Humanity’s initial foray into metal use started with non-ferrous metals.

The adoption of bronze, an alloy blending copper and tin, marked the pivotal shift from the Stone Age to the Bronze Age circa 3200 BCE. Casting non-ferrous metals stands as a highly impactful industrial practice, shaping civilizations.

Over millennia, advancements have refined techniques and procedures, yet the foundational principles remain enduring, fostering ongoing innovation.

But, many people still don’t know much about the non-ferrous castings or how they usually work. And that’s what we will be discussing in this article. So, let’s get started with it.

Things to Know – 1: What is a Non-Ferrous Metal Casting?

Non-ferrous metals encompass a range of chemical compounds present on Earth, excluding pure iron. Contrary to pure metals, which are elemental, these non-ferrous metals consist of alloys, combinations of two or more metals fused together.

Crafting alloys involves a skillful blend of elements — often resulting in improved properties and advantages. Precision in alloy mixing can yield valuable and sought-after characteristics, making them a crucial part of modern metal usage.

Metals like aluminum, lead, tin, zinc, nickel, and copper are widely known.

Copper-based alloys without iron, like brass (a mix of copper and zinc) or bronze (a blend of copper and tin), are among them. Besides, precious metals like platinum, silver, and gold are classified as non-ferrous metals.

Things to Know – 2: Non-Ferrous Metal and Ancient History

Humans initially used non-ferrous metals for metallurgy, with copper, gold, and silver being particularly appealing due to their resistance to corrosion, unlike ferrous metals.

Copper, known as the initial metal manipulated into items during the ‘Copper Age,’ along with gold and silver, replaced wood and stone due to their malleability.

Their scarcity made them highly exclusive materials often reserved for luxurious goods. The introduction of bronze, achieved by blending copper with tin, marked the transition from the Copper Age to the Bronze Age.

Things to Know – 3: Material Diversity

Non-ferrous castings encompass an array of materials, including aluminum, copper, zinc, and magnesium alloys.

Each exhibits distinct characteristics — aluminum boasts lightweight strength, copper offers excellent conductivity, zinc facilitates die-casting, and magnesium showcases exceptional lightness. It allows for tailored solutions in various industries, from aerospace to automotive, enhancing efficiency and performance.

Things to Know – 4: Complex Casting Processes

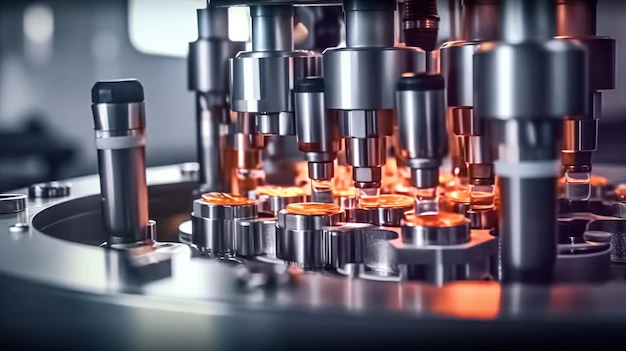

The casting process for non-ferrous materials involves intricate methodologies.

Techniques like sand casting, investment casting, and die casting are prominent. Sand casting, a traditional method, involves pouring molten metal into a sand mold.

Conversely, investment casting uses wax patterns for intricate designs. Die casting, preferred for high-volume production, employs reusable molds for precise, rapid casting.

Things to Know – 5: Corrosion Resistance

One of the standout features of non-ferrous castings is their resistance to corrosion. Aluminum and its alloys form a protective oxide layer, rendering them resistant to rust.

Copper’s inherent resistance to corrosion makes it a much preferred choice in plumbing and electrical applications, ensuring durability and longevity in various environments.

Things to Know – 6: Application in Diverse Industries

The adaptability of non-ferrous castings extends across numerous sectors. In the automotive industry, aluminum alloys enhance fuel efficiency due to their lightweight nature.

Copper alloys find extensive usage in electrical components, ensuring efficient conduction. Aerospace usually relies on magnesium alloys for their lightweight strength, enabling aircraft to achieve optimal performance.

Things to Know – 7: Sustainability and Recyclability

Non-ferrous materials align with sustainable practices due to their recyclability.

Aluminum, for instance, retains all of its properties even after recycling, making it a highly sought-after material for eco-conscious industries.

The recycling process consumes significantly less energy compared to primary production, contributing to reduced carbon emissions and resource conservation.

Things to Know – 8: Design Flexibility and Precision

The overall versatility of non-ferrous castings allows for intricate designs or precise detailing.

Investment casting can allow the creation of complex shapes with fine details, fulfilling the demands of industries like —

- Jewelry making,

- Aerospace, and

- Medical equipment manufacturing.

This flexibility aids in achieving the desired functionality and aesthetics of the final product.

Things to Know – 9: Types of Non-Ferrous Alloys and Metals

I. Aluminum

Aluminum stands as one of the most abundant non-ferrous metals.

Its lightweight nature, excellent conductivity, corrosion resistance, and malleability render it indispensable across diverse sectors.

From aerospace components to beverage cans, aluminum’s versatility knows no bounds. Its conductivity makes it ideal for electrical transmission lines and wiring.

Additionally, aluminum alloys, such as 6061 and 7075, offer enhanced strength, making them suitable for structural applications in aviation and automotive industries.

II. Zinc

Zinc, used as a coating to protect steel from corrosion, also finds application in die-casting processes to produce intricate shapes for automotive components and household fixtures.

Zinc alloys, like Zamak, offer improved mechanical properties and are commonly used in the manufacturing of various consumer goods and automotive parts.

III. Lead

Despite environmental concerns leading to reduced usage, lead still finds applications in certain industries due to its high density and corrosion resistance.

Historically used in piping, batteries, and radiation shielding, its usage has decreased due to health and environmental regulations.

IV. Copper

Copper, known for its great electrical and thermal conductivity, has been in use since ancient times. Its overall flexibility and malleability enable it to be shaped into wires for electrical applications and tubes for plumbing systems. Copper alloys, including brass (copper and zinc) and bronze (copper and tin), possess superior properties like —

- Increased strength,

- Corrosion resistance, and

- Aesthetic appeal

These make them quite valuable in architectural designs, musical instruments, and marine applications. You can use them in various other aspects as well.

Conclusion

The non-ferrous castings embody a unique convergence of material science, manufacturing expertise, and application versatility. The myriad benefits—ranging from corrosion resistance to recyclability—underscore their pivotal role in modern industries.

Understanding these essential aspects empowers industries to leverage the unique properties of non-ferrous materials, fostering innovation, sustainability, and efficiency in manufacturing processes worldwide.

Read Also:

- Why Metal Studs are More Suitable for Your Construction Works

- Is Prefabricated Metal The Future Of Warehouse Construction?

- How Many Jobs Are Available In Precious Metals?