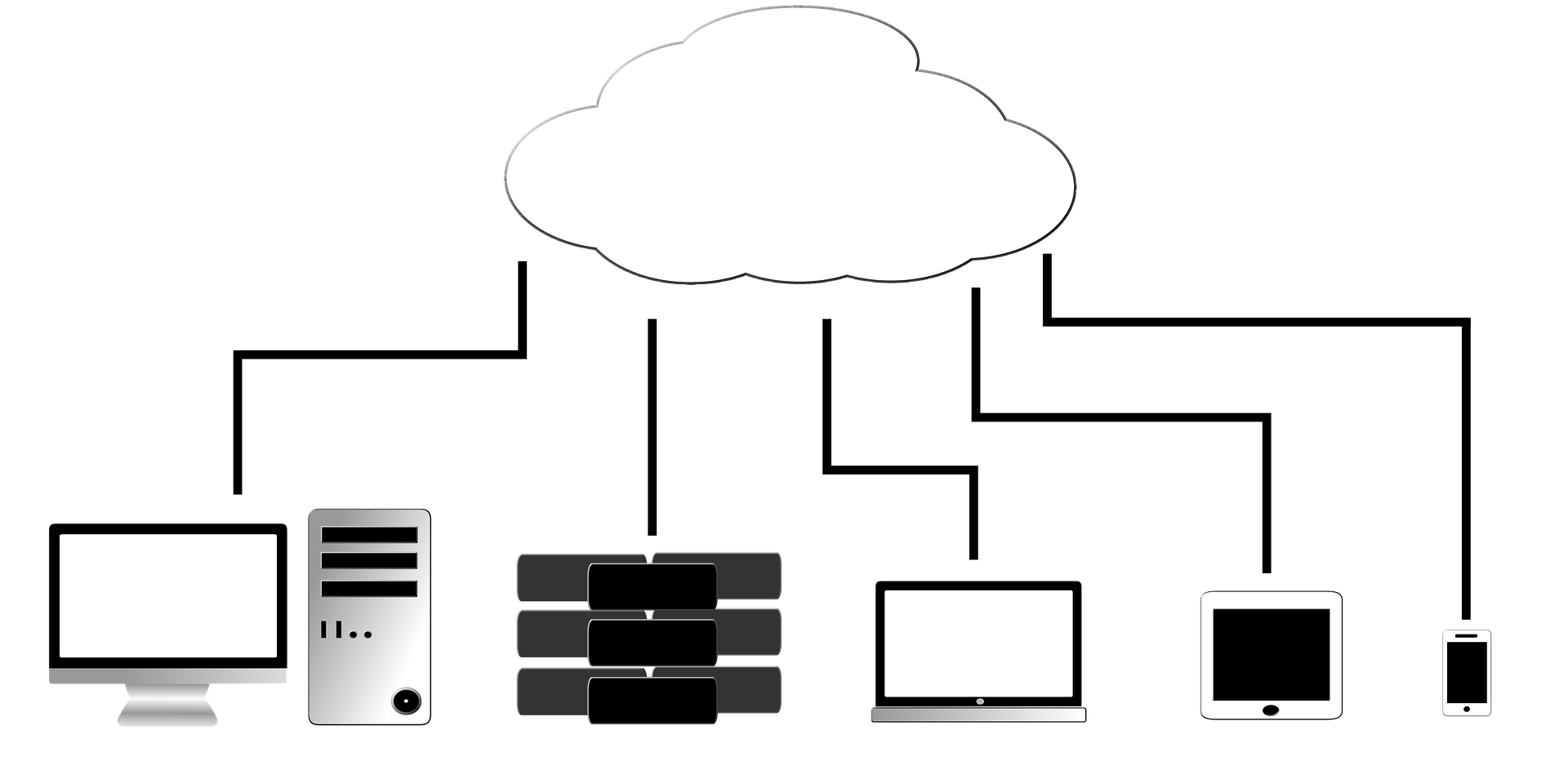

Online backup services are helping many businesses in storing their files on the web. It is better than using hard drives and other external storage for some reasons, especially for security purposes.

IT nerds in California are so amazed at Backblaze because of how it keeps more data safely. It is named the best cloud storage service with its personal and business backup function.

Cloud storage works to protect old and new files better than Dropbox and other online storage mediums. Its security level is also higher than expected with the help of experts behind it.

Well, before securing your files & data on Cloud storage, you must always think about IT equipment disposal and server recycling. This is to get rid of all the unwanted hardware in the server room, thus creating new space. A data center decommissioning specialist like “Dataknox” can help in such complex ITAD solutions in Newark CA, in a professional way.

If you are in doubt whether Backblaze is good for your business, below is a rundown of benefits you can consider in making decisions.

Four Benefits of Backblaze’s Cloud Storage

1. Easy to Manage:

Backblaze is easy to use and ideal for a wide range of users. Once the backup plan is set, the cloud server will be fully responsible for keeping your files secure.

However, Backblaze is unlike other backup storage that allows user intervention over the files at any time. The software itself will do the tasks for you. This function may not be good for some users but benefits others.

2. Backups File Automatically:

As said earlier, user intervention is limited with Backblaze’s backup storage. The good news is that it keeps files automatically for unlimited storage at a reasonable cost.

This main feature of cloud storage makes the backup process run continuously. It assures keeping files safely at the right places with the help of data centers. Backblaze guarantees to manage your data with less hassle on your behalf.

3. Full Protection Against Data Loss:

The disadvantage of other backup services is providing easy access to files through multiple devices. This may cause data loss if not manage very well. With Backblaze, it promotes data protection that helps to recover files easily when lost or stolen.

It also boasts double-layer security by encrypting all of your files on drives to improve privacy. It helps to prevent hackers to steal your data whenever they wanted.

4. Unlimited Storage:

Lastly, Backblaze can offer businesses extra storage up to quintillion bytes to hold their data. It is huge enough to keep even the files of larger enterprises. That is why this online backup service can be suitable for a wide range of usage.

Moreover, it is very affordable with all the other features it has to offer. Its unlimited online backup is a plus that requires additional cost.

Final Thoughts:

Wrapping it all up, entrusting your business files with Backblaze is the right decision. It protects your data from possible security leaks, unlike other backup storage options. Backblaze is also affordable and yet provides the best storage features for your specific needs. The staff behind will be fully responsible for keeping your files secured and easy to access.

For your data backup needs, contact Backblaze for more details.

Read Also:

- 8 Surprising Ways Cloud Computing is Changing Education

- Best Server Management Tips for Startups

- What are the things you need to know while choosing Antivirus Software?