Category: Business

ContentRally is a leading source of reliable news and trending topics on Business. Get hard-to-find insights and advice on Business from industry-specific leaders.

What Are Solar Incentives?

In a bid to put an end to global warming, more and more technological inventions are tilting towards promoting the sustenance of the environment; which is practically the main reason why the solar panels are invented as a means of producing electricity in the first place. To get more people on board to subscribe to this new means of producing power, measures were put in place; in which one of them is to allow the owners of the solar panels to enjoy certain privileges, which are loosely called Solar Incentives. So you ask, What Are Solar Incentives? This is a measure put in place to ensure that owners of the solar panels enjoy certain benefits, just by installing and using the product. These solar incentives have led more people to subscribe to the idea of installing and using the panels for their homes and business; because not only is it profitable to the environments, it is also profitable to their finances in the long run. The following are some of the Solar Incentives there is: 1. Solar Investment Tax Credits: Of all solar incentives available, this is the one that is commonly known. In this case, Solar owners benefit by having the privilege, as made possible by the federal government, to take out a portion of the cost of the solar panels from their taxes. What that means is that the cost of the system is being subsidized by a certain percent, from your taxes. The common investment tax credit percent is 30% of the cost of the solar panel system. Enticing isn’t it? So, if the solar panel system costs $10,000, you are only paying 70% of that amount, with the remaining 30% already footed for from your taxes. The only twist to this is that to be able to claim the investment tax credit, your taxable income should be higher or equivalent to the investment tax credit. 2. State Tax Credit: This is basically similar to the federal investment tax credit, only that this time, a small portion of the cost of the solar panel system can be deducted from your state tax bill, relieving you of some costs that would have been invested in purchasing of the solar panel system. The only twist to this is, unlike the federal tax credit, this is not applicable to all states; only residents of some states are privileged to enjoy this package. For those that could enjoy this package, they could end of saving about 50% of the cost of the solar panel, making it easier for them to purchase the solar panel system and enjoy its benefits. 3. Solar Renewable Energy Certificates (SREC): The New Jersey’s Solar Renewable Energy Certificates (SREC) program have made it possible for residents in new jersey that have acquired and installed the solar panel system to enjoy a special kind of solar incentives called certificates – though this is not exclusive to new jersey alone. You may be asking, what are Solar Renewable Energy Certificates? These are a type of solar incentive that allows owners of a solar system to sell the certificates to their utility. By standard, if you can generate 1000 kilowatts hours (kWhs) from your solar system, you are eligible to get one SREC; and an SREC is worth at least $300. Now imagine how much that figure can rise up to if you can make 6000 kilowatts hours. Let me just leave you to do the mathematics yourself. If you were once unsure about purchasing a solar panel, this should make you change your mind. 4. Net Metering: It is common knowledge that some owners of the solar panel system produce more than they can consume, in which they decide to store the overflow in an On-site battery. What if I tell you that instead of storing that in an on-site battery, you can sell to your local utility company and get returns which can be used to foot other bills. Amazing deal, isn’t it? I can bet you think it is. That’s basically what Net Metering is all about. So in days, you create more electricity beyond what you can consume with your solar panel system, instead of hoarding it in your battery, you are given another opportunity to get returns for it. Think about the future energy bills and other bills you can foot by selling excess power produced by your system. 5. Cash rebates: These are basically cash backs for the owners of the solar panel systems. It could come from different parastatals – like the government, utility company etc. – that are concerned about promoting the use of solar energy. This could also help subsidize the cost of the solar system. With the aforementioned solar incentives available, the idea of investing in the purchase and installation of a solar panel system is becoming more appealing. What are Solar Incentives? I hope this article has done justice to answering that question. Read Also: Prepare Your Solar Panels For The Fall Everything You Need To Know About Portable Solar Power What You Should Know About Solar Energy For Schools: Benefits, Expectations, And More

READ MOREDetails

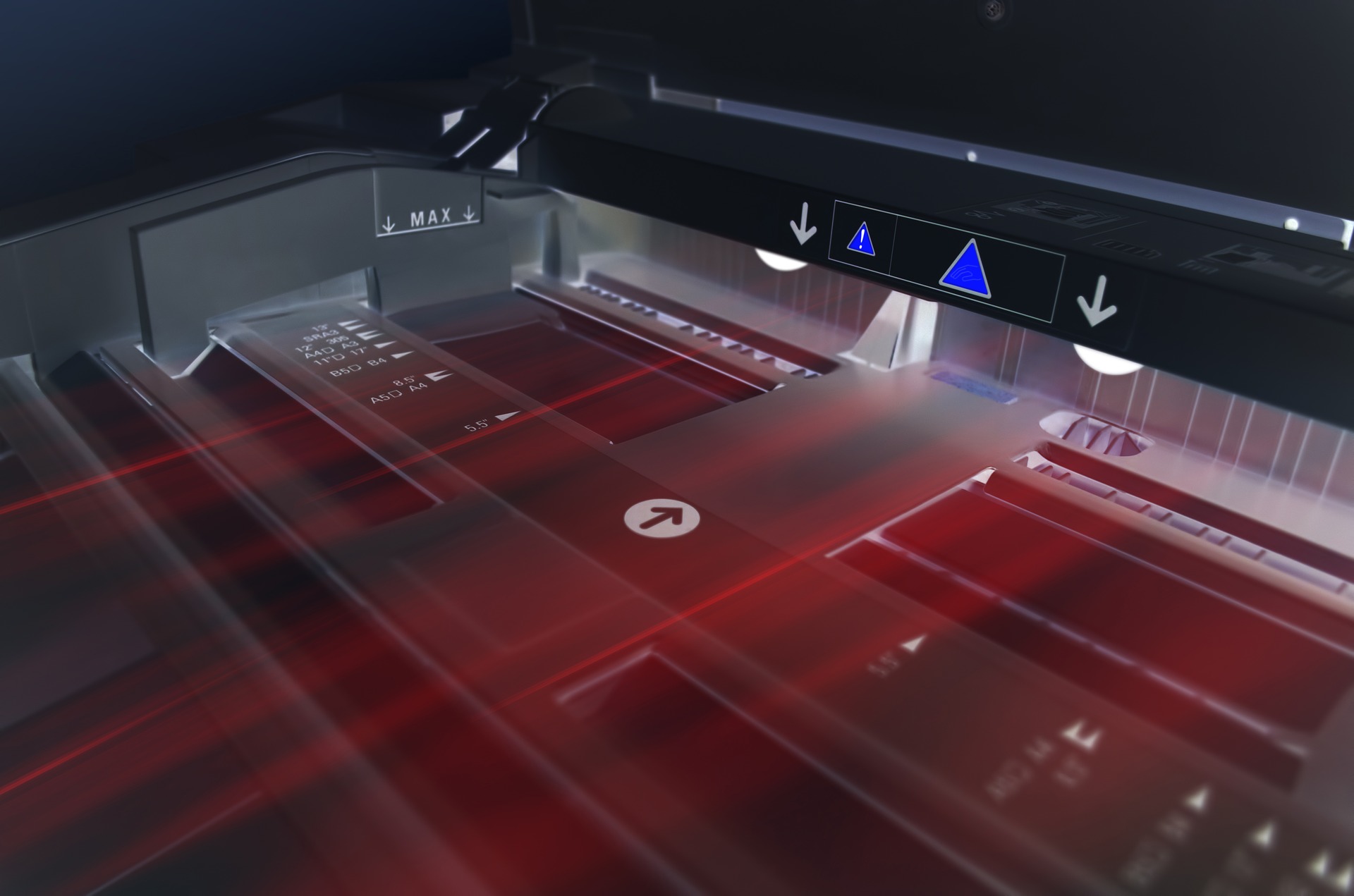

Digital Printing Contributes Much towards the Progress of the Industry

The scope of digital printing has widened during the past few years. From large organisations to individual professionals, the printing job knows no bounds. Improved print quality has succeeded in clearing the complexities. Fast printing: Digital tee shirt printing has helped the industry in delivering quicker outcomes. You will find a natural option in digital printing when you are searching for a printing job on clothes or other things. The faster pace does not affect the print quality. Also, you do not need to establish an extra set up. It is quite effective for printing items in bulk. Great print quality: Digital printing provides the most advanced printing solution for all. It offers an edge over lithographic printing. It is also a simple option to print your favourite images. Advanced printing methods: The printing industry has never experienced such a unique option as that of digital printing. You may choose any type of finish and surface for printing texts or images of your choice. You may print any image on canvas, metallic, and ceramic surfaces. Return on investment: Digital printing methods yield a great return on investment. The printing expenses fall as the process consumes less time and ink. Over the past few years, the price of digital printers Stockport offers has even gone down. They have become more compact than before. The manufacturers launch upgraded printers every year. A large palette of colours: Most consumers will now find a few extra colours to choose from. Personalising images gets easier for an individual or a company. The colour palette has numerous options for every brand. You may use over 1,800 colour options for creating a personalised image. Interactive opportunities: The advent of digital technology has made the printing process more interactive. You must have noticed a few unique ways of using thermal colours for printing. Another revolutionary concept results from interactive QR codes. Professionals participating in the print design process will find the digital methods more interactive. Unique craft skills: Your skillset plays a crucial role when you are printing a photograph or design. The technology used in the digital printing world continues to evolve. However, the skillsets are really important for achieving the desired image. These days, you have the extra benefit of consulting online tutorials while working. You may follow a certain step-by-step guide while creating your desired image. It has nothing to do with the material you are using. The advent of digital printers has improved the option to develop photographs. The new technology helps us in developing clearer and sharper images. It does not create pixilated images. It gives us an indication that it is easier to print photographs on different surfaces. You may apply it to ceramicware for your business. Trying your hand at clothing materials will give you a new look on your birthday. Likewise, you can draw an image on canvas and get it printed for your school project. A good printer will always allow you to explore your imagination and win accolades. Read Also: Paper Authority: Basic Tips In Purchasing A Printer Advance Copier: Printing Quality Business Cards On Your Own Computer 7 Ways To Stop Spending So Much On Printing In Your Business

READ MOREDetails

Things to Remember While Buying a House for Revenue Generation

Flipping a house is one good way of generating revenue. It is also possible to gain much profit from it. House flipping refers to the purchase of a property that is sold under its market value. It is sold after it is renovated with the aim to resell it in the shortest possible time. The house is resold at a cost that is kept higher to earn more money. There are various advantages to flipping houses. Drawbacks come in a bundle as well. It is always advantageous for flippers to consider the pitfalls and benefits of a property before they proceed to invest. A Few Important Points of Consideration Are Mentioned Below: Low barriers to entry: Every person has the right and opportunity to buy a property so long as they have sufficient cash on hand. They may also apply for a personal loan. There are no specific requirements for selling or buying a property. Quick gain opportunity: The process will not be exceeding 6 months from the beginning. It can, in fact, be done in about two months. Among the best-selling points of flipping is that it is something that provides gains that are fast and big. Be your own boss: Flippers might be regarded as the boss or proprietor of a property since they are taking all the decisions on their own. They are accountable for the decisions regarding the house flip. This is among the advantages of home flipping even when you are checking properties in seaside townships like Mornington. Even while preserving the full-time occupational income, a person can generate additional income by flipping houses in Mornington. Therefore, house flipping provides the advantage of exploring an additional income source. Sometimes it gets risky when you flip a house. It is essential to claim the right property on time. You will lose much of your income if the property sits empty on the market for a much longer period than what you anticipated initially. Selling and buying of a property that sits empty on the market for long gets complicated. The longer a property remains vacant, the more you need to acquire a large amount of capital for its maintenance. A significant amount of capital: Alongside repair work, you need a big sum of capital to upgrade your property. The expenses that you bear for procuring materials, equipment, and labour, are often quite high. You must remember that you have to bear them after meeting the cost of insurance, maintenance, and utilities. You will have to spend a considerable amount of cash on paying insurance, maintenance, and utilities for the home that arise if you cannot sell the home within the given time frame. Tax implications: Whenever you sell a house within one year, your profit is regarded as derived from a business as opposed to investment. You are held accountable for any loss and can be disheartened by the pitfalls as they are eventually much costlier. In a nutshell, all the benefits of house flipping frequently overshadow the downside. Apart from consulting a real estate investment expert, you may consider doing your own research back home. A few good online resources are available to fulfill your quest for knowledge on this. Read Also: Things To Know Before Buying A New House Best Home Buying Tips For First Time Buyers

READ MOREDetails

Tips for Renting a Wheelchair Van at Your Destination

For most people, travel involves making a lot of arrangements, including obtaining a rental car for the duration of the trip. Those with disabilities need to go about the process a little differently. Many individuals who use wheelchair accessible vans don’t take these vehicles with them when they travel. Rather, they prefer to rent one when they arrive at their destination. But assuming that a rental car company at the airport will be able to provide a handicap van could prove to be a disastrous mistake. Planning is essential for a successful, worry-free trip. Here are some tips to keep in mind when renting a wheelchair van at your destination. Tips To Keep In Mind When Renting Wheelchair Van At Your Destination 1. Plan Ahead Renting a wheelchair accessible vehicle is not something you can wait until the last minute. Make sure to plan and book everything ahead of time and re-confirm. This includes planning the company you will use, how you will get there from the airport, what kind of vehicle you will need, how long you will need it, how you will return the van, and what the total cost will be. This can help eliminate surprises and unnecessary frustration. 2. Look Outside of the Airport: Renting a vehicle from a kiosk at the airport includes high fees and taxes. Also, there is no guarantee that there will be a vehicle available that meets your needs. It’s often less hassle to choose a conversion van dealer off the airport. The dealer may even offer airport pick up and drop off making your rental a smooth transaction. Just be sure to call and make arrangements with the dealer in advance and re-confirm prior to arrival. 3. Does the Rental Car Company Offer Wheelchair Vans? Not all rental car companies will be able to provide a handicap van. Its best to make sure you call the rental agency at the location where you will be renting and ask if they rent wheelchair accessible vehicles. Because inventories change, it’s a good idea to speak with someone at the rental location to make sure they have an accessible vehicle. Find out the kind of accessibility they offer, such as ramps or lifts. For example, some rental companies offer adaptive equipment, but not lift-equipped vans. 4. Make Sure the Handicap Van Will Accommodate Your Needs: All wheelchair-accessible vans are not alike. Each make and model has its own specifications, features, seating, and cargo capacity. Make sure the one you choose will adequately accommodate the needs of your passengers and luggage. 5. Consider a Conversion Van Dealer: Sometimes, a rental car company simply cannot accommodate your special needs. You may need to contact someone at your destination who specializes in wheelchair-accessible vehicles. A conversion van dealer may be able to provide you with a wheelchair-accessible van to serve your needs for the duration of your trip. Whenever you make the selection of the wheelchair van in your destination keep these factors in mind. Use These Tips to Reduce Stress on Your Trip: Traveling doesn’t have to be stressful, even if you or a loved one are traveling with disabilities. Make sure your wheelchair van rental will accommodate your special needs. It will make your trip much more enjoyable and worry-free. Read Also: 6 Reasons Why Vehicles Are Now Safer Than Ever Your Essential Guide To Leasing A Vehicle In The UK Feature Image: Source

READ MOREDetails

Useful Marketing Tips for Startups

Startups need to use different marketing methods compared to established businesses. The reason for this is simple – startups have a very limited budget and less experience compared to established companies. It is crucial to be aware that, if your marketing is done right, it can have an incredibly positive impact on the success of your business, and its net income. However, if you do it wrong, it may feel as if you are throwing money away. If you want to be successful and profitable, you need to use the right methods of advertising. Don’t copy established businesses as you are surely not able to do all the things that they do. Instead, you should try certain marketing methods that are perfect for small companies with limited budget and experience. These methods will help you increase sales, profits, and avoid wasting money. Different Marketing Tips Startups Must Consider At Their End There are multiple marketing tips startups can consider as their end while developing their business in the right direction. Try to Think Outside the Box: You need to keep in mind that the business field is changing rapidly. The marketing landscape has changed dramatically over the years, especially compared to the time before the internet. If they want to be successful, startups need to combine traditional marketing methods with online advertising. When advertising products and services that you offer, you need to be original and think outside the box. It is crucial to come up with unique and innovative solutions that will be both effective and creative. Whatever you do, you should make sure that it is original, instead of just trying to copy what was already done numerous times before. Provide Useful Information about Your Products: Of course, your products are amazing in your eyes. However, it doesn’t mean that everyone else is delighted by them, and is just waiting to hear about them. You need to be aware that people are not rushing to buy the products that you offer, and if you want to change this, you need to advertise them properly. You shouldn’t push anyone to try them. Instead, it is a wise idea to provide information and tips that people will find useful. If you want to be successful, you should use visuals including images and videos. People will look forward to trying your products if they consider them interesting and useful. Use Powerful Business Signage: Another thing that can improve your success and increase sales and profits is exciting and quality business signage. Many people pay attention to signs and are more likely to buy products that a particular company offers if they notice interesting signs in front of it. You need to keep in mind that many people pass by your business on a regular basis, and all of them are potential customers. However, a significant percentage of these people won’t be aware of your existence if you don’t attract their attention with custom business signs. You should use eye-catching signage if you want to increase your customer base and turn them into loyal clients. Something like this will have a huge positive impact on the success of your startup. Read Also: 7 Startup Ideas For Young Entrepreneurs 5 Marketing Tips To Help Grow Your Business On Instagram

READ MOREDetails

Debt consolidation plans for your debt relief

Debt consolidation is a financial strategy that merges several financial bills into one debt that gets paid off through a management program or loan. Debt consolidation is useful when the debt is of high interest like the credit card. It needs to reduce your monthly repayments by lowering the rate of interest on all your bills, which makes it easy to pay the debt off. The option of debt relief untangles the mess that consumers face each month when they are struggling to keep up with several bills from various card companies and different deadlines. In its place, there is a single payment to one source each month. It also saves money at the end of the day. There exist two primary forms of debt consolidation – signing up for a debt management program or taking up a loan. It is up to you to decide on the method that fits your situation. You can also call this credit consolidation or bill consolidation. Consolidating debt should help get you out of debt very fast and improve your credit score. How does it work? It works by lowering the rate of interest and reducing monthly payments to a price that is affordable on debts that are unsecured like credit cards. The leading step towards debt consolidation plans is calculating the total money you pay for your cards monthly and common interests paid on the cards. It provides a baseline for purposes of comparison. You will then have to look at the budget and add spending on basic utilities like transport, housing, and food. How much money are you left with? For many individuals, there is always enough left to handle the budget and help them pay their debts. However, motivation and effective budgeting are never evident when individuals fall behind on bills. And this is where debt management programs or debt consolidation loans step in. All of them need one payment monthly and gives you time to track the progress of removing debt. Will some calculations and research inform you if a debt management program or loan will be of more help in paying the debt? Using a loan to do Debt Consolidation: The standard method of doing debt consolidation involves getting a loan from the bank, online lenders, or credit unions. The loan has to be large enough to clear the unsecured debt at once. The loan gets paid with monthly installments at the negotiated interest with the lender. The period of repayment is usually five years, but the amount of benefits charged is the crucial element. The lender will take a close look at your credit score while determining the interest rate charged for the loan. In case you are falling behind with your debts, it is likely that the credit score will tumble. In case the debt consolidation interest is not lower than the average benefits you are paying on credit cards, then the loan will not be doing you any good. There are other alternatives to loans like personal loans or equity loans, but none of them will help if the rate you are paying is long and does not make sense. Consolidating Debt without a Loan: There is a possibility of combining debt and reduce installments without another loan. Agencies that do non-profit counseling provide debt consolidation via debt management programs that do not require you to take credit. In that place, the non-profit agencies work with companies of cards to reduce interest rates and lower monthly repayments to a level that is affordable. The consumer will send payments to the counseling agency that then distributes the funds to agreed creditors. The agency may tell the firm to waive over-the-limit and late fees. This solution is not quick. Programs of debt management take up to five years to manage the debt. If you miss one payment, they may revoke the arranged concessions on the monthly fee and interest rates. Read Also: Eight Essential Tips For Getting Out Of Debt Are Debt Consolidation Loans Recommended For Credit Card Consolidation

READ MOREDetails

Three Essential Techniques To Form Lasting Customer Loyalty

A great product and/or service may be the foundation of a company, but customer loyalty is the key to success. Customers don’t come with a guarantee to stick by you just because they’ve purchased something: loyalty and repeat business must be earned and enticed. The standard adages and techniques apply: put the customer first, reward their continued business, and create a valuable experience beyond your product. How can these things be effectively achieved? Review the following key areas and tailor them to your business. Different Ways To Maintain Customer Loyalty There are multiple ways you can maintain customer loyalty. You have to understand the ways that can work well for you in the best possible manner. Access customer relationship management tools: In the same realm as enterprise resource management tools, there are digital solutions to assist with practically managing and improving relationships and dealings with customers. These systems provide easy, streamlined access to data and customer information anywhere, with cloud capabilities. Manage sales, customer support, marketing, and more. Collect the right data from customers and learn how to utilize it to your advantage. Employees are empowered with accurate reporting tools to manage and forecast effectively. Marketing programs are automated, and campaigns can be tracked, analyzed, and altered. Customers have tools to help themselves in addition to enhanced customer care and satisfaction applications. Expert consultants can offer professional Sage software help to better customize a CRM solution to fit your organization. Go beyond offering incentivizing rewards: Rewards programs, like earning points to spend, or free products based on milestones, are common because they work. Customers are indeed drawn to return to companies that add extra value to their repeat business. But, because these perks are standard, and many businesses offer them, so too do your competitors. You need to go beyond a rewards program. Encourage people to spend time on your site with entertaining and informative content. This could be blog articles that enhance your product or service with tips for usage, getting the most out of their purchases, how to improve their lives in the same general subject area. Videos are another great way to deliver this information and encourage engagement. Promote a sense of community among your customers. Send newsletters that treat everyone like members of a team with common interests and goals. Create social media channels suited to your brand where people can interact and potentially help and add value to each other’s lives. The plan sponsored events and opportunities in the community. Develop a branded app to for additional functionality and connection. Provide authentic customer care: Open communication channels to offer feedback and ask questions. Let customers know they not only have a forum, but that it is being read, considered, and responded to. Allow other members of the community to aid your efforts through offering their assistance and tips on a digital platform like a message board or social media. Allow your loyal customers to help your company make decisions and steer you in new directions. Provide surveys that go beyond asking ‘How Did We Do?’ by asking for and valuing their opinions on new offerings, designs, and customizations. Allowing for multiple aesthetic and functional options to choose from when buying to better personalize your offerings makes your product or service suit the individual better and sets you apart. If customizations aren’t feasible, instead of better inform customers on how to make the most of their purchase with proper instructions, additional materials, and tips. Read Also: 30 Things Your Customers Do Not Dare To Tell You Why Your Business Should Care About Social Responsibility

READ MOREDetails

Are Payday Loans Really as Bad as People Say?

You’ve probably gone to your computer to research online payday loans in Texas and instead been met with a barrage of negative information regarding payday loans. Most consumer advocates demonize this type of finance, saying it is predatory and that it needs to be banned because it does not help the average consumer. That is not true at all. Repeat Customers: What most detractors of the finance system do is that they focus on the supply side of this business. They don’t look at the demand side, which grows stronger and more demanding every day. What is it that makes borrowers come back for payday loans repeatedly? In order to answer that question, you need to have an intimate understanding of the average borrower that relies on payday loans. This is typically a low to medium income earner whose wages cannot cover surprise expenses such as a broken-down car, medical expenses, or emergency funding for your business. They typically don’t have savings or investments or even the same incentives to save and invest that higher-income earners have. Their real wages have been on the decline since 1972, and so they find it harder every year to make ends meet adequately. Moreover, traditional banks have all but abandoned them and won’t touch them with a 10-foot pole — not since the financial disaster that began sometime in 2007. What recourse is there for such a consumer? What can they do and who should they turn to when their backs are against the wall? Watch Out for Predatory Lending: To be sure, there are some unscrupulous payday lenders that take advantage of borrower’s situations and harass them, making them live in constant discomfort over their loans. They also encourage them to borrow a lot more than they can ever hope to pay back, just so they can roll over the loans or take out other loans to pay the initial ones back and get trapped in a constant cycle of debt. But this isn’t all lenders. To begin with, the lending industry is well regulated with lenders being required to follow strict rules on what they can say or do when trying to recover their money from a borrower. They also aren’t allowed to take borrowers to court in many states. The good lenders are having their name tarnished by a combined team of bad lenders and so-called consumer advocates who don’t quite understand or empathize with the dire situation of the low-income earners who need these loans. These are people who typically have neither good credit nor friends and family from whom they can borrow money or ask for help. The payday loan is their last resort. Would it be fair to take that last resort from them and give them no alternative to replace it? Take Only What You Can Pay Back: There are also many borrowers who take just enough money to meet their emergency needs. They make sure it is something they can pay back with their paycheck, and they pay it all back on time. Just like there are lenders who encourage borrowers to take only what they can reasonably pay back, and do not harass them when they run late on payments. Payday loans are not evil. They are a quick solution to many of the needs of a certain otherwise abandoned section of society. Read Also: How To Save More Money? 9 Vital Options For When You’re Desperate For Money

READ MOREDetails

5 Important Tools For Pipe Recovery Operations

For well lodging and digging you use many types of equipment like drilling tool, lodging tool, measuring tools and more for perfect well. You can attach these tools with a single string or with group o strings and put them down in the wellbore. However, due to some reasons, either the wireline string breaks or the digging tool gets stuck in downhole formations. Does your drilling string often get set stuck inside the well? If so, then use pipe recovery operations to release the string or to make it free from the blocked position. Pipe recovery services use to make the portion of jammed string free from well formations. These services help you in identifying the location of block pipe, to cut the stuck string and finally to bring back the free portion of the pipe from well. If your pipe gets stuck and you wish to release it then, below are some tools that will help to take out the portion of blocked pipe from downhole or well. Free Point Indicator Tool: This tool is used for pipe recovery services to identify the location of stuck pipe in the wellbore. It works by measuring the torque and pressure of wireline in the downhole to identify the location of blockage in the well due to the stuck pipe. You can also use it to judge the stuck point in all type of tube wells, coiled tubes, and well casing. Back Off Tool: Once you are done with a location check of the stuck point of pipe, you might be thinking on the way to release it. There is a back off a tool that helps you to remove the free portion of the string from the well. It works by applying the torque on a stuck portion of wireline and detonate it. Hence the free string gets separated from stuck string and can be pulled up from the wellbore. Chemical Cutter: It is a good tool for the recovery of electric wireline services and is widely used in operations where no need of any torque to pull up the string. It is capable to cut coiled tube, well casing and drill pipe without providing any harm to other portion of pipe or well. These tools are designed to operate in conditions like extreme pressure and temperature which make it best tool for oilfield well. To make a clean cut and not leave any debris in the hole. Radial Cutting Torch: It is lowered down into the well to cut the stuck string. It uses the mixture of powdered metal that a burn with high temperature on ignites and it melts to become molten plasma. This plasma is then ejects through a nozzle onto the target string and cut. Fishing Tool: You can use this tool to release or remove the stuck pipe and any other suspended material from the wellbore. There are many fishing tools available such as spear, overshoot, junk mill and boost basket that help you to recover the stuck string from the well. A spear is a tool that can fit within the pipe and help to grip the pipe from inside. However, overshoot tool grips the pipe from outside and help to bring it up from the well. Recover the wireline as soon as possible to save the drill time off well. Recovery of the pipe is also a need that protects further damage to the good casing. If you feel that wireline recovery operation is not easy for you then, you may call any pipe recovery service provider. Read Also: Power Drill Safety Tips Guide To Different Types Of Water Flow Meters

READ MOREDetails

A Little on the Side…Or Not? Your Guide to Supplemental Insurance

Have you ever experienced something you didn't expect? It might have been something good, like bumping into an old friend on vacation or being taken to a surprise party. Or it could have been something not so favorable: a car accident, the loss of a job, a sudden illness… The world is an unpredictable place. Each new day brings its own surprises - both good and bad. We can't plan for those surprises, but we can protect ourselves. In 2017, Americans spent $1.2 trillion on health insurance premiums. Having a good health insurance plan can protect you in the event of an unforeseen injury or illness. But it's not always enough. Some people go to make a claim only to find that it isn't covered. Others can afford to make their monthly premiums, but when they need medical assistance, they can't afford to pay their copays. Even with health insurance, medical bills are the leading cause of bankruptcy in the US. Supplemental insurance may help cover those costs so you don't need to add a financial emergency along to your medical emergency. What Is Supplemental Insurance? As the name might suggest, supplemental insurance is a type of insurance that supplements your existing healthcare coverage. There is a wide variety of health insurance plans, but most plans give you a choice between a low monthly premium and a high deductible or a high monthly payment with a low deductible. Most people choose to go with a low monthly premium-especially if they're generally in good health. But since 61% of Americans don't have enough savings to cover a $1,000 emergency, that high deductible could ruin them. Supplemental insurance is a separate health insurance policy that can be used to cover additional expenses that you may be unable to cover on your own. You might use it to pay for a deductible, copays, or care that your regular insurance does not cover. Some supplemental insurance companies will even cover lost wages for time off due to illness. Supplemental insurance carries its own monthly premium. However, this premium is often lower than the difference between your current insurance plan and a plan that would cover everything else you need. Types of Supplemental Insurance: Just like every health insurance plan is different, there are several different kinds of supplemental insurance. You can mix and match these plans as needed. Dental Insurance: It's likely that you already have supplemental insurance without realizing it. Most health insurance plans do not cover dental work. And since regular visits to the dentist are an important way to fight dental problems, that could leave you on the hook for expensive out of pocket costs. To cover your dental care costs, you must have a supplemental plan. This supplemental is often provided in your benefits package from your employer without you even realizing it. If you manage your own insurance, your primary insurance provider may offer a separate plan to cover these. Vision Insurance: Like dental insurance, vision care is not typically covered by most health insurance policies. And that's bad news considering that 75% of Americans need some kind of vision correction. While you could always see an optician at the cheap eye clinic in the strip mall, that's a poor substitute for regular appointments with an optometrist or ophthalmologist. An optician can also miss other serious problems that an optometrist or ophthalmologist would catch. Supplementing your medical insurance with vision insurance can keep your vision care expenses from running through the roof. Medigap: Medicare is a state-run insurance program that covers citizens over 65 or certain individuals with disabilities. It is funded through taxes, so recipients do not pay a monthly premium. Many people depend on Medicare to cover the cost of their ongoing healthcare. But it doesn't cover everything. Medigap plans can help cover out-of-pocket expenses or necessary care that is not covered by Medicare. Travel Insurance: If you're traveling away from home and you are injured or become ill, you may not be able to find any healthcare providers within your network. Purchasing supplemental travel insurance before you travel is a good way you can stay covered if the worst should happen. Critical Illness Insurance: While insurance exists to cover unforeseen costs that you cannot afford, every insurance plan has an annual limit or a cap on how much they will cover. If you reach that cap, you must pay for any costs beyond that. If you become seriously ill, it can be easy to reach the cap in a hurry. Supplemental critical illness insurance is used to cover expenses beyond your insurance policy's annual limit. Do I Need It? You might be reading this thinking, "this is all well and good, but do I actually need supplemental insurance?" Can you afford to pay your entire deductible? Can you pay for out-of-pocket expenses like copays and prescriptions? Can you afford to pay for additional care out of pocket? Are you at risk of reaching your policy's annual limit? If you answered "yes" to most of those questions, then you might not need supplemental insurance. If you have a savings account that you can dip into to cover extra costs, you can skip it and pay less per month. However, if you do not have a lot saved up, paying a few dollars more per month for supplemental insurance could save you if you suffer a health crisis. Take a look at your financial situation, your current health insurance, and your overall health and make an informed decision. Protect Yourself: Supplemental insurance is a great way to protect yourself from uncovered medical expenses. But as the old saying goes, an ounce of prevention is worth a pound of cure. You can help prevent runaway medical costs by taking care of your health. For more articles about how you can stay healthy, visit the health & fitness section of our blog! Read Also: How To Get Low-Cost Life Insurance For Seniors Small Business Guide To Private Health Insurance Exchanges

READ MOREDetails

How to Protect Your Property as a First Time Landlord?

No matter what route you take to the rental market, you’re making an exciting step in life. Many people believe that becoming a landlord is fail-proof. However, although the process can be both financially and mentally rewarding, there are downsides and potential pitfalls. Renting out a second property is ideally an investment and, as such, several risks come with it. As a result, you need to protect your investment and mitigate against risk. Here’s how you can do just that to make sure that you are getting returns for your investment. 1. Take Out Insurance Being The Landlord: Traditional insurance doesn’t usually cover rental properties. As a result, you should take out specialist landlord insurance. As well as protecting your home in the same way traditional home insurance would, landlord insurance can protect you against other problems, such as unpaid rent or a tenant injuring themselves at your property. Get a company that offers the best insurance deals to landlords and insure your property with them. 2. Draw Up the Correct Contract: The correct tenancy agreement can help you in case you need to evict a tenant or take action against them. The vast majority of rental agreements come to an amicable end, but there may be times when you need to evict your tenant. A correct tenancy agreement will provide you with the framework to issue either a Section 21 notice (giving them two months’ notice) or a Section 8 notice, which allows the person to seek possession under particular grounds such as rent regions and anti-social behaviour (more information on both of these notices can be found here). Make sure that the tenancy agreement that you craft will protect you under all circumstances. 3. Take A Security Deposit: Taking a security deposit or a damage deposit (usually a month’s rent) allows you to protect you and your property against any breakages or damages. It is important to put these measures in place if you want to be sure that you are on the safe side. You must place the deposit in a concern that is regulated by a government deposit scheme, such as the Deposit Protection Service, MyDeposits or the Tenancy Deposit Scheme. The deposit is then returned to the tenant at the end of the tenancy unless they fail to meet the terms of a tenancy agreement, cause damage to the property or fail to pay rent and bills. 4. Ensure There’s an Inventory: Before your tenant moves in, you should complete an inventory of everything currently in the property. As well as listing everything currently in the property, you should also list its current state, including any dents, scratches or stains. Once this is complete, you should have a walk around the property with the tenant. Then you can both confirm everything listed is present and the condition described is accurate. When this process has been completed, you should both sign and date the inventory. 5. Have a Financial Buffer: Finally, you should ensure you have a financial buffer, in case you have to pay for running repairs. The costs for running a rental property can quickly stack up. Although you could take out an installment loan to finance any major payments, it’s advisable to have a pot of savings before you begin, in case you need to finance any running repairs. Read Also: Is Property Investment Still A Good Way To Make Money? 6 Expert Tips For Finding The Right Home To Buy

READ MOREDetails

How to Protect Your Finances While in a Nursing Home

It is usually the case that very few seniors know what rights they have when it comes to long-term care, as well as their options when it comes to their finances. Many people will either avoid thinking and planning about the issue or develop a faith that they won’t need senior care when they grow older. The statistics point out that nearly 70 percent of Americans age 65 and older will need some kind of long-term care for their sunset years. Nursing Home bills can be expensive if you are not aware of it. When it comes to payment for nursing home costs, you will typically use a combination of Medicaid, long-term care insurance, assuming you took out a policy and have been faithful with the premiums and money out of your own pocket. Paying for it out of your own pocket or some form of insurance will take a lot of planning beforehand and savings as well. Because most people don’t do this, they instead turn to Medicaid. A Look in Medicaid Of Nursing Home: Medicaid isn’t like Medicare, which doesn’t cover long-term care. Medicaid is a means-tested system which means that you can only qualify if you have a low income, own a small amount of money or assets or both. It is usually the case that seniors will want to preserve their money, either to pass it on to their families or simply because they want to preserve it. The problem is that Medicaid has strict requirements that do not allow for this. Medicaid requires Americans to spend money out of their pockets before the program steps in. If a senior American gives their assets away to their families, then Medicaid has a 60-month look-back period where they will look for this inheritance and hit the senior with a penalty period where they will be disqualified from Medicaid. There are, however, various legal strategies you can use to protect your finances, according to The National Association of Nursing Home Attorneys. Put Your Money in an Asset Protection Trust: These trusts, as you might imagine, are designed to protect your wealth. You can, however, use it to protect your money in other instances as well. When you pass your assets along to a properly designed trust, then that property no longer belongs to you. It is therefore not within reach of any creditors or even Medicaid. Make sure you make the transfer more than five years before you need long-term care because it could still come within the look-back period of Medicaid. Put Your Money in an Income Trust: You have to deal with income limits when you apply for Medicaid. If your income exceeds that limit, it will be considered as excess. To avoid this situation, you can put your money in either a pooled income trust or a Qualified Income Trust. Qualified income trusts are designed to hold any of your excess income. It is an irrevocable income trust. A pooled income trust, on the other hand, is used to hold excess income for disabled individuals. The income from many such individuals is pooled together managed by a not-for-profit organization. Caregiver Agreements: This can prove to be a useful strategy in some situations. It is useful when the individual would like to access extra services that Medicaid does not cover. You can get a friend or family member that has taken some time off from work to provide you with these services and pay them an income for it. It is an excellent way to ensure you are cared for by someone you trust and also to reduce your countable resources from Medicaid’s perspective. Read Also: Everything You Need To Know About Term Insurance Plan Premium How To Choose The Best Auto Insurance Company?

READ MOREDetails