Riding on the back of the booming Italian and US auto markets and the development of autonomous vehicles, the global automotive aftermarket industry is progressing

After over 10 consecutive years of growth following the global economic depression of 2008, the global automotive aftermarket reveals interesting data from the automotive industry. Let’s see together what the state of the global automotive aftermarket is and the various future projections.

The automotive aftermarket: 2018 in review:

The year 2018 for the global aftermarket ended positively. According to data processed by the ANFIA Components Group, the turnover of the spare parts increased by 0.8% last year compared to 2017.

Looking at the performance of individual product families in Italy, 4 out of 5 have a positive trend. The body and interior components had significant increase while in 2017, they had remained substantially stable. This was followed by increases in electrical and electronic components which recorded the greatest contraction in the previous year.

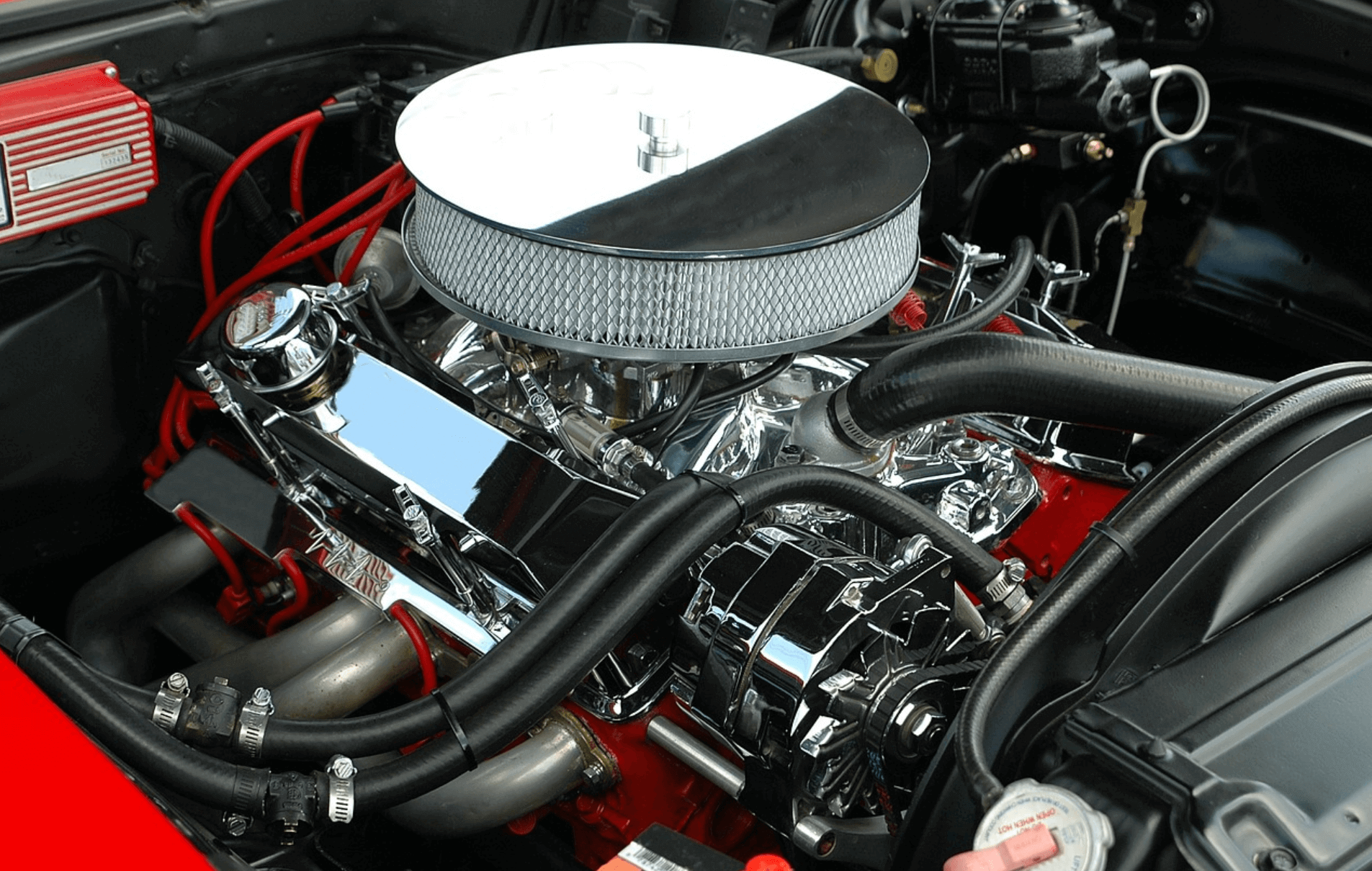

The only parts with a negative sign in 2018 is that of engine components (-7.9%), which worsens its performance compared to 2017, when it had closed at -0.2%.

Analysts point out that the two-figure increase recorded by the family of body and interior components. In this case, one can link to the fact that the renewal of the Italian fleet, which has now reached a median age of almost 11 years for passenger cars, proceeds slowly. According to them, this helps to ensure some continuity in maintenance work for older vehicles.

You Must Know about the Aftermarket review in 2018:

On the family of electrical and electronic components, researchers must say that, the increasingly central electronics and telematics had great roles to play here. While on the one hand, they have contributed to reducing the margin of human error in maintenance and repair operations. The electronics and telematics aftermarket offer products that are more reliable and safe. This market has also increased the sale of spare parts of this type and the maintenance and repair interventions on increasingly complex components.

On the other hand, the decrease in the turnover of the engine components can be attributed in general terms. According to ANFIA, to the fact that the increasingly high level of quality of the components of the car, guarantees an extension of the average life. This, for complex systems such as the engine system, means that no replacement or repair work is necessary without major failures.

Aside from the above information, there are hundreds of other trends and statistics to consider when it comes to the automotive market. Let’s take a look at them, shall we?

Trends and statistics in the global automotive aftermarket:

1. In the last decade, the average usage of the vehicle fleet in the US has increased by about 17%

2. The length of use of new and already used vehicles over the last decade has increased by 60%

3. While 25% of the auto spare parts repair is handled by dealerships, 75% is done by independent repair shops.

4. 56% of automotive decision-makers predict a 30 to 50% decrease in the number of physical outlets by 2025, according to KPMG. As is with virtually all merchandise around the world, the automotive aftermarket industry is going electronic (online) and its marketplace is evolving. Parts and even repair services are being sold and offered online.

Additional trends and statistics in the global automotive aftermarket:

5. The irruption of the autonomous vehicle into the public space would offer more flexibility and profitability for all stakeholders. For example, 43% of respondents in a study conducted by KPMG say that current vehicle owners no longer plan to own the traditional car by 2025.

6. One can’t expect the demand for diesel engine replacement to thaw out quickly. Although diesel has become politically and socially unacceptable in many countries, the use of this fuel remains technologically and economically relevant for 50% of decision-makers worldwide. This figure even increased by 3 points in 2017 and illustrates the uncertainties that manufacturers face in this transition period.

7. As the world continues to anticipate the mass production of autonomous vehicles, the market is bracing up for an increase in demand of auto cooling systems such as the small AC compressor offered by Rigid for electric vehicles and car cabins. According to a report by Transparency Market Research, the automotive cooling system market will exceed $64b by 2026. During the period of forecast, the CAGR is expected to expand over 4%.

Read Also: