Surveying is a construction technique and process that building contractors perform to measure distances between points and angles. Surveying is also a way of levelling construction sites before the actual construction commences. The right surveying equipment helps in guaranteeing the accuracy and efficiency of the measurements. There are several instruments and equipment that surveyors use before construction.

Theodolite:

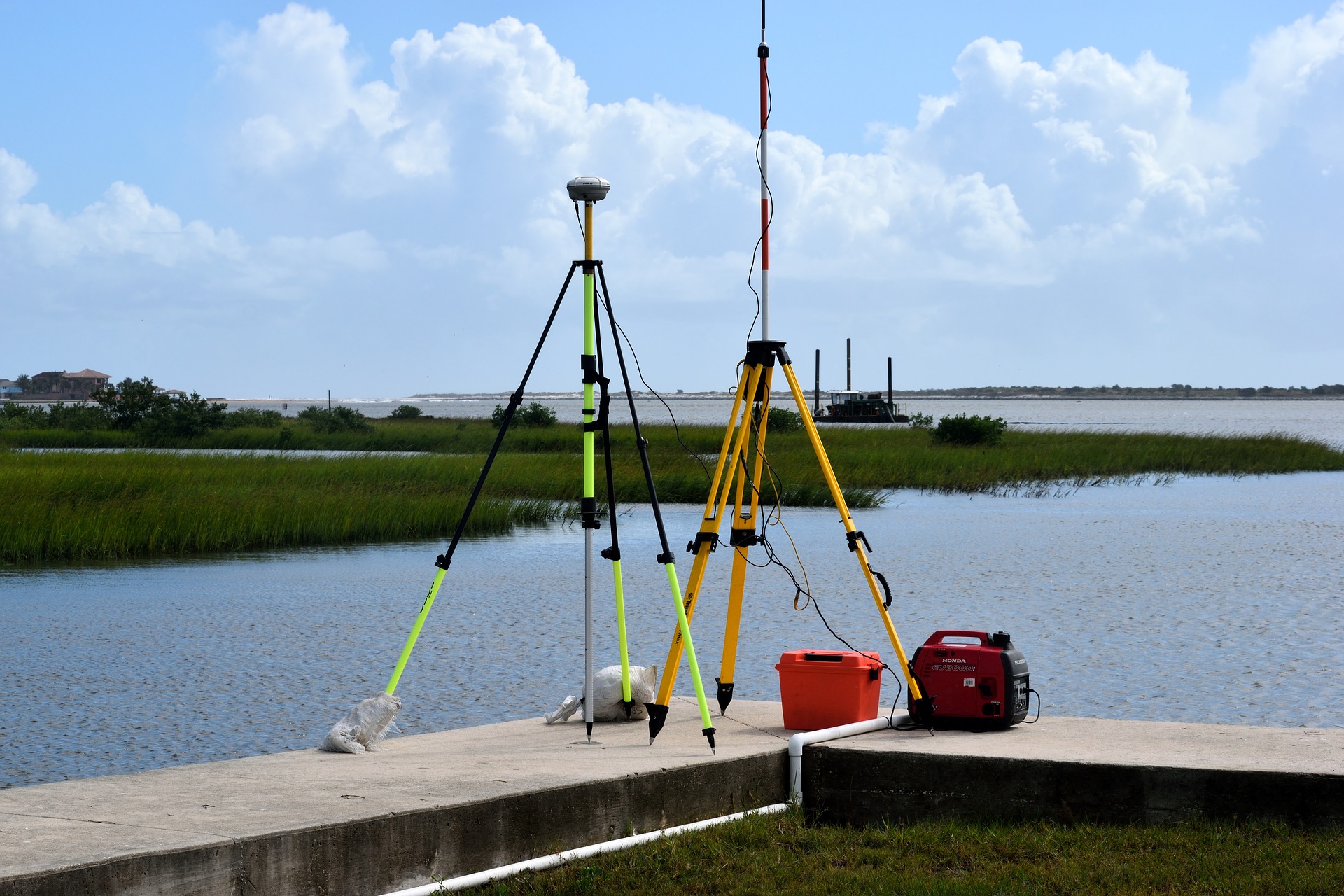

Surveyors use a theodolite for precisely measuring both vertical and horizontal angles for triangulation. Triangulation is the measuring of the distance and location of a certain point. A moveable telescope connected to a perpendicular axis is what comprises a theodolite. The telescope is on top of a tripod head that supports the whole instrument. There are screws for tightening and loosening the telescope. Placing the apparatus directly above the point produces a precise measurement. A laser plummet, or a plumb bob is essential in measuring a position using a theodolite.

Dumpy level:

A device that looks like a telescope perched on a tripod is what makes up a dumpy level. Surveyors use this instrument in establishing points in one flat area. A dumpy level has other uses: paired with a vertical staff, it can measure differences in height and relocate elevations. A dumpy level has three variations:

- A tilting level is where you can move the telescope 180 degrees.

- A digital electronic level uses electronic laser techniques to interpret a vertical staff with barcodes.

- An auto level is easy to set up. The internal compensator mechanism can eliminate any variation.

Measuring Wheel:

A measuring wheel is a less accurate instrument for measuring distances. The wheel is rolled manually from one point to another. One turn of the wheel measures a certain distance, either a metre or a yard. A mechanical device connected to the wheel counts the revolutions and measures the range directly. The measuring wheel is the most straightforward and most uncomplicated surveying instrument, but it does not provide the same accuracy and precision that other devices offer.

Total station:

A total station is the more modern version of a theodolite. A total station has an electronic distance meter. Another essential component of a total station is a microprocessor unit. This component gathers data to establish the following:

- The three coordinates of the measured points.

- The elevation of elements.

- The average of various measured angles.

- The distance on a horizontal plane.

- The proportion of different measured distances.

- The range of two points.

You can download the following data that is gathered by the total station to process using computer-aided design (CAD), geographic information system (GIS) or building information modelling. The best thing about a total station is that it can produce precise and accurate measurements.

If you are planning to build an establishment for business or a home, you can seek the help of building surveyors in Leicester which has several companies that you can go to for this purpose. These surveying companies possess all the necessary tools for the job. Do not bypass the surveying part of construction as doing so may result in problems in the long run.

Read Also: