Is consumer service jobs a good career path or not? , you have landed in the right place If you have the same question.

Firstly, consumer services are only one of the preferred areas where people try to start their careers. However, we must take a look at it and explore the opportunities that it has to offer. This particular sector has a lot to offer, which can help you achieve career growth while earning the utmost potential for a great future.

Consumer service jobs play a vital role in an excellent economy. It also helps provide all kinds of necessary services for individuals while providing significant support to most industries.

Besides, consumer services play a significant role in the overall GDP or gross domestic product. Moreover, employment opportunities for millions of people.

In this blog, we will discuss consumer services and what consumer services jobs pay. I will also provide examples of consumer service jobs that can help you grow in your career.

The concept of consumer service jobs

Consumer services are known for some activities designed to meet the personal needs of consumers. There are industries such as retail, hospitality, finance, education, telecommunications, etc., which are highly focused on consumer services.

Consumer services put their focus on providing better convenience as well as supporting all the daily activities. These experts use human resources, technology, and computers to assist all the customers.

The primary aim of all consumer services is to meet two things: the needs and expectations of the consumers. Various industries provide services that are beyond the customer’s abilities.

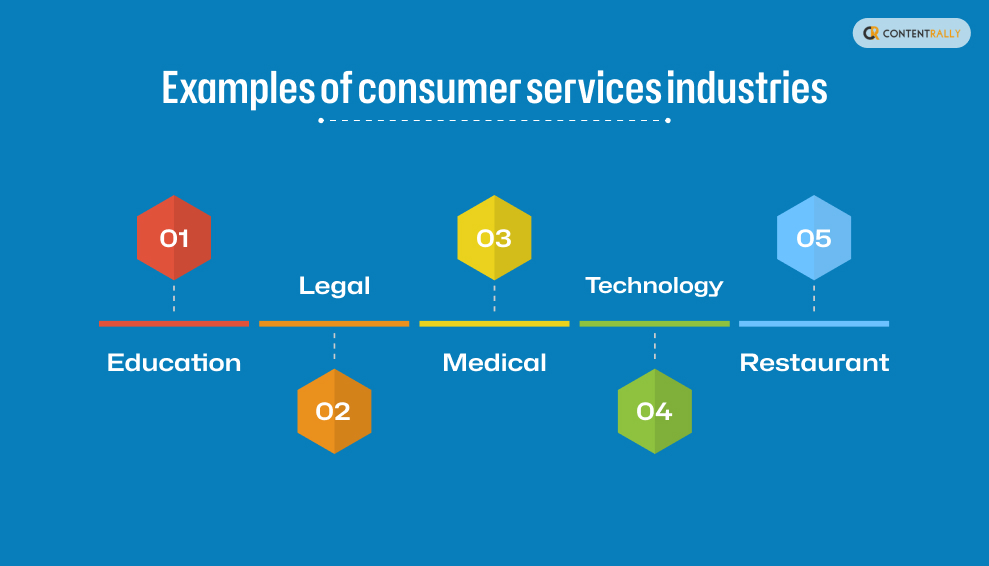

In the following few sections, I will discuss a few examples of consumer services industries along with the top 7 consumer services jobs.

Examples of consumer services industries

The consumer services industries are vast in numbers. They include the services provided by various hotel companies, personal insurance, education, healthcare, recreation, catering, home maintenance, etc. Here, I have provided some of the examples:

Education

Education is a service that provides help to students of all ages, backgrounds, and academic levels. The primary aim is straightforward: to meet learning needs.

Mainly, an educator prefers using many teaching methods like lectures, storytelling, and experiments, which help the students learn.

As a result, students can benefit a lot from education. They start to develop new talent, gain a lot of knowledge, improve their communication, and learn to think critically.

If you are looking for a consumer service job in the education sector, here are some examples:

- School teacher: For elementary level

- High school teacher

- College professor

- Adjunct Professor

Legal

In the legal industry, consumer service includes helping anyone who needs legal assistance. The legal service providers typically help others by assisting in court.

Moreover, this may include representing a person in court or helping an individual while dealing with police authority. In the following, I have listed a few legal services careers for great future opportunities:

- Lawyer

- Public defender

- Police officer

- Detective

- Paralegal service providers

Medical

Medical services comprise anything that is related to the healthcare sector. In general, the healthcare services are segregated into four parts:

- Diagnosis and treatments

- Disease prevention

- Health promotion

- Rehabilitation.

Doctors, nurses, and other healthcare providers are responsible for providing medical services to patients. The professionals who work in the healthcare industry are:

- Pediatrician

- Nurse

- Emergency medical technician

- Surgeon

- General Physician

- Psychiatrist

Technology

Information technology or IT falls under the consumer service jobs. As an expert in the technology industry, individuals may provide all kinds of technology-related resources.

The IT specialist mainly provides services such as developing, designing, maintaining, and supporting various web applications. Moreover, they work on different computer networks, help you troubleshoot systems, and install computer programs.

The technology services include:

- Software developers

- IT consultants

- Network engineers

- Technology service managers

Restaurant

Restaurants are known as the most common ground for consumer service jobs. Furthermore, this industry offers many services that ensure better loyalty and satisfaction.

The services mainly include food, drinks, and dining experiences. The primary aim of the service providers is to maintain a clean ambiance to increase customer engagement further.

In the following, I am going to provide some of the positions that are considered consumer jobs in the restaurant industry:

- Sous Chef

- Sommelier

- Chef de partie

- Dining server

- Executive chef

- Restaurant manager

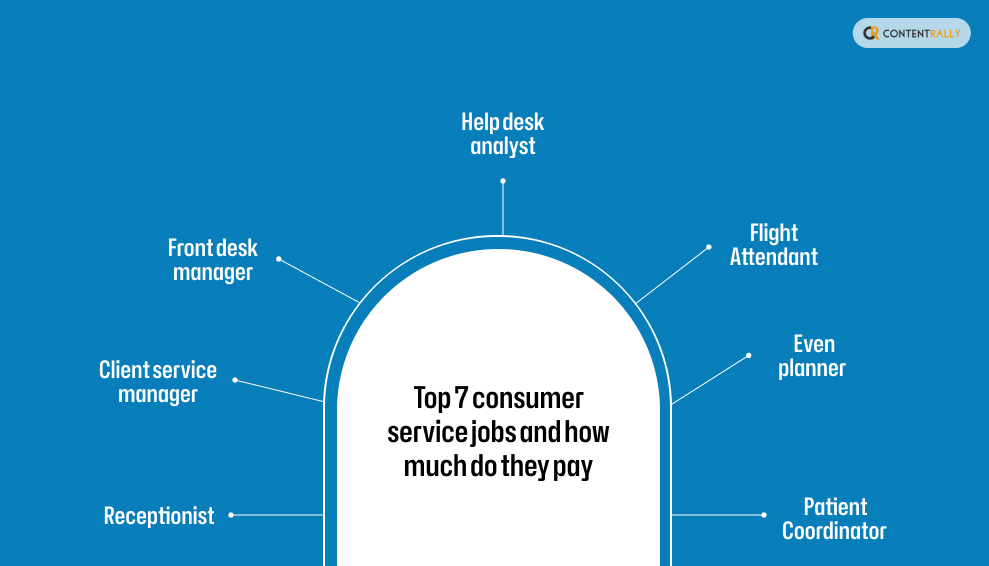

Top 7 consumer service jobs and how much do they pay

Consumer service jobs seek great people skills. If you are good at that, then consumer service jobs are the one for you. As I have mentioned before, you will find consumer service jobs in almost every industry, such as healthcare, retail, etc.

The field has high-paying jobs with a lot of future opportunities. Moreover, as a consumer service provider, you will cater to customers and focus on improving customer satisfaction. Now, you might be wondering what consumer services jobs pay and how much they pay.

Here are some of the best roles you can pursue if you want a career in consumer services.

Receptionist

Firstly, as a receptionist, you will be the first contact person for the visitors and customers of your workplace.

Average salary: $47,431 per annum

Responsibilities:

- Greeting all the guests in a polite and friendly manner

- Providing guiding visitors to the right person or a department.

- Making schedules

- Keeping the records updated

- Managing all kinds of administrative tasks

- Answering essential phone calls and connecting them to the correct department.

Client service manager

Second, a client service manager provides services as the first contact for a business client. They focus on maintaining a good relationship with both existing and new clients.

Average salary: $69,411 per annum

Responsibilities:

- Understanding the needs and expectations of consumers.

- Providing better customers and guiding the clients

- Managing client relationship

- Onboarding clients and collecting feedback.

- Checking if the clients are satisfied with the services or not.

Front desk manager

A front desk manager is responsible for managing every front desk operation as well as staff at a business.

Average salary: $52,507 per annum

Responsibilities:

- Managing reservations and bookings

- Coordinating with different departmental staff

- Addressing customer complaints and managing them

- Answering phone calls and emails.

- Making schedules for employees.

Help desk analyst

When you are working as a help desk analyst or a technical support representative, you become an essential part of the IT team of an organization.

Average salary: $48,771 per annum

Responsibilities:

- Providing technical assistance

- Resolving all kinds of system-related issues

- Addressing and resolving technical issues over emails and phone calls

- Performing maintenance for the back end.

- Troubleshooting issues related to hardware and software

Flight attendant

As a flight attendant, your primary focus will be to ensure the safety and comfort of all the passengers while traveling by air.

Average salary: $39,448 per annum

Responsibilities:

- Greeting all the airline passengers during boarding

- Performing a proper safety check to ensure passengers’ safe journey

- Keeping the passengers educated about the emergency and safety protocols

- Helping all the passengers find their designated seats

- Addressing customer queries and resolving issues

Even planner

The event planner job role falls under the hospitality industry. As an event planner, you are supposed to execute events like corporate parties, events, weddings, etc.

Average salary: $47,052 per annum

Responsibilities:

- Understanding the needs and wants of clients

- Finding suitable venues and booking places.

- Keeping a good partnership with vendors to organize events.

- Managing both budgets and timelines.

- Managing logistics related to catering, entertainment, and decor.

Patient Coordinator

Lastly, the patient coordinators are responsible for overseeing patient care and related services, communicating with patients, managing patient appointments, and lastly, ensuring proper care.

Average salary: $50,000

Responsibilities:

- Making schedules for patients based on the availability of doctors

- Handling the process of insurance verification

- Addressing patient queries during billing

- Managing patient records.

Wrapping it up!

In conclusion, the blog has explored different kinds of high-paying customer service jobs. From the client service desk to the patient service coordinator, we discussed each role along with the average salary for each role.

This blog will help you stay informed about consumer service jobs and what consumer services jobs pay. If you want to learn more about consumer service roles, please let us know in the comment section.

Happy job hunting!

Read Also:

- How Many Jobs Are Available In Consumer Services?

- What Is a Remote Job? Everything You Need to Know