Welcome to the world where the real estate business is an endless superstar, where every centimeter brings you profit and success. The world of digital marketing is progressing at an unbelievable pace, which often means that, with great opportunities come great risks.

So what are you waiting for? Getting adequate protection for your investment with robust insurance coverage is not a matter of a choice; it’s better to necessity; it is a necessity. Are you still confused about optioning adequate insurance coverage for the multiple-priced assets that you have acquired in the country with the most trusted insurance specialist for Australia’s commercial properties? Come along, let’s go into this together.

The Importance Of Preserving Your Financial Security: How To Avoid Frivolous Spending

Commercial property ownership implies the obligation of the landlord to protect their investment, thus, it is crucial for them.

Your Property can be viewed as a source of substantial expense at times, thus sheltering it from all avenues of unplanned disasters, a prerequisite for sustainable achievement.

Hence, sufficient insurance coverage is rather crucial to you. If there is inadequate insurance coverage, risks such as a natural disaster, vandalism, or liability claims might be raised against you.

Carrying a sufficient CIB commercial property insurance policy allows you to bounce back from the financial crisis in the event something unforeseen happens to your home.

Aside from shielding your business and property from potential devastation, business property insurance, you are also ensuring your tranquility against losing anything you own.

The Importance Of Insurance For Commercial Property Owners: How To Safeguard Your Investment

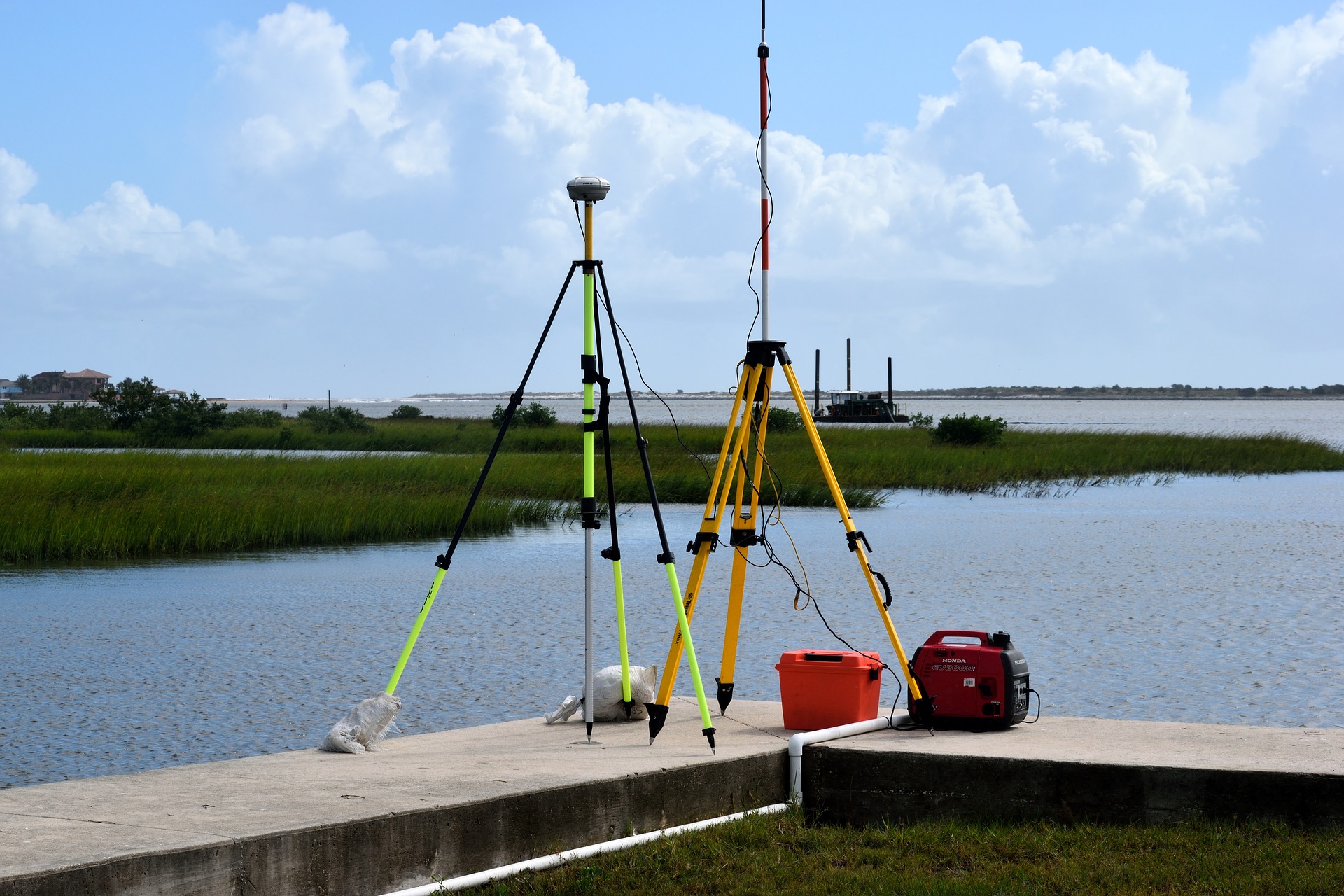

Commercial property can be a profitable investment in many perusals, but it is also an investment that encompasses many occupations. From natural disasters like floods or fires to events like vandalism or theft, commercial property owners might have to think of their main loss drivers and it is very possible that the loss could directly impact their bottom line.

With their insurance policies unable to completely cover these threats, they can easily make them end up with huge financial debacles. Repairing damage from a fire or replacing stolen equipment can quickly add up and strain your finances. Furthermore, your source of rental income will be compromised if the intended tenants are shut down by the property damage.

It should be kept in mind (to be prepared) for the unfolding of unforeseen circumstances to attain business success which could otherwise risk your investment. The above-mentioned coverage combined with good insurance practice and a clear contract with the insurance company is what will give you good peace of mind and asset protection even in times of uncertainty.

The Key To Success: How Specialist Insurers Excel In Risk Management

Focusing on protecting your commercial property investment by working with a professional insurance provider enables one not only to have bespoke coverage befitting his needs but also to save money in the long run. These professionals recognize the specific risks related to commercial properties and can provide a broad spectrum of coverages for your assets to be insured.

Insurance companies with specialization in the industry put a lot of expertise to work, and they can serve you through the vestiges of complexities in commercial property insurance. They may also help you assess and recognize where these gaps exist and show you additional protection options as risk shields for unintended accidents.

Collaborating with a skilled underwriter secures your ownership of the network of their asset and skills. They work with high-rated insurers to source the best policies that suit your budget while also reducing the time you have to spend negotiating and cutting costs.

Moreover, most professional insurers in addition provide also value-added services like, guidelines on risk management, services on claims, and policy reviews to keep your insurance coverage updated. What makes them stand out is the fact that their 24/7 availability enables addressing any arising issues or questions while in keebuko with your insurance policy.

How Service Gaps Can Lead To Customer Attrition In The Insurance Industry

As you are maintaining your commercial property, having the right insurance coverage is a must too. Australia’s leading commercial property-only insurance provider can also extend their cover options and deliver services beyond the standard insurance product to ensure you are completely secure.

The extra insurance forms you may need could include coverage against natural disasters that may including flooding or earthquakes and business interruption that may arise in a case where your property becomes uninhabitable due to covered losses. Along with this, the insurance company may extend its services to you by also providing liability insurance that will be able to cover you in case someone is hurt on your property.

Among these, their experts might also be able to give you a solution that goes according to the condition of your finances and requirements. They are well-trained in their craft and empathetic to their clients, thus, making them efficient in the claims process to make you recover as soon as possible.

Experiencing the insurance expertise of a risk-savvy commercial property specialist who knows how to write policies addressing the specific risks associated with this type of investment, you can be sure your properties are adequately secured against unpredictable incidents.

If you are investing in commercial properties you may want to consider commercial property insurance. Have you already invested in a property earmarked for commercial purposes and need to protect your assets? The process of acquiring commercial insurance may be easier than you see it. Talk to your personalized specialist in no time and discuss your particular needs so that the insurance advisor will be able to give you the best policy that suits you.

Before it is too late – ensure that the security of your organization is sufficient and it has a reliable backup around during unplanned incidents. This way, you are sure that your organization will continue operations without huge disruptions. Reach out to text experts who are not only familiar with the nuances of commercial property insurance but cannot only consider your business-specific requirements but also formulate a policy accordingly. It’s worth getting protection for your assets starting now.

Read Also: