & Logistics Business Owners Before Investing In Insurance

You need to make sure that you have considered how you will buy insurance before you get started managing your company. Most people who run a large business like this think that they just need to get insurance for their vehicles, but you should be a bit more clever with the insurance that you buy. There are some steps below that will make your life much easier, and each of those steps will be easy to follow because you only need to have a look at what your options are when talking to an agent. Let the agent guide you and realize that you have a lot of things that actually need an insurance policy. Insure The Vehicles First When you work with a company such as Connect Business Insurance, you will still insure the vehicles first. You need to have insurance if you plan to send the vehicles on the road. You need to get the vehicles valued and insured properly so that they can be replaced on their own. A lot of companies just own the trucks, and you are hauling someone else’s trailer. Even if you own your trailers, they get their own insurance when you have the policies written up. Insure The Trailers You can insure the trailers with no trouble because they have their own value in and of themselves. When you do not own the trailers, your partner needs to insure their own trailers. They will cover the loss of the trailer in the event of an accident, and you can move on to other types of insurance that will actually pay to replace the items that are in the trailers. Property Loss Insurance You can get property loss insurance that will pay for the loss of anything that was in the trailers in the first place. When you are getting a policy like this, you need to get a general replacement value that could be used for anything that you are hauling. All you need to do is keep track of the things that are in your trailers because that will help you file the claims in the future. You also need to remember that you must have these manifests ready for any insurance claim if the partner is paying for the loss of property. Profit Loss You can take out business insurance that will be used to pay for lost profits. When you need to shut your business or stop using trailers or trucks, you can use insurance to pay for lost profits. This is how a business can afford to stop working when it has an emergency. You also need to remember that these policies have different values based on how much you think a lost day of work is worth. Let the agent value your workday for you so that there is no confusion. Use The Agent Often You should use an agent in all cases because that is the only person who can properly value your policy, write the policy, and offer customer care. Read Also: How To Choose The Best Auto Insurance Company? Have You Paid Enough Attention To Liability Insurance When Launching Your HHA Business?

READ MOREDetails

A Closer Look At The Common Types of Business Accounting Services

So, you have recently launched a business, and that is great. However, in order for it to succeed, and even though you are just starting, you need to know with the various kinds of accounting services available. Becoming familiar with these services will allow you to know what is to come and how to handle the situation. The ability to pinpoint the following will be a huge benefit to your business as you'll ultimately require a few pairs of hands in order for it to excel. Ensure that you do in-depth research or consult professionals for detailed information. That being said, here are the common types of business accounting services. A Closer Look At The Common Types of Business Accounting Services: Bookkeeping This is perhaps the most common type for companies that have just launched, up until the medium ones. Bookkeeping involves recording the daily activities that include your papers, files, and expenses. It is imperative to have everything in place as it is a common ground for new businesses. In this digital age, bookkeepers utilize accounting software like Knuula and Quickbooks to monitor financial information. Tax Accounting This is a form of tax income returns specialization. Professionals who specialize in this field are the best ones to consult when you are paying unnecessary taxes. They are ideally knowledgeable on the various tax fees that different areas have. Chartered Accounting Accounts under this field have their specialized field in the accounting domain. They are ideally part of the professional accountants that are skilled in an array of accounting range. Forensic Accounting Accountants in this fieldwork to figure out any tax discrepancies or possible tax fraud or evasion in the financial records. They can be able to identify any missing slots in detail, thus making them an ideal asset to law enforcement agents. Financial Controller Services This is a service that's known to be the head of accounting departments. Their role is to assign work for employees, hiring as well as both internal and external. They ideally speak to clients and ensure that your company is performing well. Public Accounting This is a form of accounting that varies with the field. It consists of accountants in the management accounting domain, financial analysis, and much more. Since it is a broad type of business accounting, it is sometimes referred to as 'assurance services.' Accounting Audit Accountants in this field are tasked with tracking down financial records, receipts, and statements to ensure all the information submitted is valid. With this, they're able to know the status of your company and how it is progressing, which is an important aspect of running any business. Management Accounting Professionals in this domain of accounting are able to see the company's financial data. Their role allows them to analyze your company's assets, and are able to manage them properly. Not only that, but the accountants are able to budget the business' allowance just in case you are planning to release a new service or product. Internal Auditing Accountants in this field look into your business' practices to ensure that you are doing everything right in the eyes of the law. Ideally, they check for any malpractices, fraud and anything else that involves going against the law financial wise. These are the most common types of business accounting. Read Also: Tips To Hiring Accounting Firms Rochester NY For Your Business 7 Advantages In Hiring A Third Party Company To Manage Your Accounting Needs

READ MOREDetails

How Do Construction Loans Work?

It can be difficult to find your dream home, even when the downturn in house prices is the largest on record. If you’re considering finance for your home build then you need to understand how construction loans work. The simple reason is that houses are still incredibly expensive, and, even if you have the funds to buy, you’re getting someone else’s idea of a dream home. It doesn’t matter how much you spend, you’re going to need to modify it to suit your own tastes. That’s why so many people are building their own homes. It’s actually cheaper than buying and you get to design the layout yourself. Of course, you still need enough funds to complete the build, that’s where a corporate finance specialist comes in handy! The Lending Criteria for construction loans: The first thing to understand is that the loan company does not have a physical asset to secure the loan against. This makes this type of lending riskier. As such, the criteria tend to be tighter, you’ll need a good credit history, and the percentage they will lend you is going to be less than with a pre-built home. It’s likely that they will expect you to put 20-30% of the funds upfront yourself. This shows your commitment and reduces your risk. The Lending Stages: Once you’ve agreed on the number of funds that you’ll need the loan company will not just give them o you. Instead, there are released in three distinct phases: 1. Foundation: The first step is to purchase the land, clear it and build the foundations. Along the way, you’ll need to get planning permission and the designs approved. This is the stage where little appears to happen but it creates the base for everything else. Once the finance company is happy this is completed they’ll release the second installment: 2. Construction: The main construction phase involves getting the walls and roof up. In short, your building project will start to look like a home. This will be a frame. You’ll need to verify with the lending company exactly what is included in this stage, they may want to see doors, windows, and internal wall ups. 3. Finishing: Finally, the third stage of funds will be released and this will cover the most labor-intensive stage, where the electrics are fitted, plumbing completed, and the interior finishing is done. This doesn’t mean your home is ready to move in, this will depend on the contract you’ve agreed with the builders. It’s possible you’ll still have to finish the decorating. Construction loans can be used if you’re undertaking the building work yourself, or if you’re using a company. But, you’ll need to have each stage checked and signed off before the next lot of funds are released, it reduces the risk to the lender. Once the house is completed the lender will expect the loan to be repaid very quickly. At this stage, you can obtain a standard mortgage for your home. Read Also: 5 Tips For Buying A Second Household How Industry-Specific Loans Can Support Your Business 7 Expert Tips In Finding The Best Mortgage Broker In Vancouver

READ MOREDetails

Choosing The Right Financial Advisor

There are plenty of financial advisors out there; you can never have trouble finding one. But, like buying any product, you need to find the right one. Deciding the type of advisor you should hire can be challenging. With poor research, you may end up losing a large sum of money from carelessness and ineptness. Thus, it is essential that you determine which advisor will help you meet your goals. The following are five steps to selecting the best financial advisor. Choosing the Right Financial Advisor: 1. Know your financial needs: There are various reasons why you would want to hire a financial advisor. For instance, you may need help in managing an inheritance, a retirement fund, or a loan. Financial advisors have diverse experience and expertise. Thus, not every advisor will be able to meet your needs. This is why you need a financial adviser that can help you in every step of the way. Since the requirements of each individual are different, you need someone that can help create personalized investment solutions for you and your financial needs. Make sure to share and discuss your expectations from the adviser in advance. Ensure you identify and rank your financial goals. You should be clear on the amount of capital you’re investing. Also, you should state your financial objectives and how much risk you are willing to sustain. It will help you select the right advisor. 2. Expertise: Always go for certified financial advisors because the fact that they are licensed will help ensure you that the advisor you are about to hire is qualified and that they know exactly what to do and how to help you. Besides, credentials issued by independent bodies can be another evidence of qualification. Find a financial advisor in West Des Moines with a CFP (Certified Public Planner). It is the most significant credential. Its members must pass the tests administered by the CFBS. Moreover, find out whether he/she takes the annual courses required by the law. 3. Experience: Experience is vital if you are to entrust this person with your dreams. Most financial advisors ventured in other fields before getting into a financial career. It equips them with knowledge about financial investments in different areas. But you should remember that everyone has to start somewhere. Intelligence, responsibility, and passion can, in some cases, make up for the experience. 4. Cost: Fees and commissions can end up making your investment, not so fruitful. Discuss the advisor’s compensation before closing the deal. It will avoid any conflicts on payment. You need to study the record of the adviser and your anticipated future record. For example, if your stock portfolio is 8%. You agree that the advisor gets 4%. Then, your net return will be 4%. 5. Compatibility: Your financial advisor should have a personality that makes you comfortable. If you do not like your advisor, you will find it so difficult to open up about your financial concerns. Find a financial advisor in West Des Moines who has the patience to answer your questions. Face-face meeting is a great way to assess your advisor, giving you a better impression. Would you marry a person who you meet at an online dating service without a face-face meeting? The same case applies here; you should not give your financial future to a stranger. Bottom Line: Remember how much you worked hard to earn the capital. Pick the best advisor and protect your wealth. Also, ensure he/she has the expertise needed to provide the best advice. Read Also: How To Start Your Career As A Financial Advisor? How Artificial Intelligence Is Helping Banking And Financial Institutions?

READ MOREDetails

How a Smart Guy Gets an Amazing Commercial Lease with Bad Credit

Sometimes, things can go south when you need to take up a commercial lease, but you discover that your credit score is bad. There is an unfortunate stereotype about people with a bad credit score as they are seen to be a typical bad guy, starved off trustworthiness. Yet, in reality, a bad credit score can occur to just anyone. Bad credit essentially means a financial history of your inability to pay up loans when you were obligated to. Worry not, for in this guide, we will show you how to secure your dream commercial lease, even in the face of bad credit. 1. Do a wide search of your options: Honesty is quite needed here, and you have to search for all the options open to you. Your real estate advisor or lawyer can help you do it, but you need to be honest about the reasons why you were unable to meet the previous financial commitments so that they have adequate information to help you. When you know you have several options, you will be more relaxed to seek out a property owner who can accommodate your bad credit. 2. Get a good guarantor or co-signer: If, for instance, you’re considering getting an office space for lease Seattle with bad credit, getting a guarantor or co-signer with a high credit score to sign as a surety for you can help you secure the commercial lease. The property owner would know that he or she would have nothing to lose as your guarantor or co-signer will be held liable to pay if you default. Admittedly, since your credit is bad, it could be hard to get a guarantor, in which case, look for a family member or friend whom you would be willing to offer a percentage of the business proceeds, making the deal more lucrative and mutually beneficial. 3. Be willing to stake high: Negotiations for an office space for lease Seattle with bad credit could be quite tricky, but you can still get a fair deal. You would have to increase your stakes to make your offer attractive, despite your low credit score. You can offer to make a hefty security deposit, add collateral, or even agree to pay a higher interest rate. A business-minded property owner would be more interested in offering you a lease with such these attractive conditions. 4. Consider bartering: Bartering means exchanging what you have for something that you need. Identify a connection between your line of business and what the property owner can get in place of the payment and have the willingness to exchange, even if you’re a bit on the losing side. If finding a connection is difficult, you can join a barter club where the credit scores of the members can be used towards your lease. 5. Go for a motivated property owner: Property owners can sometimes be motivated to advertise that they are willing to bargain or offer leases to people with bad credit. Search out for them and be prepared to commit to their terms, giving assurance that you will keep to the lease agreement. When you need a commercial lease, and you have a bad credit score, you don’t have to panic. There are some things that you can do to rectify the situation. The bottom line is that whatever arrangement you decide to use, you have to document and sign it to protect yourself in the future. Read Also: Debt Consolidation Plans For Your Debt Relief Using Short-Term Loans To Help Rebuild Your Credit Score Revolving Debt Vs Installment Debt – Which Impacts Your Credit Score The Most?

READ MOREDetails