Term insurance plan is a type of insurance policy that offers pure life protection to the family of the insured in case of an uncertain demise of the insured person. This is the most basic kind of insurance policy that you can opt for. The premium amount on the term plan is also the lowest as compared to other life insurance policies.

What Is A Term Insurance Policy?

The term insurance policy offers life coverage for a specific period of time to the family of the policyholder in case of any eventuality. In case the policyholder expires within the tenure of the policy then the nominees get the sum assured amount. If the policyholder, however, survives all through the term plan and the policy expires then no maturity benefit is offered to the policyholder. The term plan is designed in such a way that it protects the family financially in case of the policy holder’s death. The online term plan is also for a set period of time. There is no wealth creation or investment benefit when you invest in a term plan.

Term Insurance Plan Offers an Affordable Premium Rate:

The offline/ online term insurance plans offer the lowest premium as compared to the other kinds of insurance policies. This is because the plan has no investment component attached to it and it is pure life protection. So in case, the policyholder expires during the policy term then the nominees will get the benefit. However, the term plan has no survival maturity benefit. This makes the term plan different from the other insurance policies that offer a maturity benefit to the policyholder in case the policyholder survives the entire tenure of the policy.

How Is The Premium Of The Online Term Plan Calculated?

Term insurance is basically a contract that the policyholder and the insurance company get into. The insurance company agrees to financially protect you and your loved ones in case of any eventuality within the policy term. In return for this security, you pay a premium amount to the insurance company.

Having an online term plan is a great idea and should be apart of your financial plan. Life is unpredictable and your family could get into a big financial crunch if you leave them without any financial backup. Thus if you are not financially secure then your family could be in big trouble.

If you leave without insurance then you may leave your family in big debt and thus you need to make it a priority to protect your family in every possible way. The term insurance plan is simple and the most economical way in which you can insure your life. The insurance plan lets you to financially secure your loved ones even when you are not around.

Terminsuranceplansattract a premium amount and thus you need to know first what decides the premium amount that you pay towards the term insurance policy.

The Term Plan Premium:

The premium of an online term insurance policy is calculated based on some simple aspects. This is the premium rate which is multiplied with the coverage amount that you have chosen. Mathematics and statistics are used to decide the premium rates. The risk is calculated to determine what the term premium is. The risk is basically how likely you are to place a claim. The lower is the risk attached to you the lower is the term insurance policy premium rate.

Factors That Affect the Term Insurance Premium Rate:

The insurer determines the premium amount based on the various factors when you apply to buy a term insurance plan.

-

Your age

Age is one of the most important factors that determine the premium amount of the online term plan. The older you are the more is the premium amount that you will have to pay. This is because as you age you are a higher risk to the insurance company and the chances that you will be claiming the insurance amount is high. This is why it is advised that you get the term insurance plan when you are young.

-

Gender

It is studied that women have a higher life expectancy than men. The insurance companies feel that women are less likely to die and thus they are charged a lesser online term plan premium than men of the same age. This is why the premium that is charged for men is higher than that for women.

-

Job profile

What your occupation also determines the online term plan premium amount that you will pay. There are some job profiles that are high risk as per the insurer and thus you will have to shell out a huge premium if you are working in any of those profiles. Those that are in some dangerous professions like an army, pilot, etc. have a higher premium rate than those who work in safe working conditions.

-

Geography

Where you stay also plays a very vital role in deciding the premium amount. Those places that are less prone to disaster charge you less premium than those places where natural calamities could charge anytime. This includes places that are prone to earthquakes or hurricanes.

-

BMI

Your body mass index is calculated by the insurance company. If you are overweight then you are likely to suffer from medical conditions like heart diseases and thus you will be paying a higher premium towards the life insurance policy.

-

Smoking

Smokers have a lower life expectancy and thus if you smoke then get ready to shell out extra towards the term insurance policy. This is because smokers have a high probability of having cancer and lung disorders.

The cost of premiums can vary more wildly for smokers than non-smokers, so it is even more important to compare quotes. You could use a comparison website or a regulated broker such as Reassured.

-

Alcohol

If you drink a lot then you could be prone to health problems related to alcohol. This is something that is considered when calculating your insurance premium.

-

Medical history

Your past medical state is also considered to calculate the premium amount. If you have ever suffered from illness in the past then this could cause the life insurance premium to increase. Also if your family member had some life-threatening disease at an early age then this could cause you to pay a higher premium towards the term insurance plan. This is because you are likely to get affected by the same disease at a later stage in your life.

-

Adventure Sports

If you are into adventure sports then you are likely to die having met with an accident. If you are too much involved in adventure sports then the premium charged to you will be higher.

-

Other factors

There are many other factors that could affect the premium that you pay towards term insurance policies. This includes your travel history, marital status and whether you have chosen for an additional rider. Every factor of your life determines how much premium you will be paying towards an insurance policy.

It is important that you declare them all when buying a term insurance policy. There is no point keeping the insurer in the dark because in case they get to know about it after then they would reject the claim. Thus your whole purpose of having a term insurance plan in the first place gets nullified.

How Much Premium Do You Need To Pay Towards Your Term Insurance Plan?

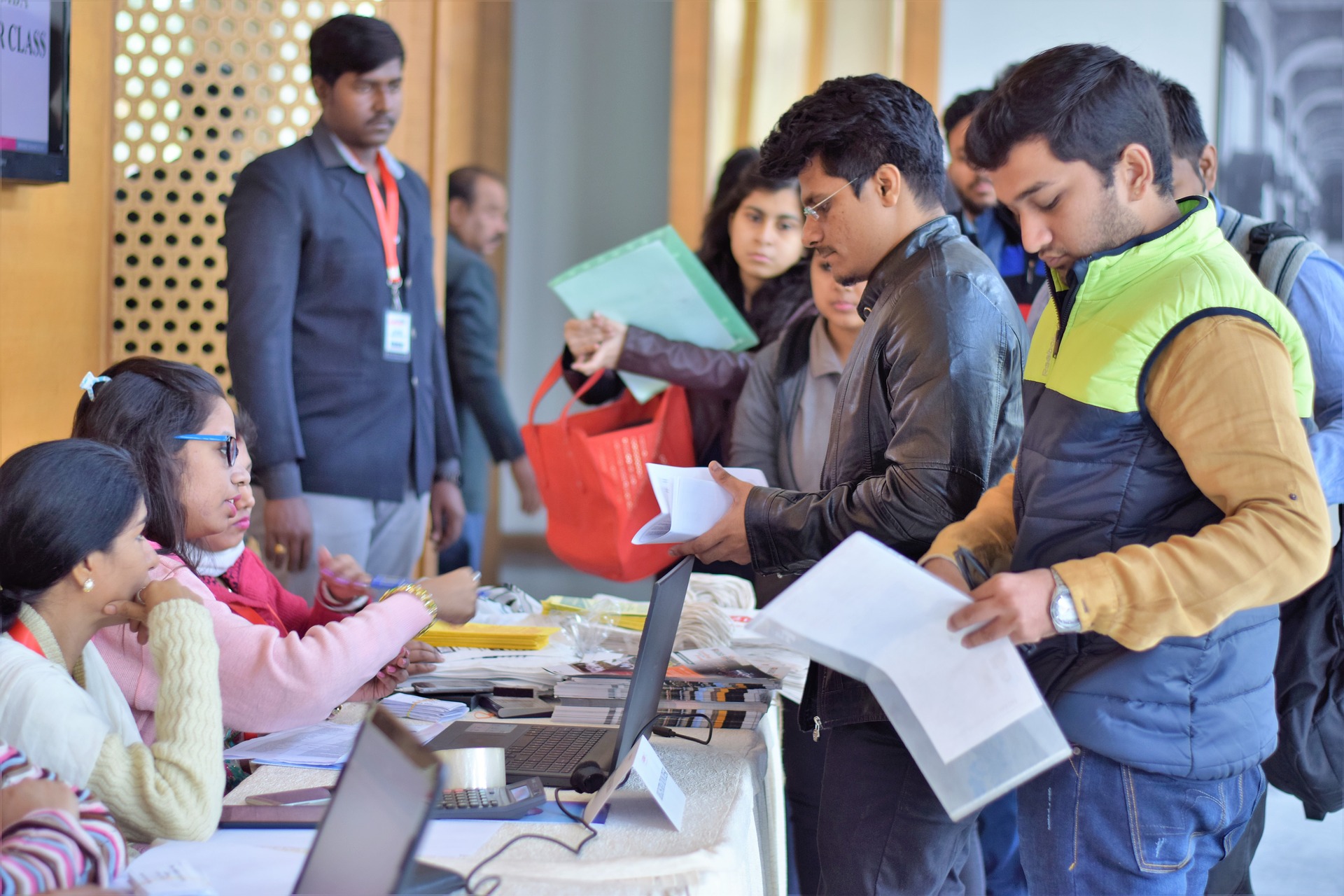

If you are wondering how much premium you would have to pay towards your term insurance plan then here you go. You could use a term insurance premium calculator that will be available for you to use for free on the website. All that you will have to do is to key in some details required and this will calculate the premium amount for you.

How much insurance coverage you will need is dependent on your age mostly. You need to add your present income and multiply it roughly with 15 and then add any of the outstanding debts or loans to it. This will give you an approximate amount of the coverage that you need.

This just gives you an approximate amount. You will also have to figure out the premium based on your retirement age, present age, inflation, liabilities that are existing and other needs. It is important that you consider the information and put in as much information as required and accurately you can come up with the most approximate figure.

Some of the details that will be required when you use the online calculator are your name and age, purchase year, tax liability, date of birth, gender, total coverage amount, etc.

You can use the term insurance premium calculator to get a rough amount of premium that will be charged towards your term insurance plan.

Choosing the Best Term Insurance Plan- Term Insurance Comparison

It could be a little tricky to decide on the best term insurance plan. You need to keep the following things in mind to make an informed choice.

- The reputation of the insurance company

- Coverage required

- The claim settlement ratio of the company

- Factors that could affect the coverage

- Terms and conditions associated with different companies

- Online or offline term insurance plan purchase.

All these will let you decide on the term insurance premium calculator on the best term insurance plan for your needs. The premium of the term insurance plan is comparatively lower than any other insurance plan that offers life coverage. It is however advised that you buy a term plan because it offers higher life coverage for a very low premium amount.

Read Also: