Brokerage companies are constantly launching proprietary and new platforms, as some of their clients look to use other software rather than just the traditional MT4 or MT5. Capex is one of the brokers that had developed its own Web-based platform and today we’ll get a close look at some of the features it offers.

Capex Trading Platform Review:

User-friendly and improved design

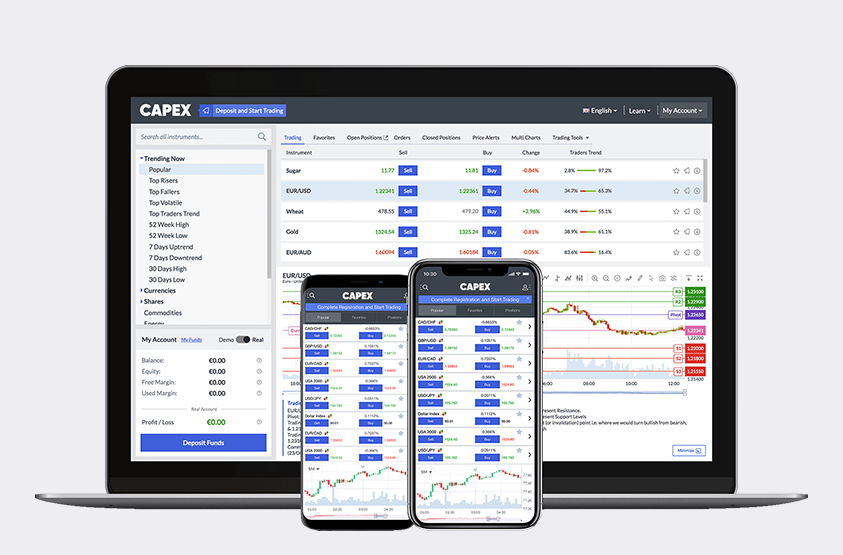

Investing in proprietary trading solutions means a company can come out with an improved platform tailored toward clients’ needs. The Capex trading platform comes with dedicated instruments & account panels, which give you complete control over activities like order management, deposits, and withdrawals.

With refined asset monitoring, you’ll have access to insightful data on each instrument you want to trade, no matter whether it is a rising or falling market. The layout also includes enhanced functionalities for a one-stop trading experience, all of them organized in menus easy to navigate.

Improved decision-making:

If you are at the beginning in your trading journey, or if you simply want to put your own trading ideas to the test by seeing what other experts think about the market, the Capex trading platform includes several powerful decision-supporting tools.

The DAR (Daily Analyst Recommendations) is one innovative tool integrated into the platform, which enables a free-flowing trading experience by offering access to a service that evaluates public stock recommendations made by financial analysts. DAR also comes with several features that help you see the expert average return or statistical significance, in order to find out which experts provide the best trading ideas.

Trading Central is another important technical analysis tool built into the Capex platform. Currently available for Signature account holders, it provides complex technical indicators for a wide range of assets: currency pairs, ETFs, bonds, shares, and commodities. Trading Central is a Certified Member of three Independent Research Providers Associations (Investorside, Euro IRP, and Asia IRP) and 38 of the top 50 banks have already subscribed to its services.

Trading filters:

It is much easier to spot top-ranking instruments with the filters provided by the Capex trading platform. Top Risers & Fallers, Top Volatile, Top Traders Trends, 52-week high & low, Uptrend & Downtrend, as well as 30-day high & low will help you spot the exact assets fitting to your trading strategy. As a trader, you’ll need volatility and managing to find fast the most active instruments is a very important part of your trading process.

Read Also: