In today’s globalized economy, businesses are constantly engaged in international transactions and dealing with multiple currencies.

Accessing accurate and up-to-date currency exchange rates is crucial for seamless financial operations, informed decision-making, and ensuring the accuracy of financial records. This is where currency APIs come into play.

Currency converter API (aka. exchange rate API) enable businesses to retrieve real-time exchange rates and perform currency conversions effortlessly. They provide a direct and reliable channel for accessing currency data. Hence, eliminating the need for manual data collection and ensuring the accuracy and timeliness of information.

Why is reliable currency data crucial for businesses? Accurate currency information is vital for various financial activities, including e-commerce, international trade, travel and hospitality, investment analysis, accounting, and risk management. It enables businesses to calculate product prices, manage inventory costs, track revenue and expenses, and evaluate profitability across different markets.

However, with numerous currency APIs available, it becomes essential to identify reliable data sources that suit your business requirements. To help you navigate the options, we have curated a list of 10 trustworthy and free currency APIs that offer reliable and accurate exchange rate data. Let’s learn about them.

What Is A Currency Converter API?

A Currency API Convertor allows applications to retrieve real-time or historical currency exchange rates, perform currency conversions, and access other currency-related data. It acts as a bridge between different software systems, enabling seamless integration and communication. Let’s read about some of the most popular currency APIs available today.

What Are the Ten Best Currency APIs Available In the Market Today?

Here are the ten most reliable currency APIs.

Fixer.io

Fixer API is a popular currency API that provides real-time and historical exchange rates for over 170 currencies. This API comes with 6+ years of experience and rock-solid data sources, making it a reliable API. As a result, thousands of developers trust this API worldwide.

It offers reliable data retrieval through a RESTful API and supports multiple integration options. Fixer API offers free and paid plans, with pricing details available on their website, catering to businesses of all sizes.

Currencylayer

Currencylayer API is a popular choice for businesses seeking reliable currency data. With access to real-time exchange rates for 168 currencies, it offers features like historical rates, time-series data, and conversion capabilities. You can try these API endpoints available on their website.

While it offers a free plan with limited features, its premium plans provide more comprehensive options tailored to specific business needs. Pricing starts from $14.99 and goes up to $99.99. There is also a custom plan for users.

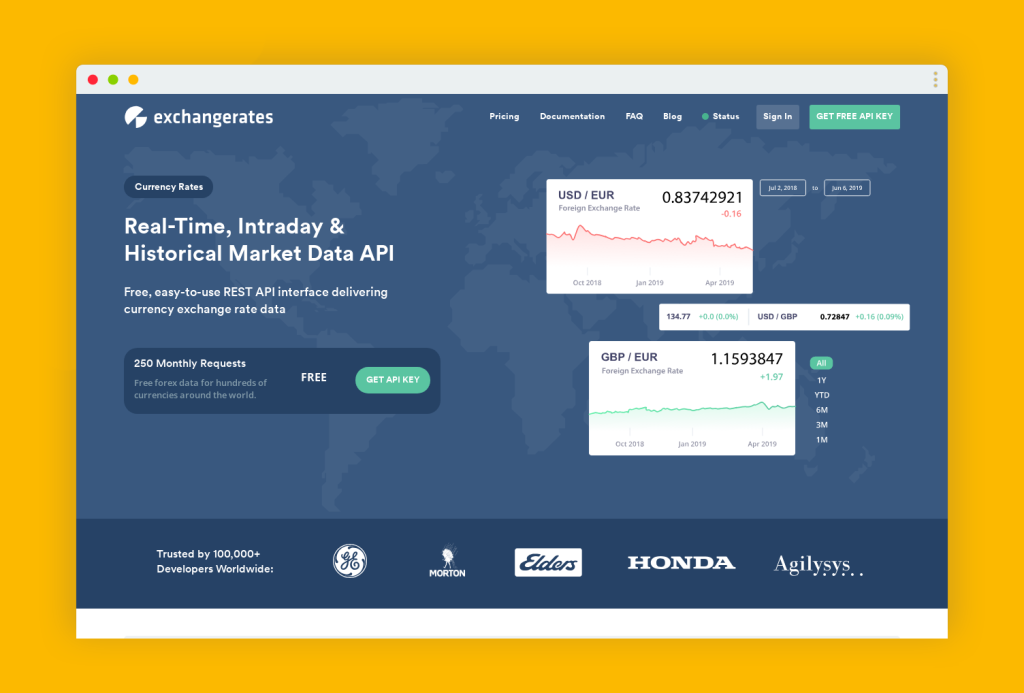

Exchange Rates API

Exchange Rates API is a reliable currency API that provides access to real-time and historical exchange rates for over 200 currencies. Moreover, the API gives 250 free requests monthly. It is a simple, quick, and reliable API with pricing starting from $9.99. This API uses over 15 exchange rate sources to bring accurate data for the users.

Open Exchange Rates

Open Exchange Rates is a popular currency API provider offering accurate and up-to-date exchange rates for over 200 digital currencies. With various integration options, it enables seamless data retrieval and currency conversion.

Businesses like Shopify and Etsy also benefit largely from the Open Exchange Rates API. The pricing starts from $12 per month. You can also choose the unlimited plan that costs $97 per month.

XE

XE API is a widely trusted currency API that offers real-time exchange rates and historical data for over 210 currencies. Its easy integration allows businesses to access reliable currency data for accurate conversions and financial operations. Pricing for XE API can be found on their website, accommodating different business needs. However, this API is more expensive than other available options. Businesses like Vistaprint and Shopify also trust this API.

Currency API

Currency API offers a robust set of features supporting 170+ currencies globally. The API gives updated results after 60 seconds. This simple and reliable API comes with 300 free credits per month. The prices range between $9.99 and $74.99 per month. You can also get a custom plan.

IBAN

IBAN’s Forex Reference Suite is a leading currency conversion API in 2023. It sources its data from reputable central banks as well as trusted providers, ensuring the reliability of the information.

This API consistently refreshes the currency rates every 10 minutes, offering timely and accurate updates. Access to over 154 currencies enables users to obtain the latest conversions accurately reflecting dynamic market fluctuations.

OANDA

The OANDA currency converter API allows users to access a comprehensive collection of past data spanning over three decades, encompassing over 200 different commodities, currencies, as well as invaluable metals.

This API caters to various professionals, including accountants, auditors, hedge fund managers, and also treasurers. Its primary objective is to deliver precise exchange rates that meet strict financial compliance standards.

Currency Converter API

Catering to developers of all proficiency levels, this API provides a currency API with three options: a free version, a prepaid service, and a premium solution. The unpaid version, as well as the prepaid service, cater to companies with lower request volumes. In contrast, the payable service is geared towards individuals seeking a robust and ready-to-use currency API for production purposes.

Exchangerate.host API

When you are searching for an API that is free and has a small resource footprint, it provides real-time and past exchange rates for foreign currencies and cryptocurrencies. The API guarantees an uptime of 99.99% and includes historical data spanning two decades.

Conclusion

Access to reliable free currency APIs is a game-changer for businesses operating in a global economy. These APIs provide accurate and up-to-date currency exchange rates. Hence, allowing businesses to streamline financial processes, make informed decisions, and ensure the accuracy of their international transactions.

The ten reliable free currency APIs mentioned in this blog offer a range of features and data that cater to different business needs. By leveraging these APIs, businesses can reduce errors, save time and resources, enhance customer satisfaction, and gain a competitive edge in the global marketplace.

So, take advantage of these powerful tools and unlock the potential of seamless currency data integration for your business’s success.

FAQs

Is There a Free Currency API?

Several free currency APIs, such as Fixer, Open Exchange Rates, ExchangeRate-API, and CurrencyLayer, are available.

What Is the Free Web Service for Currency Conversion?

A popular free web service for currency conversion is XE.com, offering accurate and up-to-date exchange rates.

What Is the API for Currency Conversion Rates?

The API for currency conversion rates provides real-time or historical exchange rates for seamless currency conversions.

Read Also:

- Why Entrepreneurs Should Pay Attention To Cryptocurrencies In 2021

- Crypto Staking: Locking Up Crypto Holdings To Earn Interest

- Can I Convert My 401k To A Gold IRA?