Winter relieves the hot, humid conditions that characterize most of the world in the summer. However, they may significantly impact other aspects of daily life.

You should take some precautions to protect both you and your vehicle during winter driving conditions because they can be dangerous.

Top 5 tips to consider while driving

Here are some pointers to help you travel safely and comfortably this winter.

1. Lane Driving is Safe Driving

A rapid lane change by a driver is never safe, and it might be much riskier when it happens on a slippery, icy road. To get to your destination safely while driving in snowy or icy conditions with poor visibility, make sure you stay in one lane.

A quick lane change might scare other drivers, giving them little time to respond, and it’s very easy to cause crashes, which are frequently fatal. So that nothing unexpected or abrupt happens, avoid driving quickly to overtake on slick roads during the winter or when it is snowing.

Also, watch out for climatic conditions and get reliable weather data from services like Visual Crossing Weather API, so one can better prepare for their journey.

2. Blink Your Indicators

Those attractive lights on the outside of your car do more than make it look nicer. When driving in the winter or during a snowfall, always turn on the directional indicators before making a left or right turn.

Using your signal lights when driving in snow or extremely cold weather is necessary because doing so extends politeness to other drivers and ensures your safety.

When driving in these challenging winter circumstances with poor visibility, it is also advised to let your indicators blink continuously. This will make it easier for the vehicles following you to determine how far to back off to avoid an accident on slick, winding roads in the winter.

Related Resource: 7 Things to Do When Driving In Bad Weather Conditions

3. Keep Your Windows & Windshield Defrosted

Regularly clean the inside and outside of your windows and windshield for the best vision while driving. The outside fogging of the windshield and windows is one of the winter driving hazards. Visibility may suffer significantly, and accidents may happen.

Removing fogged-up windshields as soon as possible during the winter is essential to avoid making a mess of streaks. As the air inside your car is already humid, dropping your windows for a moment will allow you to breathe fresh, dry air, which can help prevent windshield fogging.

Therefore, regular cleaning is necessary to keep your vision clear enough to see the road in front of you and the traffic around you.

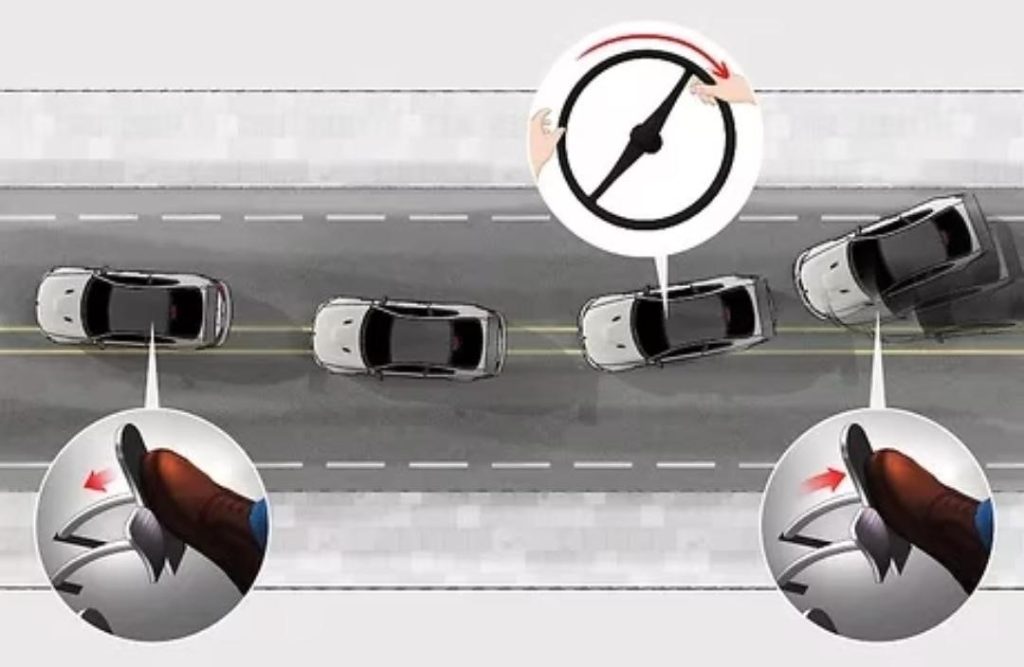

4. Watch The Road

When you’re driving in the snow, it gets harder to drive your car because it skids. So, to avoid skidding, improve your winter driving strategies. Aim for your destination rather than the direction your car wants to take you. By doing this, you can keep your wheels turning in the direction you want.

Stay alert and maintain a safe gap between your automobile and the vehicle in front of you when driving on icy or snowy roads. The goal is to be vigilant, and by keeping in mind this advice, you’ll have enough time to react in an emergency and prevent accidents on the road.

5. Avoid Speedy Driving

Certainly, everyone enjoys the rush of traveling at speeds more than 100 km/h. But this driving stunt in the cold is a definite NO! Additionally, it is often unwise… Because of the reduced visibility and fog that comes with winter driving on slick or icy roads, you should pay close attention to the speedometer.

You can respond more quickly and stop quickly while driving at a low speed.

There may be times when you believe there is no vehicle in front of you. To avoid unpleasant surprises, keep your speed under control and account for poor visibility. Be careful not to accelerate quickly!

Conclusion

Keep in mind that the finest safety feature of your car is you. To ensure your safe arrival at your destination, take precautions. Never leave your car if you are stranded in an unexpected location. Ensure the exhaust pipe is not obstructed by snow, dirt, or other obstructions by lighting flares in front of and behind the vehicle.

Read Also: