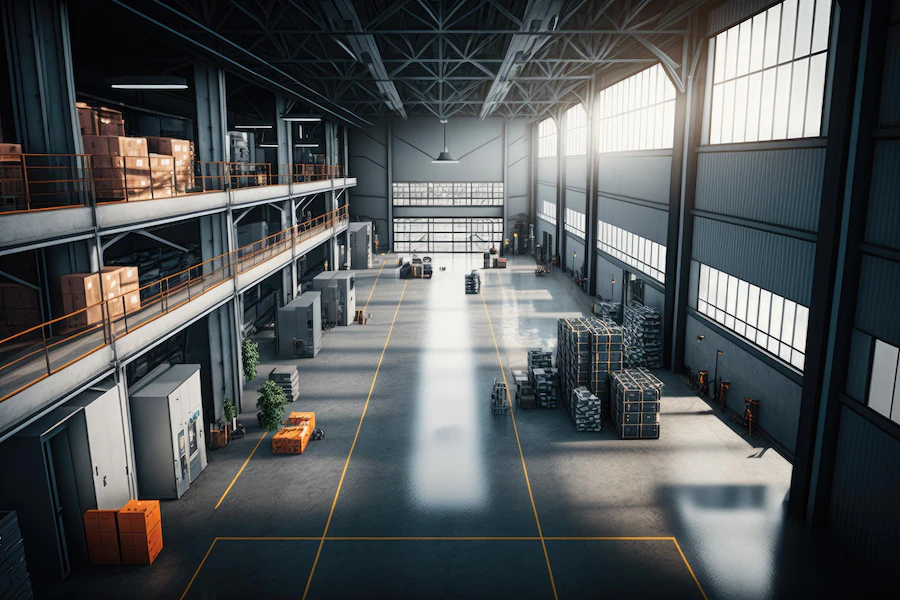

With technological advancements and building techniques revolutionizing the industry, warehouse construction has come a long way in recent years. One such innovation that has gained significant attention is prefabricated metal construction. Warehouse prefab appears to be the sensible method to build currently, with its multiple perks and advantages. This article will explore the principles and advantages of prefabricated and why it is becoming increasingly popular in the industry.

The Evolving Landscape Of Warehouse Construction

The warehouse construction industry is continuously evolving to meet the growing demands of businesses worldwide. Traditional construction methods have their limitations, including time-consuming processes and higher costs. As a result, alternative solutions like prefab construction have emerged to address these challenges and offer a more efficient and cost-effective approach.

Understanding Prefabrication

Prefabricated involves the fabrication of building components off-site, which are then transported to the construction site for assembly. These components, commonly made of steel or other metals, are manufactured in a controlled environment, allowing for greater precision and quality control.

Benefits Of Prefabricated Metal Construction

Prefabricated metal construction offers several advantages over traditional construction methods. Here are some key benefits:

Speed And Efficiency

Prefabricated metal components can be manufactured simultaneously with site preparation, reducing construction time significantly. The streamlined process enables faster project completion, allowing businesses to start operations sooner.

Cost Savings

Due to the controlled manufacturing environment and the ability to optimize material usage, prefab often leads to cost savings. The reduced labour and construction time can lower overall project expenses, making it an attractive option for businesses with budget constraints.

Durability And Strength

Metal structures are known for their durability and strength. Prefabricated metal components undergo rigorous quality checks and withstand harsh weather conditions, seismic activities, and heavy loads. This makes warehouse prefab an ideal choice for projects that require long-term reliability and structural integrity.

Sustainability And Eco-Friendliness

Prefabricated metal construction promotes sustainability by minimizing waste and optimizing energy efficiency. The controlled manufacturing process allows for precise material usage, reducing scrap and minimizing the environmental impact. Metal structures can also be recycled, further contributing to eco-friendliness.

Overcoming Challenges With Prefabricated Metal Construction

While prefabricated warehouse construction offers numerous benefits, some challenges must be addressed to ensure successful implementation. By understanding these challenges, stakeholders can make informed decisions and maximize the potential of prefabricated metal construction.

Transportation And Logistics

Transporting significant prefabricated metal components to the construction site requires careful planning and coordination. Specialized equipment and logistics support is necessary to ensure these components’ safe and timely delivery. However, with proper planning and experienced contractors, transportation challenges can be effectively managed.

Skilled Workforce

The prefab construction process requires skilled labour familiar with the specific assembly and installation techniques. Training and education programs can bridge the skills gap and equip workers with the necessary expertise to handle prefabricated metal components. Investing in a skilled workforce is crucial for successfully adopting this construction method.

Conclusion

As the demand for efficient and cost-effective construction methods grows, prefabricated metal construction is emerging as a leading solution in the warehouse industry. With its inherent benefits of speed, cost savings, durability, and sustainability, prefabricated metal offers a promising future for warehouse construction. Stakeholders can unlock their full potential and reshape the industry by addressing the challenges associated with this construction method.

Read Also:

- Project Management in a PRINCE2 setting

- How Can BYOD Improve Your Productivity?

- The New Global Project PRINCE2 Management Forum

- Commercial Construction After COVID-19: How Developers Can Adapt