Planning to investigate some small business loans? What are the best options out there?

Most importantly, how can these loan options help you?

Contrary to popular belief, it is more complex than filling out a form and getting your loan approved. That too from the very first source!

There is eligibility, which you must fulfill from your end, and criteria that the small business loan providers must ensure.

These are subjective to individuals and the business they are trying to build.

For example, which provider should you go for when you need a quick loan of a larger or smaller amount?

So, without any further ado, let’s get into the blog post

What Are Small Business Loans?

What are exactly small business loans? The criteria? Is it different than other forms of business loans?

Small business loans are classified under money lending for commercial purposes Like any other business loan.

There are several reasons why you would consider lending. Do not worry if it is for operational expenses and you fall short!

Not everyone accesses such loans just for their initial business investment or to extend their business to new grounds. In fact, it is common for people to underestimate their expenditure margin when they are starting their business.

In fact, in 2020, 56% of all small business loans were to manage operational costs. While only 31% of loans were for expansion opportunities.1

The Best Small Business Loans

Here are the best small business loans to investigate:

1. SBA 7(a) Loan

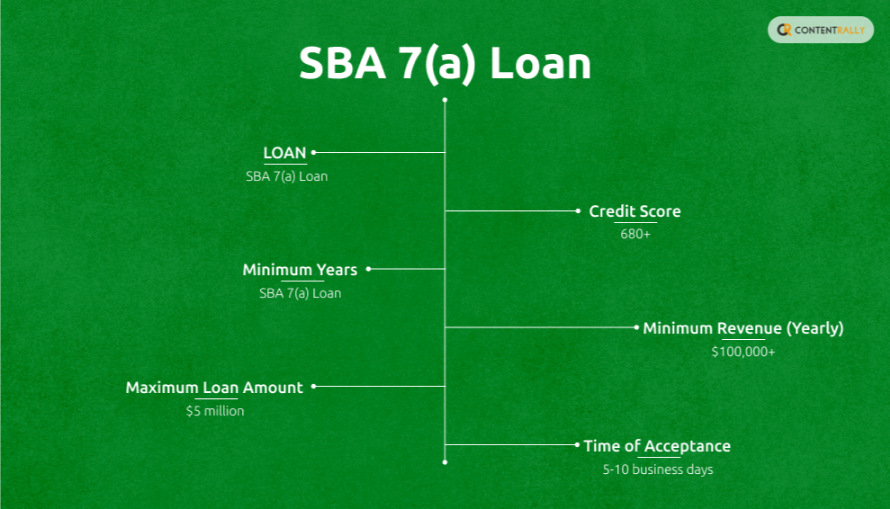

| Loan | Credit Score | Minimum Years | Minimum Revenue (Yearly) | Maximum Loan Amount | Time of Acceptance | |

| SBA 7(a) Loan | 680+ | Two years | $100,000+ | $5 million | 5-10 business days |

This government-backed loan program offers competitive rates and long terms for various needs.

Pros:

- Low interest rates

- Long repayment terms

Cons:

- Lengthy application process

- Strict qualification criteria

2. Kabbage Business Line Of Credit

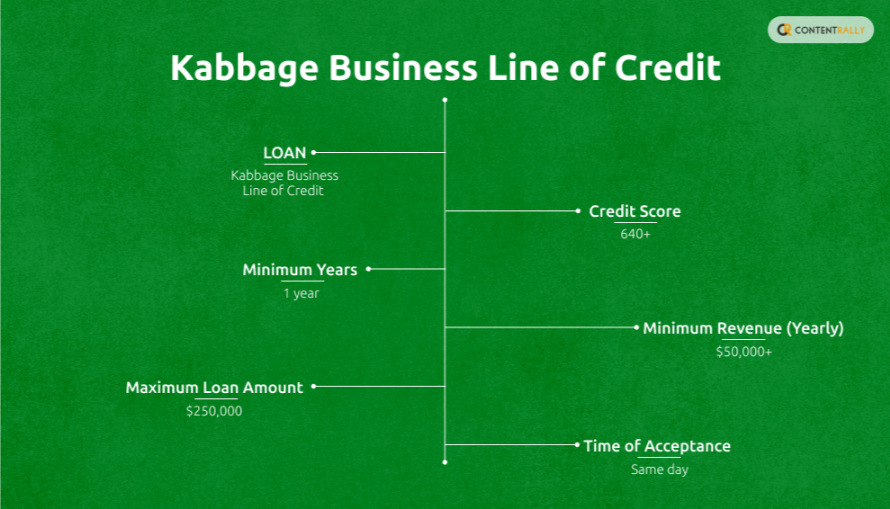

| Loan | Credit Score | Minimum Years | Minimum Revenue (Yearly) | Maximum Loan Amount | Time of Acceptance |

| Kabbage Business Line of Credit | 640+ | 1 year | $50,000+ | $250,000 | Same day |

This is a revolving line of credit with a quick application process for managing cash flow.

Pros:

- Fast funding

- Flexible access to funds

Cons:

- High APR

- Limited revolving credit line (although that is how they advertise).

3. OnDeck Term Loan

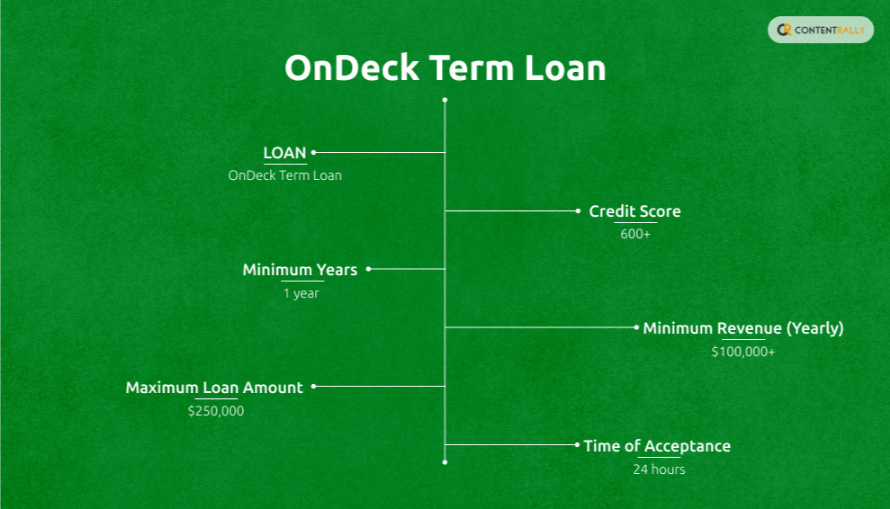

| Loan | Credit Score | Minimum Years | Minimum Revenue (Yearly) | Maximum Loan Amount | Time of Acceptance |

| OnDeck Term Loan | 600+ | 1 year | $100,000+ | $250,000 | 24 hours |

This loan offers short-term loans with quick approval, which is ideal for fast access to capital.

Pros

- Fast Funding

- Discounts for repeat customers

Cons

- High interest rates

- Frequent repayments

4. BlueVine Business Line Of Credit

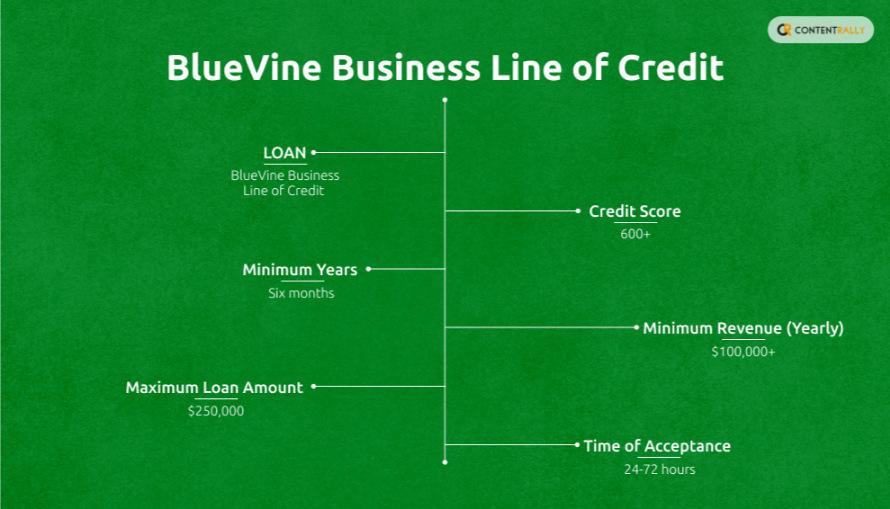

| Loan | Credit Score | Minimum Years | Minimum Revenue (Yearly) | Maximum Loan Amount | Time of Acceptance |

| BlueVine Business Line of Credit | 600+ | Six months | $100,000+ | $250,000 | 24-72 hours |

Flexible line of credit with fast approval, useful for managing cash flow.

Pros

- Quick funding

- No early repayment fees.

Cons

- Higher rates for lower credit scores.

- Limited to revolving credit.

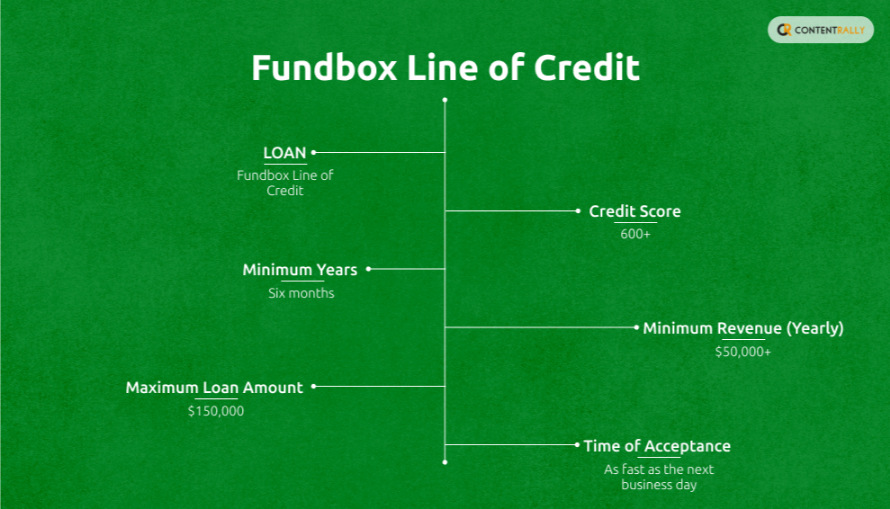

5. Fundbox Line Of Credit

| Loan | Credit Score | Minimum Years | Minimum Revenue (Yearly) | Maximum Loan Amount | Time of Acceptance |

| Fundbox Line of Credit | 600+ | Six months | $50,000+ | $150,000 | As fast as the next business day |

It provides a simple, quick line of credit ideal for immediate cash flow needs.

Pros

- Easy qualification

- Quick access to funds

Cons

- Lower Loan Amounts

- Shorter Repayment terms

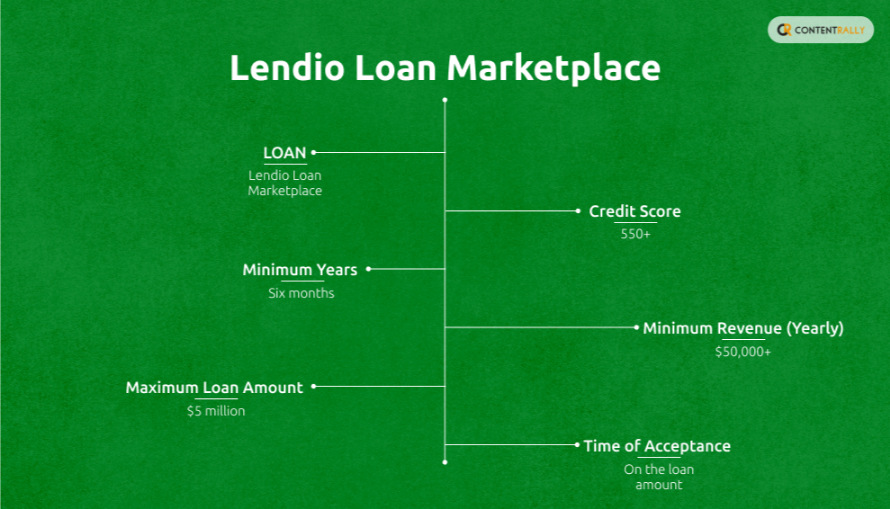

6. Lendio Loan Marketplace

| Loan | Credit Score | Minimum Years | Minimum Revenue (Yearly) | Maximum Loan Amount | Time of Acceptance |

| Lendio Loan Marketplace | 550+ | Six months | $50,000+ | $5 million | On the loan amount |

This type of loan is a great help to small business owners. Rather than just one loan, this is a marketplace that connects businesses with multiple lenders for various loan types.

Pros

- Wide range of loan options.

- Easy comparison of the offer.

Cons

- Can receive multiple calls from lenders, which can be irritating.

- Not all lenders have favorable terms.

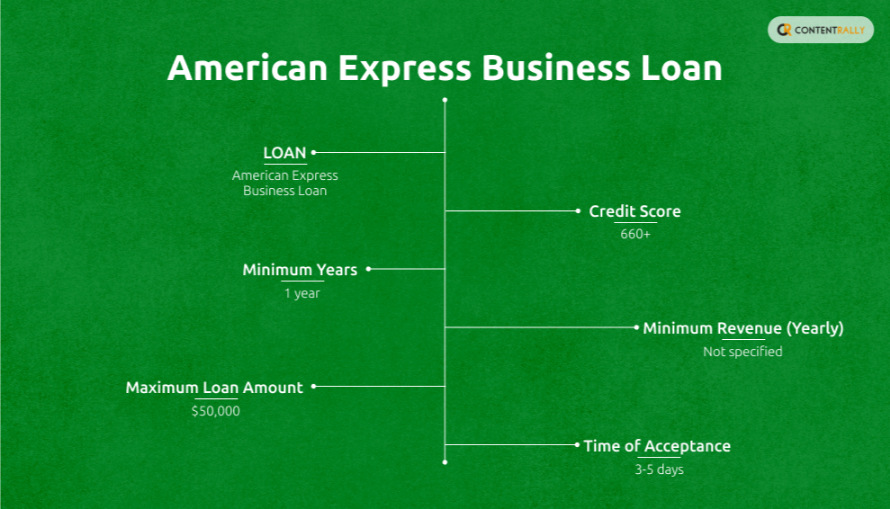

7. American Express Business Loan

| Loan | Credit Score | Minimum Years | Minimum Revenue (Yearly) | Maximum Loan Amount | Time of Acceptance |

| American Express Business Loan | 660+ | 1 year | Not specified | $50,000 | 3-5 days |

This fixed-rate loan is available only to pre-approved American Express Business Card members.

Pros

- Fixed rates

- No origination fee

Cons

- Only available to pre-approved members.

- Relatively small maximum loan amount.

Therefore, if you plan to get a small business loan in the foreseeable future, getting an American Express Business Card is better.

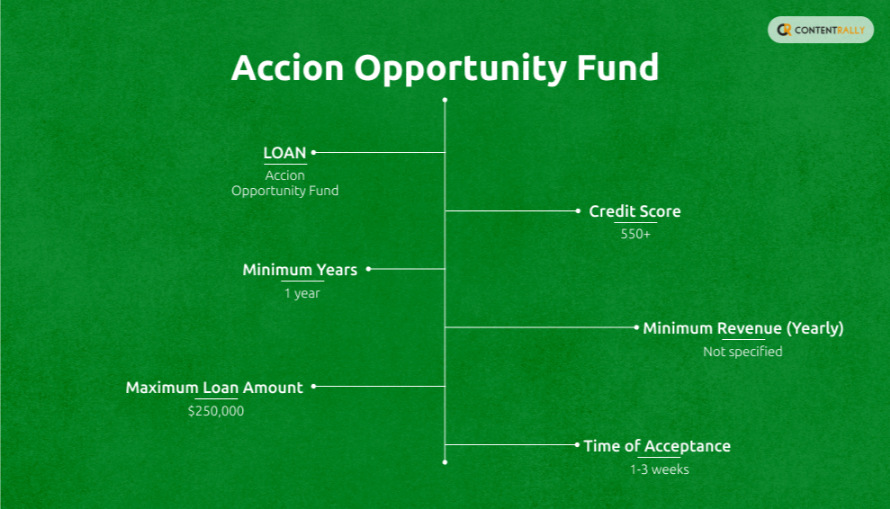

8. Accion Opportunity Fund

| Loan | Credit Score | Minimum Years | Minimum Revenue (Yearly) | Maximum Loan Amount | Time of Acceptance |

| Accion Opportunity Fund | 550+ | 1 year | Not specified | $250,000 | 1-3 weeks |

Offers loans to underserved small business owners, including minorities and women.

Pros

- Focus on underserved businesses.

- Personalized support

Cons

- Longer approval process.

- It may have a higher interest rate.

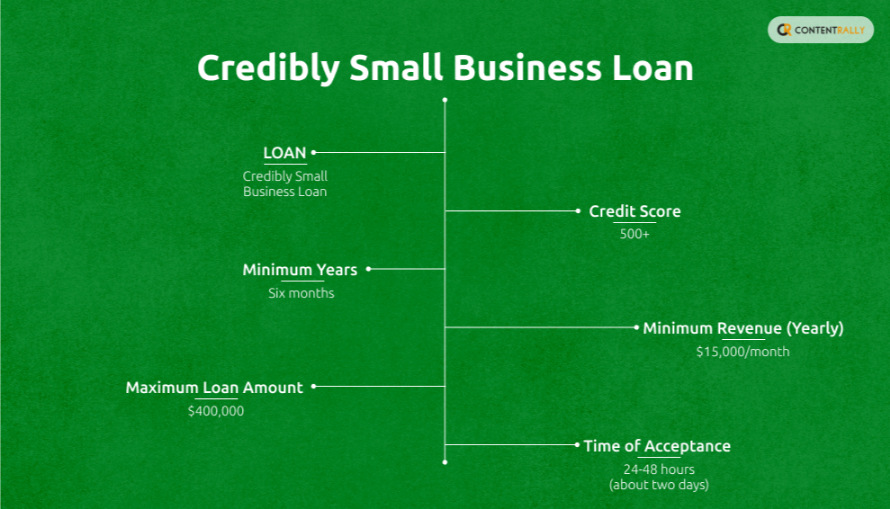

9. Credibly Small Business Loan

| Loan | Credit Score | Minimum Years | Minimum Revenue (Yearly) | Maximum Loan Amount | Time of Acceptance |

| Credibly Small Business Loan | 500+ | Six months | $15,000/month | $400,000 | 24-48 hours (about two days) |

Provides working capital loans and merchant cash advances with flexible terms.

Pros

- Fast funding

- Flexible repayment options

Cons

- Higher cost of financing.

- Frequent repayments

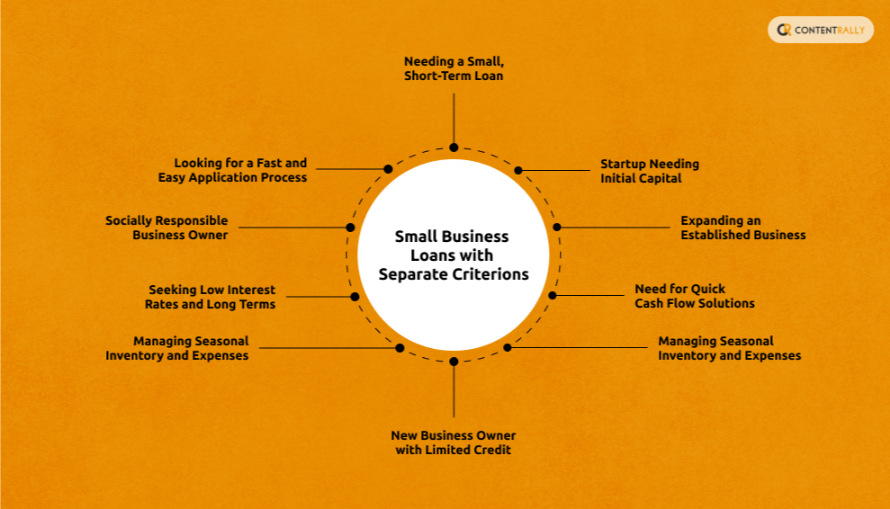

Small Business Loans With Separate Criterions

Now, we will be delving into the different criteria and which small business loan provider would be best!

1. Startup Needing Initial Capital

“I just started my business and need funds to get it. What are my options?”

Best Loan: Fundera by NerdWallet

Offers access to multiple loan options, including startup loans, even with lower credit scores and minimal business history.

2. Expanding An Established Business

“I’ve been in business for two years and want to expand. What loan should I consider?”

Best Loan: SBA 7(a) Loan

Ideal for established businesses needing significant funding for expansion, with favorable terms and interest rates.

3. Need For Quick Cash Flow Solutions

“I need quick access to cash to manage cash flow. What’s the fastest option?”

Best Loan: Kabbage Business Line of Credit

Offers quick application and approval processes, with funds available on the same day for urgent cash flow needs.

4. Managing Seasonal Inventory And Expenses

“My business is seasonal, and I need funds to purchase inventory before the busy season. What loan fits this need?”

Best Loan: OnDeck Term Loan

It provides short-term loans with quick funding, ideal for managing seasonal inventory purchases and expenses.

5. New Business Owner With Limited Credit

“I have a low credit score and a new business. Are there any loan options available for me?”

Best Loan: Credibly Small Business Loan

Accepts lower credit scores and offers working capital loans, making it accessible to newer businesses with limited credit.

6. Needing A Flexible Line Of Credit

“I want a flexible financing option. This is to cover unexpected expenses as they arise. What should I look for?”

Best Loan: BlueVine Business Line of Credit

It offers a flexible line of credit with fast approval. Plus, it is suitable for covering unexpected expenses.

7. Seeking Low Interest Rates And Long Terms

“I’m looking for a loan with low interest rates and long repayment terms. What’s the best choice?”

Best Loan: SBA 7(a) Loan

It is known for its low interest rates and long repayment terms. Therefore, it is ideal for businesses seeking cost-effective funding.

8. Socially Responsible Business Owner

“I want to support a loan provider that helps underserved communities. What are my options?”

Best Loan: Accion Opportunity Fund

Focuses on providing loans to underserved small business owners. In fact, it also includes minorities and women, with personalized support.

9. Looking For A Fast And Easy Application Process

“I need a loan. However, I don’t want to go through a long application process. Which loan is easy to apply for?”

Best Loan: Fundbox Line of Credit

Offers a simple, quick application process with funds available before the next business day.

10. Needing A Small, Short-Term Loan

“I need a small amount of money quickly for a short-term need. What’s the best option?”

Best Loan: American Express Business Loan

It provides small, fixed-rate loans with a quick approval process, which is ideal for short-term financial needs.

Related: How To Use An SBA Loan For Business Purchase

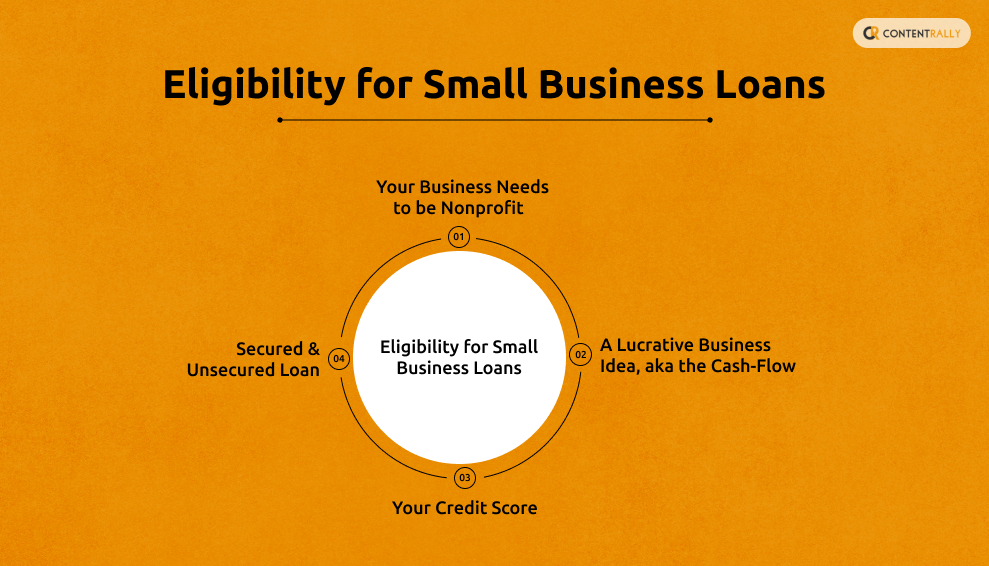

Eligibility For Small Business Loans

You might find the best loan provider. However, when it comes to eligibility, rejection can be common.

Regarding personal loans, good mortgage lending (a property that you place as collateral when taking the loan) makes loan acceptance easier.

However, when it comes to business loans, the rules are a little different. The loan lender (bank or private) must closely investigate your business expenditure, cash flow, and profit margin.

If you do not have a steady personal and business credit score (unless you are building your business from scratch, in which case the rules will be different), getting your small business loan approved can be challenging.

Do not worry; this is not to scare you. However, ensure you take the time to investigate your and improve financial health.

Here are some of the absolute eligibilities when it comes to small business loans.

1. Your Business Needs To Be Nonprofit

Unfortunately, you cannot have a nonprofit organization and demand a small business loan. Your business must be making some profit through a steady income.

2. A Lucrative Business Idea, Aka The Cash-Flow

Since business loans do not depend on collateral submission, lenders are mostly concerned about the business idea.

Most importantly, is there a demand for such business in the market?

Will there be enough opportunities to build a steady cash flow?

Is there any stock market share for businesses with the same ideation?

The loan they offer you will depend on the potential profit you can make from that base. Plus, it must be backed by solid data.

3. Your Credit Score

Although we have already mentioned the credit score for each loan provider, you need to be serious about your creditworthiness.

Any loan provider will scrutinize your personal and business credit score. Any suspicious activity (including something as simple as an unpaid credit card bill) can put you under the radar. Eventually, it does not make you a good candidate for a loan.

In other cases, your business credit score also plays a crucial role.

What is your total business income?

Is it holistic with your business expenditure?

What is your business credit card transaction history? Are you able to balance your bills alongside your monthly operational costs?

…and many more.

You must submit all your financial documents, especially if you are planning to expand through different business locations and real estate. How your business funds are handled becomes crucial in such a case.

Secured & Unsecured Loan

Starting a business? Want a small business loan? Then, you should understand the importance of collateral in such a business.

Most importantly, do you even need to submit collateral to get your loan sanctioned?

Secure business loans will charge you some collateral (cash money, real estate property, gold bonds, etc.).

Meanwhile, unsecured loans do not charge any collateral.

Which is better as Small Business Loans

As someone just starting a business, I know the advantages/disadvantages of both kinds of loans will depend on your criteria and loan amount.

So, let’s discuss the overall pros and cons of both!

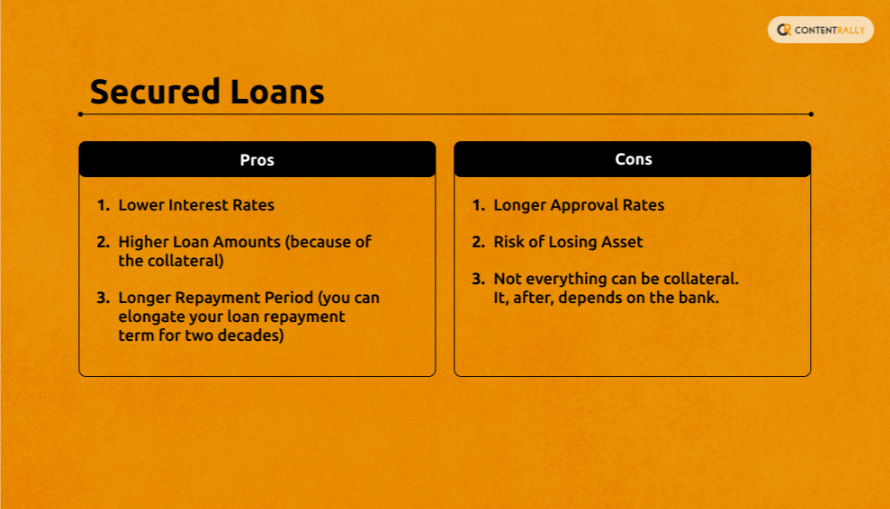

Secured Loans

Let’s begin with the kind of loans that require collateral.

| Pros | Cons |

| Lower Interest Rates | Longer Approval Rates |

| Higher Loan Amounts (because of the collateral) | Risk of Losing Asset |

| Longer Repayment Period (you can elongate your loan repayment term for two decades) | Not everything can be collateral. It, after, depends on the bank. |

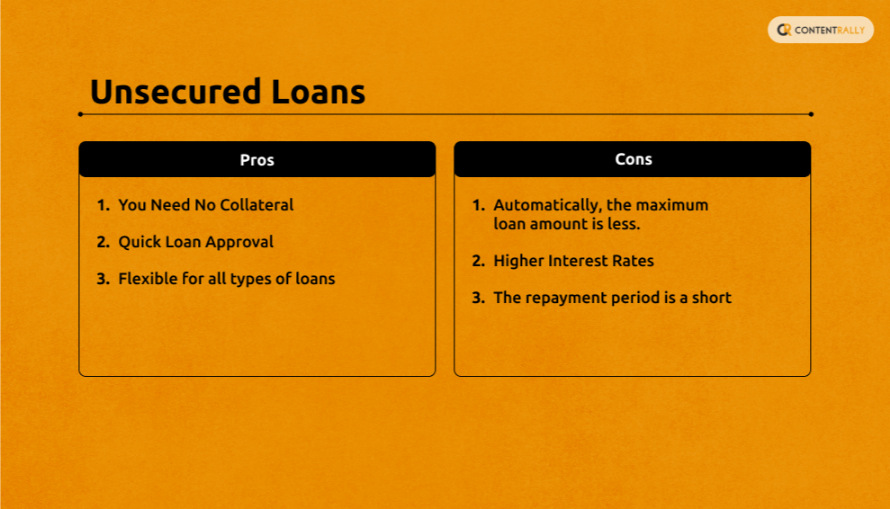

Unsecured Loans

Now, let’s talk about loans without collateral.

| Pros | Cons |

| You Need No Collateral | Automatically, the maximum loan amount is less. |

| Quick Loan Approval | Higher Interest Rates |

| Flexible for all types of loans | The repayment period is a short |

When Should You Get What?

For the ease of your own understanding, here is when you should get what!

Secured Loans Might Be Better If

- You need a larger loan amount.

- Can provide valuable collateral.

- You want lower interest rates and longer repayment terms.

- If your business has significant assets that can be used as collateral.

Unsecured Loans Might Be Better If

- You do not have assets to offer as collateral.

- Need funds quickly.

- You prefer not to risk losing business or personal assets.

- The business needs a smaller loan amount.

You can check the listicle above for a good idea of which secure/unsecured small business loans would be better for you.

Types Of Small Business Loans

These are the types of small business loans which you should investigate:

- Term Loans: You borrow a set amount and pay it back over time with fixed payments.

- SBA Loans: The government backs these loans, giving you good terms for your business.

- Business Lines of Credit: You get access to a credit line like a credit card.

- Invoice Financing: You can get cash based on your unpaid invoices.

- Equipment Loans: This loan helps you buy business equipment.

- Merchant Cash Advances: You get an advance on your future credit card sales.

- Microloans: These small loans are often given by nonprofits to help you start.

- Commercial Real Estate Loans: Use these loans to buy or fix up your business property.

- Personal Loans for Business: You can use your personal credit for business needs.

- Franchise Loans: These loans help you start or grow a franchise business.

The Final Note!

The choice between a secured and an unsecured small business loan ultimately depends on your specific needs and circumstances.

a secured loan might be more suitable If you have valuable assets and prefer lower interest rates.

On the other hand, if you need quick access to funds and prefer not to put up collateral, an unsecured loan could be the better option.

Always consider the terms and conditions carefully and consult a financial advisor to make the best decision for your business.

Things to remember before you get a small business loan:

Have a solid, chalked-out plan for how you will repay it. You wouldn’t want to lose your collateral.

Do not take hasty loans because you have fulfilled a business milestone. Remember, a loan is not a temporary fix; it is a debt for years to come. Therefore, be careful before sanctioning a loan.

Finally, be candid about your financial decision. Keeping it discreet to get a quicker loan approval will only cause you trouble later.

What do you think? Should getting a small business loan come after so many considerations, or should it be a little easier?

Do let us know in the comment section below!

Read Also: