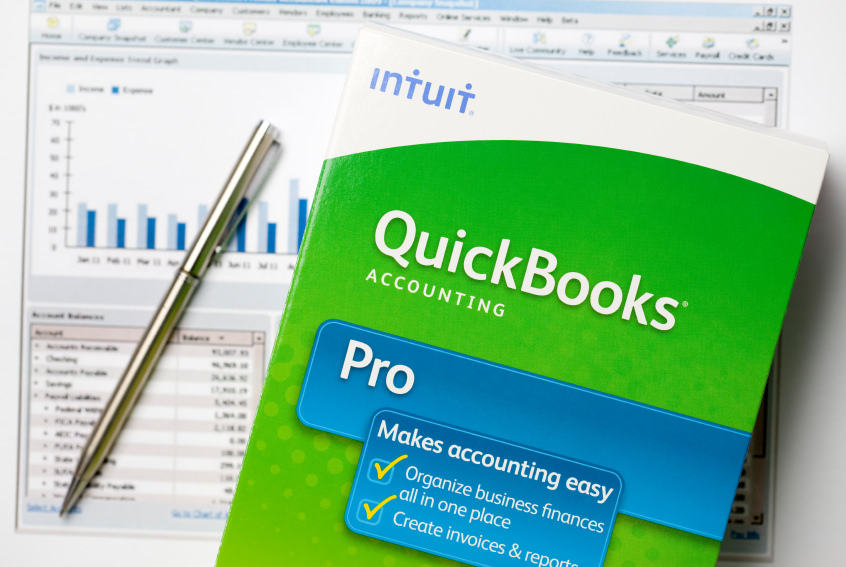

QuickBooks main function is to simplify accounting in various aspects of a business. Intuit has released various versions of QuickBooks, so that different enterprise can select different versions of QuickBooks for their needs and requirements. QuickBooks Pro is one of the versions of QuickBooks software about which we are going to talk about today. This QuickBooks version is specifically designed for small companies. The features provided by QuickBooks can handle all the accounting functions including accounts receivable, accounts payable, credit card management, and financial reporting. The software is available for $219.95 in the US, this is great because earlier it used to cost $299.95 and now it is even more value for money.

Cash Management–

The software perfectly manages the cash flow and budget for small businesses. You can input the due dates for different kind of payments and the billing information can be added along with that. You can get printed checks directly through your QuickBooks software. For future audits you don’t have to manually record any transaction because all transactions are recorded automatically, this eliminates the need for paperwork.

Expense Billing–

In any type of business there various miscellaneous expenses like small purchases, meals, business travels, etc. These expenses may or may not be included in the client’s total bill, but because of their small amounts, they are disregarded and in the end, it is billed to the client only. In QuickBooks, you can maintain such record of all the expense and later go to them at the time of the billing. This will save some of the expenses for the clients and they won’t be any quarrel and even if there is, you would have a complete record which you show them. You can directly manage payrolls and taxes from the software itself.

Invoices–

Wouldn’t it be great, if the software does work and saves up a whole lot of labor and that too without any error that may happen in the case of human involvement? Well, QuickBooks does exactly that, it automatically tracks the sales and creates receipts and invoices any time you want, like if you have to send an invoice to the customer. The type of feature is very helpful if someone is buying the QuickBooks for retail business. You can even subscribe to QuickBooks checkbook solution, this provides with the ability to scan and deposit the checks into the program without manually entering the data.

Reporting–

Through QuickBooks, you can create various types of financial reports. These include yearly incomes, trends, expenses, and other documents. You can even create an excel sheet, in case you have to send the data to the client.

Simple user interface–

This one is obvious, the QuickBooks software makes every accounting activities very easy to complete and even does some of the work for you. There are various tutorials also on YouTube and on Intuit’s website, with their help you can explore all the useful set of features that QuickBooks provide.

Planning- QuickBooks is advance planning too also for adding accounting data and also for planning your sales data, bills and other long term operations which your company performs. QuickBooks Pro can even produce tailored reports for your clients, managers, etc. which can provide you an informed view for your future planning decisions.

Business Positions- with the QuickBooks Pro, you can generate a complete report of your company’s profit and loss with the profit and loss statement. You can also find out your top customer list at the end of the financial year and even after 6 months.

Read More: