Product development is a vital component of brand marketing that keeps a company’s product portfolio up to date and helps increase revenue.

Companies conduct thorough research before introducing a new product in the market for maximum impact. Read on for some key tips on generating ideas for a new product!

A unique product idea – that grabs a potential customer’s attention – is something all businesses strive for!

Traditional product development ideas often stemmed from studying competitors in a niche and surveying the market. But product development takes a different approach to contemporary business.

How to Develop a New Product and Make Magic Happen:

Here are some effective ways to come up with insightful ideas for your company’s next big creation!

Survey the Market:

To introduce a product in a dynamic marketplace you must decipher the needs of your customer first. You need to keep pace with the economic or technological changes that may affect the buying decision of your customer base.

Identifying the new trends in the market can help modify your ideas and align them accordingly to gain maximum benefits. Any brand marketing agency in your location can provide you with the resources to explore these trends.

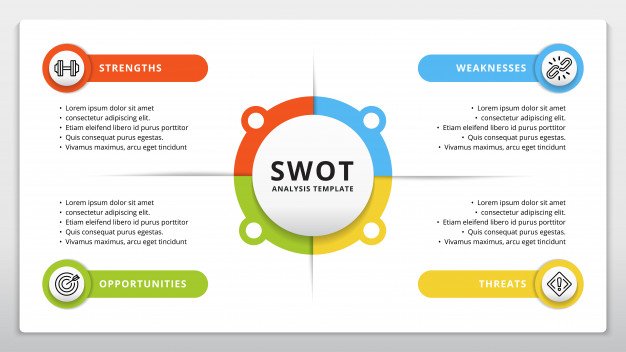

Conduct A SWOT Analysis:

Most companies realize the importance of regular strength, weaknesses, opportunities, and threats (SWOT) analyses to come up with innovative products. They help identify a business’ strengths, minimize weaknesses, expand on available opportunities — and ward off potential threats to a business or new product.

Coming up with ideas through a SWOT analysis emphasizes the need to build new strengths and seek out maximum benefit from opportunities in the market.

Research and Development Initiatives:

Research the market, competitors, similar products that are already available and consumer trends. Progressive companies allocate sufficient funds for research and development initiatives — to remain ahead of their competitors.

If you are a small company, research the R&D campaigns of established companies in the niche — and adopt one that best suits your market. It is often easier to improve on your competitors’ ideas and improvise.

Value Customer Feedback:

Customers and their requirements are the most important component of new product development. Collecting their feedback can be a challenging task, but pays dividends in the short and long term.

Offer live chat or another interactive communication platform on your business website to answer their queries and keep them engaged.

Short surveys about a product or service can offer valuable feedback to help launch a product that best caters to the target market.

Our Advice:

If product ideas are forcefully generated they can do more harm than good for a product lineup. Skim through the tips in the piece and draft your own strategy for a successful product launch.

With some insight and research, you can come up with ideas for a new product and achieve your business goals. The tips discussed in the piece can improve your marketing strategy and help introduce a product that meets the demands of customers.

How to develop a new product tips still aren’t enough to help you generate ideas, you can hire a brand marketing agency in your location to assist you!

Read Also:

- Five things to consider before starting a Business

- 7 Growth Hacking Ideas that will Boost your Startup

- Steps For Salesforce Application Development

- Reasons Why Personal Development Should Be a Priority?

- How can your business benefit from bespoke software development?

- Possible Reasons Why Your Employees Aren’t Too Productive and What to Do About It