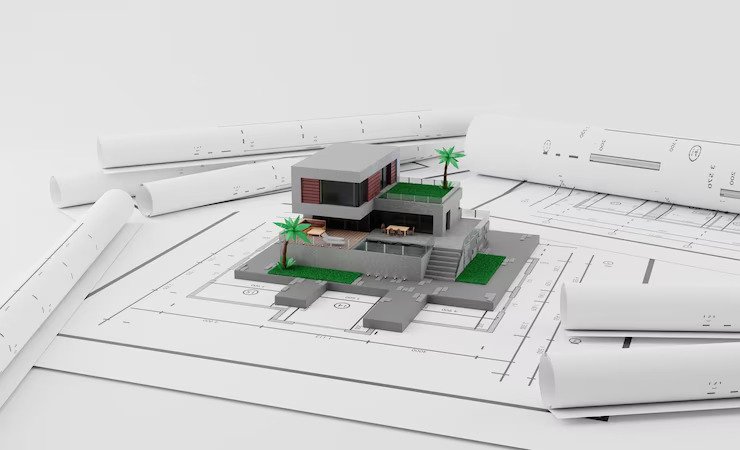

Revit modeling is a process that uses Building Information Modeling (BIM) software to create and manage information about a building project. This advanced technology is rapidly becoming an industry standard for designing and constructing buildings.

Revit modeling is used in various industries to develop accurate, high-quality, and detailed building designs. This process provides significant advantages over traditional design methods.

Improved Collaboration

Collaboration is a critical component of any building project. Effective collaboration between designers, engineers, and architects ensures the project is completed on time, within budget, and meets client expectations.

- Real-time Collaboration

Revit modeling allows real-time collaboration between team members working on the same project. With the software’s cloud-based capabilities, designers, engineers, and architects can simultaneously work on the same model, making real-time changes.

- Enhanced Communication

Revit modeling enhances communication between team members, reducing the likelihood of errors and misunderstandings. The software provides a shared platform for team members to share design ideas, make revisions, and collaborate on the project. This ensures that everyone is on the same page throughout the design process.

- Streamlined Design Process

Leverage the expertise of revit modelling services to streamline your design processes by providing a central location for all project-related information. This will equip your team with accessibility to the same information, eliminating the likelihood of errors and ensuring everyone works from the exact design specifications.

Time-Saving

Time is of the essence in any building project, and Revit modeling offers several advantages that save time in the design process.

- Automated Processes

Revit modeling automates many design processes, including generating 2D and 3D models, creating floor plans, and producing material takeoffs. By automating these tasks, designers and engineers can save significant time compared to traditional design methods. This automation also reduces the likelihood of errors and ensures the design meets the required standards.

- Rapid Revisions

Revit modeling offers a streamlined approach to making revisions. The software allows for quick and easy modifications to the design, with changes automatically reflected throughout the model. This feature reduces the time needed for revisions and ensures that all team members work with the most up-to-date design version.

- Consistent Documentation

Revit modeling ensures consistent documentation throughout the design process. The software automatically generates and updates project documentation, including construction documentation, specifications, and schedules. This feature reduces the likelihood of errors and ensures all team members work with the same documentation.

Cost-Effective

Revit modeling offers several cost-effective advantages that help to reduce project costs while improving overall project outcomes.

- Reduced Design Errors

Revit modeling reduces the likelihood of design errors compared to traditional design methods. The software automatically checks for design errors, such as clashes and interferences, reducing the need for manual checking. This helps to reduce project costs by preventing costly errors.

- Efficient Material Management

Revit modeling offers efficient material management capabilities that help to reduce project costs. The software helps designers prevent the over-ordering of materials, reducing project costs.

- Enhanced Project Accuracy

Revit modeling offers enhanced project accuracy compared to traditional design methods. The software allows for accurate design modeling and simulations, ensuring the project meets the required standards. Project stakeholders can ensure accuracy and efficiency in the design process by utilizing Revit modeling solutions.

Visualization and Analysis

Revit modeling offers several advantages in visualization and analysis that help to improve the design process and overall project outcomes.

- Simulations and Analysis

Revit modeling offers simulations and analysis capabilities that help to improve project outcomes. The software allows designers to simulate various design scenarios, such as lighting, ventilation, and energy consumption. This feature helps to optimize the design and identify potential issues before construction, reducing the likelihood of costly errors and rework.

- Efficient Design Modifications

Revit modeling offers efficient design modification capabilities that help designers and stakeholders make informed design decisions. The software allows for rapid and accurate design modifications, enabling stakeholders to evaluate different design options and make informed decisions about the project.

- 3D Modeling and Visualization

Revit modeling offers 3D modeling and visualization capabilities that help designers and stakeholders visualize the project realistically. With 3D modeling services, stakeholders can visualize the project and identify potential issues before construction, reducing the likelihood of costly errors and rework.

Conclusion

Revit modeling is a valuable tool for building projects and can help to ensure project success. Using Revit modeling in the design process, project stakeholders can optimize the design, reduce costs, and ensure that the project meets the required standards.

It offers 3D modeling and visualization capabilities, simulations and analysis, and efficient design modifications, improving the design process and overall project outcomes.

Read Also:

- Latest Trends of Graphic Design in London

- Divorce In Modern Society

- What are the Benefits of Eco-friendly reusable carry bags?