It’s funny but when you see someone shredding old documents you, immediately assume they have something to hide. This is probably due to the various high-profile scandals that have involved the destruction of paperwork, such as Watergate.

However, the simple fact is that, even in the digital age, paper is still used and personal information must be destroyed properly. That’s why every business should invest in security shredders. These are designed to cut the paper in several directions and into very small pieces, making it very difficult to piece the paper back together.

It’s the safest and most efficient way of getting rid of paper records.

Why Destroy Old Records

All businesses have to keep records of their transactions, especially income and outgoings. These are essential to back up their annual accounts. This paperwork can be examined at any time to ensure the declared accounts are accurate. This is important to the tax inspector as they calculate the tax bill based on the accounts declared. If these accounts are wrong the business may underpay tax.

To ensure this doesn’t happen the tax inspector can ask to see the records to verify figures. Of course, this means that businesses need to keep the records safe for the inspector.

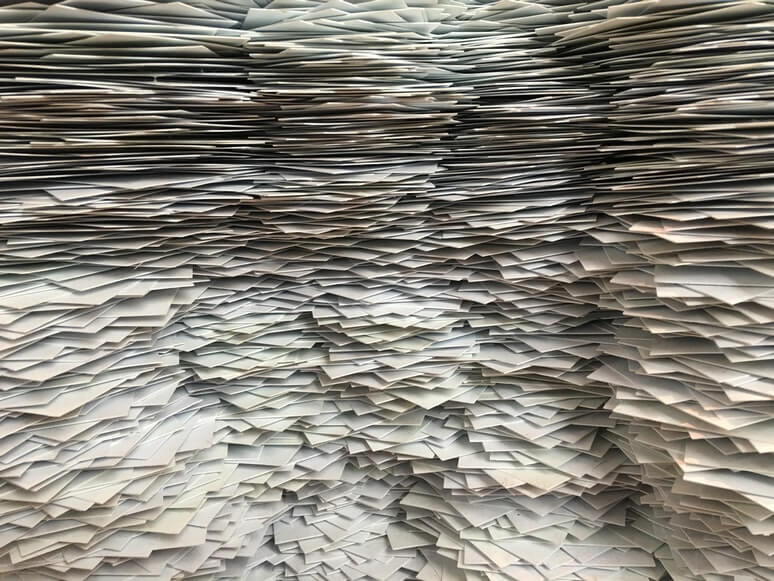

However, keeping records requires space. Just one year of accounts records can take up dozens of boxes and the problem gets worse for small companies.

In general, the tax inspector likes you to keep records for seven years.

Modern Changes

This has changed slightly in recent years as there is an increasing number of companies offering to scan your paperwork and look after it in the cloud on secure servers. Alongside this, they will usually have a secure backup to ensure the records are never lost. This is generally acceptable to the tax office. But, they do like to be able to verify some records with the scanned versions.

Of course, this is a cheaper option than renting space simply to keep old records.

In short, it is recommended that businesses keep records for between 3-5 years and the scanned copies for at least seven.

You can then destroy the old records without worrying about proving accounts.

The Destruction Process

As mentioned, you need to invest in security paper shredders as these will shred the document into small enough pieces that they cannot be identified. Standard and personal shredders offer a much larger cut and only cut in one direction, making it possible to put the paper back together.

You could burn the paperwork. But, aside from being bad for the environment, it is not guaranteed to eliminate all the data.

Shredding with a security shredder and then having a dedicated company remove the shredded paper, is the safest method. That’s important for your company’s reputation. After all, if personal information gets into the hands of the wrong people your customers will not be happy and your sales will take a dip. That’s a lot of hassle when shredding is such a simple solution.

Read Also: