What is cyclical unemployment? What does cyclical unemployment refers to? How to determine the cyclical unemployment rate? When does this unemployment rate rise and what are its effects?

Let’s discuss these queries in detail below.

Individuals who lose their jobs during the recession are known as clinically unemployed. The jobs are created after the recession ends. Moreover, this is one factor among several that contribute to total unemployment, including institutional, frictional, structural, and seasonal factors.

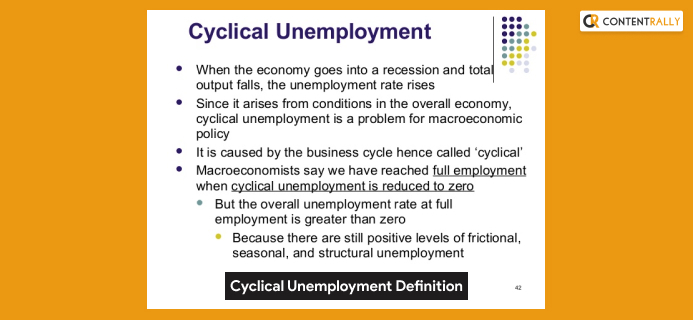

Cyclical Unemployment Definition

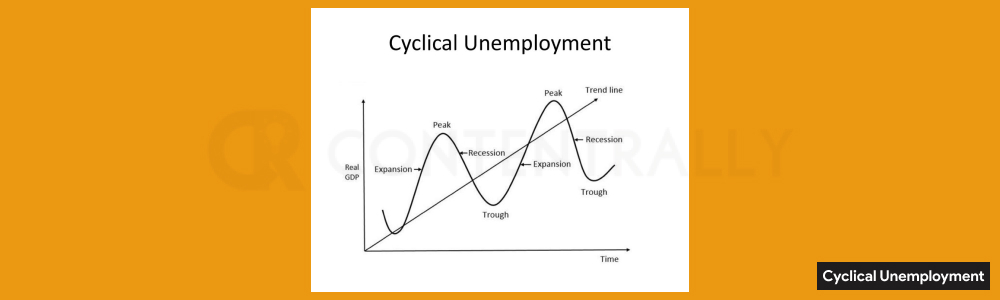

Cyclical unemployment is an element of overall unemployment that results directly from cycles of economic downturn and upturn.

In this unemployment, the labor forces are eliminated as a result of business fluctuations or cycles in the economy. The rate of cyclical unemployment is low when the economy is at its tip or undergoing constant growth.

The number of unemployed workers surpasses the number of job vacancies in the job market. Due to a drop in production, fewer workers are required resulting in job layoffs.

Examples Of Cyclical Unemployment

The best example of this unemployment is when construction workers were laid off during the Great Recession following the financial crisis of 2008.

Another example of cyclical unemployment is the increase in layoffs as a result of the COVID 19 pandemic. During this period, many loosed their jobs and wages and the US government passed an economic stimulus package to assist those hit by the pandemic pay their bills.

You can also check: How to Choose the Right Commercial Collection Agency.

Cyclical Unemployment Refers To

Cyclical unemployment refers to a year to year fluctuations in unemployment around its natural rate. Besides, this is closely associated with the short-run ups and downs of economic activity.

In this unemployment, you will see the regular ups and downs, or cyclical trends in growth and production, as measured by GDP, that occur within the business cycle. Those workers who are no longer needed will be released by the company, resulting in their unemployment.

Thus, this unemployment is highest during an economic recession and is lowest during an economic expansion.

How To Calculate The Cyclical Unemployment Rate?

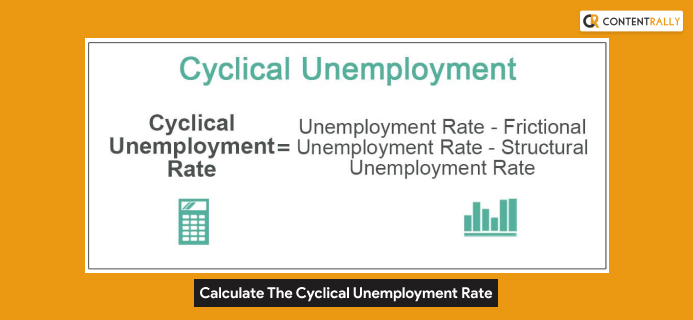

The formula for the cyclical unemployment rate estimates for the other two kinds of unemployment and their rate as well.

Cyclical unemployment rate = Current unemployment rate – (Frictional unemployment rate + Structural unemployment rate).

The rate of unemployment constantly changes when the economy enters and reenters business cycles. The average time frame for a sales cycle during a return may be only eighteen months or so.

However, when the economy settles down into a hole, the cycle could take ten years or more to be achieved. At the same time, keep in mind that high or low cyclical unemployment is only temporary.

When Are The Causes Of This Unemployment Rate And What Are Its Effects?

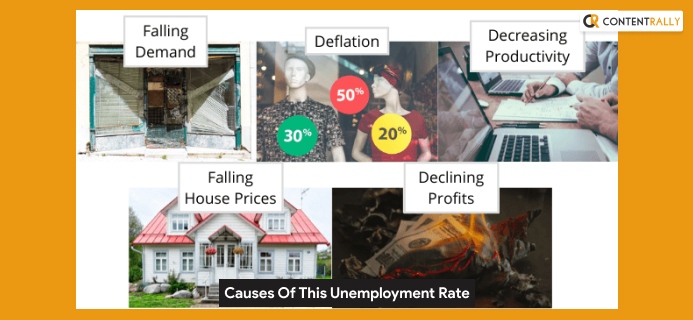

Cyclical unemployment occurs during a recession. The causes of this unemployment are the same as the causes of recessionary periods. In this period, a temporary increase in economic activity is fulfilled.

This newly unemployed have more layoffs, less business revenue, lowering demand, and less disposable income. It was not enough when monetary policies were executed at the time.

The primary causes of this unemployment rate are:

-

Market Crash

The recent market crash contributed to causing cyclical unemployment. The financial impact was far-reaching and millions of people who were employed in big firms lost their jobs.

These crashes led to a decline in employers and expand as a level of uncertainty is produced.

-

Negative Multiplier Effects

The multiplier effect determines the chain reaction that a decline in demand has. This demand not only affects the local store or supermarket but also the goods, butcher, and the farmers.

Hence, a decline in demand ends up affecting more industries and numerous areas at the same time.

-

Decline In Demand

The primary cause for Cyclical unemployment is when the demand throughout the economy fades. Once demand starts to fall, firms don’t need to buy as many products and services as needed.

You may like: Dutch Locksmithing Company Reveals How to Get Best Prices.

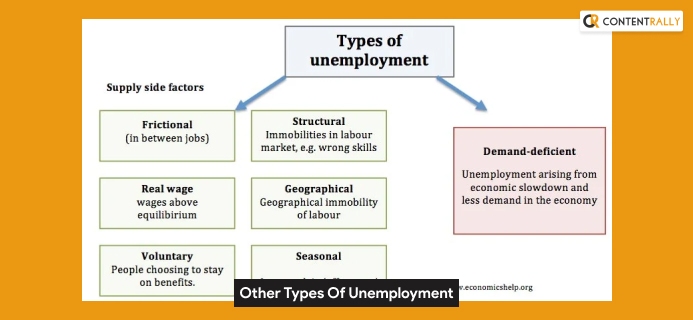

Other Types Of Unemployment

The other types of unemployment that economists recognize are described below:

-

Frictional Unemployment

Frictional unemployment determines the time that elapses when an employee is transitioning from one job to another. Many individuals consider this as a positive cycle of unemployment as it symbolizes that people are going into new and usually higher positions.

-

Seasonal Unemployment

This unemployment occurs due to periods of high interest in certain sectors and also happens as requirements shift from one season to another. This category can accommodate any worker whose jobs are dependent on a specific season.

-

Institutional Unemployment

This unemployment includes the components of unemployment attributable to institutional arrangements, such as high rates of unionization, discriminatory hiring practices, and high minimum salaries.

-

Structural Unemployment

Structural unemployment is caused by major shifts in the makeup of the economy. It is a mismatch between the demand and supply for specific skills in the labor market.

Read more: How To Increase Your Chances Of Getting Hired During A Pandemic.

The Final Thoughts

Cyclical unemployment refers to a year to year fluctuations in unemployment around its natural rate. Many individuals even described that cyclical unemployment as a result of businesses not having enough demand for labor. Hence, this is all about this unemployment type that you must know at the earliest.

Read Also: