Starting a business can be expensive. You want to be mindful of where every cent is going. While a frugal approach to business expenditure is encouraged, there are some services you need to invest in to take your business to the next level.

Failure to get Professional Services help with cash flow and computer systems management may result in unwanted issues in your business.

Let’s go over some of the recommended professional services to spend on:

1. Lawyers

Your business will have to comply with several federal and local government regulations that you may be unaware existed. An accomplished attorney will expose any legal loopholes that you might run into as you launch your startup. Since it is their field, they will be abreast of any changes that may affect these laws and advise you on how to conform.

Being compliant from the get-go can save you substantial litigation costs down the road. It will also lessen the possibility of being shut down for non-compliance.

Many business owners think that they would be able to do without a lawyer if there are no on-the-horizon legal issues. However, if you need a general counsel attorney you will be able to enjoy many of the legal services that can help you grow the business. For example, a trained legal counsel can show you ways and means of minimizing risks, ensuring coverage, and making sure all your paperwork is always in order.

2. Accountants

While their work may seem lackluster, accountants are the beating heart of any profit-seeking venture. Trained in using standardized tools and techniques, they help businesses keep track of their cash inflows and outflows, assets, and liabilities. The reports they produce periodically will give you a clear indication of whether your business is currently on the right side of the profit-loss divide and whether its future is healthy.

When you hire an accountant for a startup business, you also improve your chances of staying on the Internal Revenue Service’s good side. The last thing any fledgling venture needs is to be liable for hefty fines when revenue streams are yet to stabilize. Savvy Certified Public Accountants will help you discover and take advantage of all the tax breaks for which you qualify.

3. Web Developers

Operating any modern business without an online presence is equivalent to conducting your business in a cocoon. Close to 60 percent of the global population uses the Internet actively. First impressions are everything. To make the right one, you need to have a reputable web developer team on your side.

Your web developer will be responsible for designing and hosting your site. They will ensure that it has all the functionalities you require and offer support when you suffer downtime or external attacks.

4. Content Creators and Marketers

Having a functional website is only half the equation. Content creators and marketers will provide you with a means of reaching out to your clientele, both through your website and your social media handles. They will come up with creative on-brand messages that they will broadcast through these channels to capture the hearts and minds of your target audience.

Having digital marketers as part of your team will not only help you reach your potential customers where they are. It will save plenty of cash you would have spent on advertising through traditional media.

Digital content creators have a finger on the pulse of current trends and will have the know-how to make your products or services a part of what is trending.

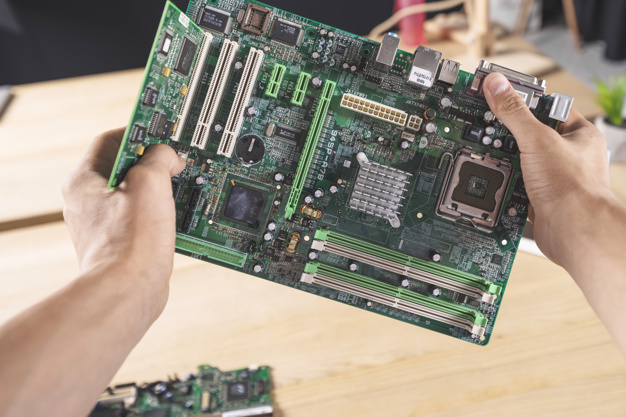

5. IT Experts

IT experts are needed to manage your business’ devices and hardware, along with the front and back-office software systems. Your tech consultants will help you put these systems in place as well as keep them running smoothly.

If you have an online presence or any functions that rely on the Internet, you need to invest in these systems’ security. Contrary to what many small business owners think, they do occasionally get targeted by hackers. With a proactive team of IT experts well versed with the latest cybersecurity threats on your side, you won’t have to spend sleepless nights wondering if your site will be next.

Two Heads Are Better Than One

It is tempting for small business owners to try to be a jack of all trades. You would rather juggle your own books, fix your own networks, and manage your own social media to avoid spending too much on outsourced expertise. While conducting some of these services yourself can save money and grant more control over your operations, you can achieve better results by hiring help.

Besides exposing your business to diverse financial and operational risks, you will become an impediment to its growth if you adopt the one-man-army approach.

Read Also: