How many jobs are available in consumer services? There are multiple types of jobs in consumer services, and you will have various career opportunities in the industry. Apart from that, most industries in this field offer many opportunities for job growth. Moreover, the US BLS states that there is much potential for new jobs in these areas.

In this article, you will learn about how many jobs are available in consumer services. Apart from that, you will also learn about the major job options in this industry. This article also gives you a brief description of the major jobs in this field. Hence, to learn more, read on to the end of the article.

What are Consumer Services?

According to Indeed.com,

“The consumer services field is a sector that focuses on assisting individuals rather than organizations or other businesses. Experts in this field can use human resources, computers, and information technology (IT) to assist customers.”

From a business perspective, consumer services have changed their meaning a bit. Here, it includes strategies and processes that a business uses to offer goods and services to people. Here, the transaction is B2C and not B2B. In these cases, businesses do not offer goods and services to other businesses.

Basically, the major aim of consumer services is to ensure that the business meets the needs and demands of its customers. Actually, there are a variety of industries that offer consumer services to businesses. These include:

- Retail

- Healthcare

- Hospitality

- Finance

- Education

Most consumer service companies fall under these industries.

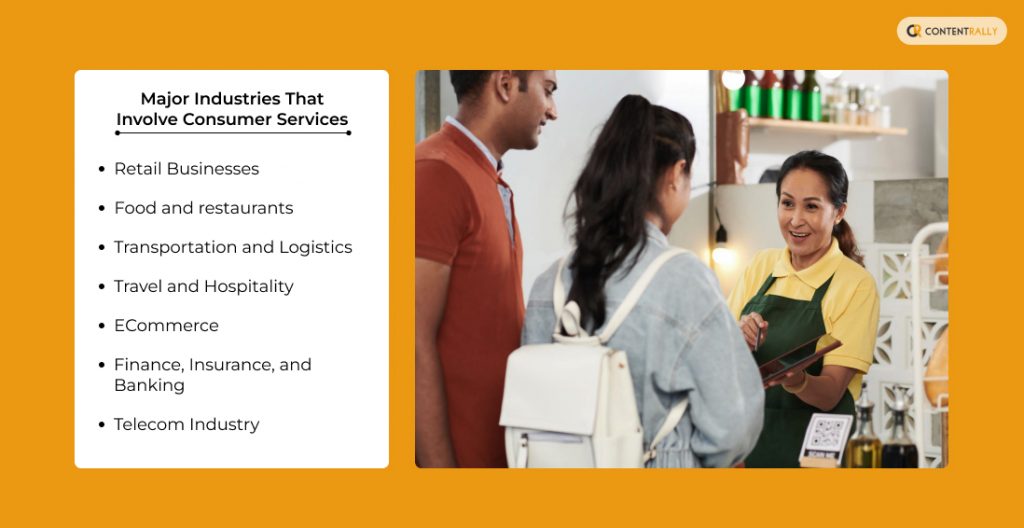

Major Industries That Involve Consumer Services

The following are the major industries that involve consumer services:

- Retail Businesses

- Food and restaurants

- Transportation and Logistics

- Travel and Hospitality

- ECommerce

- Finance, Insurance, and Banking

- Telecom Industry

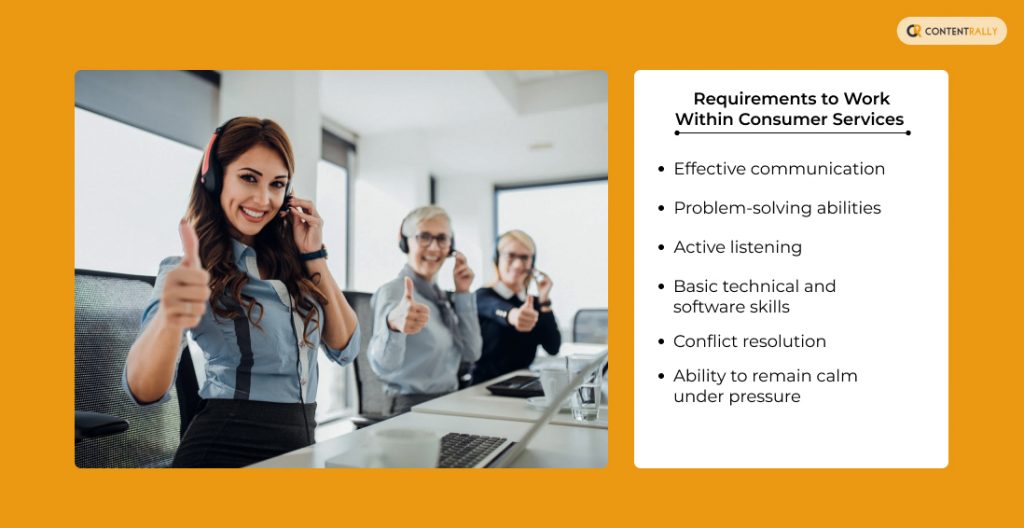

Requirements to Work Within Consumer Services

Here are the major skills you must have if you want to work within consumer services:

- Effective communication

- Problem-solving abilities

- Active listening

- Basic technical and software skills

- Conflict resolution

- Ability to remain calm under pressure

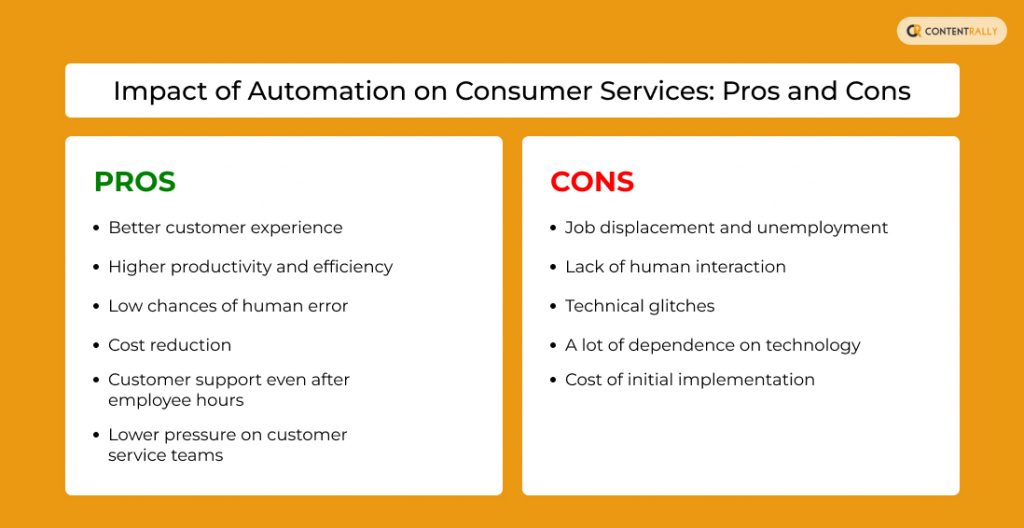

Impact of Automation on Consumer Services: Pros and Cons

The following are the major pros and cons of the impact of automation in consumer services:

Pros

Here are the major pros of automation that benefits consumer services:

- Better customer experience

- Higher productivity and efficiency

- Low chances of human error

- Cost reduction

- Customer support even after employee hours

- Lower pressure on customer service teams

Cons

Here are a few cons of the automation that negatively impacts consumer services:

- Job displacement and unemployment

- Lack of human interaction

- Technical glitches

- A lot of dependence on technology

- Cost of initial implementation

How Many Jobs Are Available in Consumer Services in 2024?

According to the BLS, employment in consumer services will decline from 2021 to 2031. This is mainly due to the introduction of AI in multiple business processes. However, there are still huge job openings in the industry. For instance, the sector has an average job opening of 390K annually (approx.)

However, these are projected openings. Generally, they come from the need to replace employees transitioning out of the industry. Or it includes the ones who are retiring from the workforce.

Apart from that, there are some consumer services fields and roles where you will find differences in occupational outlooks.

For instance, when it comes to roles like customer service and sales reps, you will see a growth of 4% in the coming decade. On the other hand, sales management roles will see an increase of 5%.

On the other hand, professionals who work in the consumer services fields like digital marketing advertising, and promotion expect a 7% increase in jobs.

Top 5 Jobs in Consumer Services

If you are someone who is looking for jobs in consumer services, the following positions integrate people and money. The following are some of the most popular and important jobs that you will find in consumer services:

1. Concierge

Generally, you will find concierges across the hospitality industry and in other sectors as well. However, you will commonly find them in hotels, lodging, travel, and tourism. Basically, a concierge helps guests in tourist centers and hotels. Actually, they will assist customers with lodging and dining reservations.

Apart from that, they are also common in transportation services, event planning, and activities. On the other hand, concierges also ensure visiting guests are comfortable. Also, they ensure enjoyable experiences when they stay.

Average salary: $41,349 per year

2. Retail Sales Associate

You will find retail sales associates assisting customers and providing support in a retail setting. Apart from that, they also answer customer questions. Basically, they play a massive role in customer service. This is to help their stores increase customer satisfaction and sales.

According to Coursera,

“A retail associate helps customers while they shop, answers questions, and assists in daily store operations. In this role, you serve as a representative of the retail brand and play an important role in the store’s overall success. Retail associates might also be referred to as sales associates or representatives.”

Generally, these professionals can also advance in managerial roles. In such roles, they supervise their teams, which interact with their customers regularly.

Average salary: $43,169 per year

3. Technical Support Specialist

In general, a technical support specialist oversees different customer service tasks. These include answering customer questions and offering solutions to tech problems. Oftentimes, they work for tech companies and offer technical and computer support to customers.

On the other hand, tech support professionals also specialize in niche areas. These include software, network, and data security.

Average salary: $54,916 per year

4. Academic Adviser

Indeed explains,

“Academic advisers provide counseling services that help students determine the best academic studies and educational programs to meet their goals. They help students choose and plan out educational coursework, evaluate academic preparedness and provide guidance for academic success.”

As the name suggests, academic advisers help students in their admission and placement processes. Generally, they work with admission offices and ensure students receive the necessary educational support.

Actually, they work in a public or a private institution and essentially help students assess their career plans. While academic advisers help high school students and others offer guidance to college students.

Average salary: $44,719 per year

5. Social Worker

According to Coursera,

“A social worker is a trained professional who works with all types of vulnerable people, groups, and communities to help them learn to live better lives. Social workers tend to work with populations suffering due to poverty, discrimination, or other social injustices.”

Social workers have an important role in ensuring the safety and health of communities. You will find them often working with mental and health care professionals.

Apart from that, they also help families and individuals to cope and overcome various challenges. These include illnesses, traumatic experiences, addiction, and disabilities.

On the other hand, a social worker also works as a support system for families and individuals. They help them make lifestyle improvements and work towards healthy social goals.

Average salary: $58,939 per year

Getting a Job in Consumer Services: The Way Forward

How many jobs are available in consumer services? Hope this article was helpful for you to get a better understanding of the number of jobs. If you want to work in consumer services, consider working towards your networking and communications skills. This way, you can increase your chances of selection.

Do you have more information to share about consumer services? Please share them in the comments section below.

Read Also: