Category: Business

ContentRally is a leading source of reliable news and trending topics on Business. Get hard-to-find insights and advice on Business from industry-specific leaders.

All You Need to Know About Pool Maintenance Services

For homeowners, pool maintenance is quite difficult because it is technical as well as somewhat cumbersome. Neatness is a key thing about this part of homeownership. In states with numerous private swimming pools, these administrations are sought after. This somewhat clarifies why numerous individuals consider this to be a suitable business alternative. The drawback is that some enter the business without the essential apparatuses or equipment or preparation. Clients just don't generally comprehend what they are getting. There is much work engaged with protecting the water clean and to utilize. The professional should likewise be legitimately prepared and see how to utilize chemicals appropriately. Luckily, understanding and assessing the nature of a pooled benefit isn't especially challenging. For any intrigued homeowner, it begins with getting quotes. Abstain from falling into the trap of feeling that the least expensive alternative is the best one. The very specialized nature of a few assignments will imply that expert rates apply. Numerous companies give free quotes in the expectations of getting your business. You ought to have no issue getting the same number of as you have to make a sensible correlation. Proficient suppliers will visit your home to take the fundamental estimations and to decide your requirements. The number of clients and the recurrence of utilization help to impact the upkeep plan. This will assume a part in detailing your rate. The normal routine assignments included make up the main part of the expenses. There will likewise be fetched for unscheduled repairs, and this ought to be planned for also. When searching for a supplier, it bodes well to begin your inquiry with organizations you have caught wind of. Pool cleaning administrations with fulfilled clients have a tendency to be outstanding so suggestions ought not to be difficult to get. In view of this, this may even abbreviate the measure of time you spend searching for the correct organization. Search for an organization that offers a total scope of choices. It is incautious to procure an organization that can clean the water, however, does little else. You should swing to another organization when specialized issues emerge. Paying distinctive suppliers to do diverse things will cost you more over the long run. What Your Pool Service Should Offer : A proficient pool cleaning company is equipped for overseeing repairs to real parts when vital. This ought to be examined before marking the support contract. Beside skimming the water's surface, you ought to have the capacity to expect: * Filter cleaning or substitution and repairs to pumps or engines. It is a smart thought for the mortgage holder to be available amid an initial couple of visits by the pool benefit. It ought not to be hard to plan the support plan with the goal that this is conceivable. The property holder ought to have the opportunity to survey the work straightforwardly. Since it isn't generally conceivable to be available, steps must be set up to empower access in your nonattendance. It is critical to recognize what to search for to survey if the cleaning work is appropriately done. The nearness of form on tiles is an indication that the region isn't being cleaned legitimately. A few parts should be checked consistently to guarantee that they are working legitimately. A productive pool cleaning administration knows when parts like channels should be cleaned or supplanted. Consistently, there must be a line of correspondence between the client and the pool benefit. You can also contact United Pools; at United Pools they provide quality and attention to detail. Their experienced TEAM has been in the business since 1979 and maintain their commitment to their missions statement. Read More : Renting A Villa In Malta With Private Pool The Best Way To Relaxing Your Feet Ten Tips To Make Most Out Of Your Outdoor Space

READ MOREDetails

What to Look for in a Transcription Service Provider

The demand for transcribers has been on the rise in the past few years. The challenge that most people who are seeking these services have is that they don’t know what they should be looking for in a reliable transcription service provider. Having a clear sense of your requirements is among the initial steps of getting it right. Are you striving to hit the timelines or you are looking for a cost-effective audio transcription service? You also need to ask yourself whether you are searching for value-ads to enhance the efficiency of your business or are you after the run-of-the-mill services. Each transcription company has its strength and weaknesses. You can get a rough idea of what to expect by looking at their website. You can also decide to send the service an inquiry about their specifics. Below are some of the elements you need to consider as you do your research. Accuracy and Quality : The first thing you need to evaluate is the quality of service that the company offers to its clients. You need an accuracy level of at least 99 percent if you are looking for reliable transcripts. The company can advertise high accuracy but its good to find out their guarantee about the same. For example, evaluate the quality control processes of TranscribeFiles.net audio transcription before you hire their services. Simplified Pricing : Check whether the company is providing a combined pricing structure for the services they offer. You may discover some hidden costs depending on the add-ons of your choice. Variable pricing makes it very hard for the customer to decide what he or she can afford. Value for Your Money : Ask yourself whether the transcription cost is realistic. Some of the charges that vendors impose are unbelievably cheap. However, you must be sure of the accuracy and quality before running for such cheap services. There is no need to take a cheap service that will force you to employ a second transcriber and waste a lot of money because of poor services. Confidentiality : Reliable transcription services should have rigorous internal processes. The company should have the ability to preserve the confidentiality that is contained in the audio subscription files to avoid any leakage of sensitive data. It's wise to choose providers who have the ISO information security certificate if you want to have some peace of mind. Qualified Personnel : You need to look at the qualification of the people who will be transcribing your files. Subject matter experts, native speakers, trained quality analysts, and top university graduates are the best transcribers. The experience they have will guide them to pick on the soft transcription elements such as enhancing the overall quality of the product, cultural nuances such as colloquialisms, slang, and dialects. Scalability : In case you have sizeable projects, then you could be searching for a bulk transcription service online. It is wise to pick a service provider who has been handling such orders. However, the transcripts may come your way late and with several errors because of the existing inefficiencies. Credibility : The transcription service you choose should be able to verify who it claims to be. Go through some of their previous assignments to know what they can deliver. Also, read their testimonials and referrals and those of third-party websites. Value-Adds : Check whether the transcription company provides any complementary or supplementary services. It can be more cost-effective and convenient to work with a provider that offers other services such as captioning, translations, copyediting, and even proofreading. In summary, choosing an audio transcription service is not an easy task. However, you can ensure the accuracy, quality, and security of your data by doing a lot of research. You will also be able to save yourself a lot of time and money in the process. Read Also : 5 Tips For Getting A Cheap Essay Writing Service Online The Importance Of SEO Based Digital Marketing Services Lawn Care Maintenance Services And Tips

READ MOREDetails

How to Start, Set Up, and Grow Your Own Massage Business

Becoming a massage therapist is an excellent way to be self-employed, earn a good living, and help others. Before you can start, though, you need to be trained, licensed, and certified. Each state has different requirements. At a minimum, you will need at least 500 hours of education and hands-on training from an accredited program. In many states, you will need more. After you qualify as a massage therapist, you can work for a health practitioner or spa. However, you will earn the highest amount of money and get the most satisfaction from your career if you start your own business. You will need to find a suitable space to lease, conform to county and city government regulations, and legally form your own company. Funding Your Massage Therapy Business There are a number of ways that you could fund your business. Even if you are unable to get a traditional bank loan because you are just starting out or have no business experience, you can often get funding from online lenders. Other choices for funding include angel investors, venture capitalists, factoring (getting invoice advances), crowdfunding, and small business grants. Setting Up Your Massage Therapy Business Here are a few things that you will need to furnish and equip your new space: 1.Basic Equipment. At the very least, you will need to have a massage bed(s) to start your massage therapy business. Find one that suits your budget. Thankfully, there is a wide variety of choices when it comes to stationary or portable equipment. You may also want to consider getting a portable massage chair so that you can offer samples at health stores or other places where you can promote your business. Additionally, consider bringing in some additional equipment to improve the massage experience for your clients like adjustable headrests and neck bolsters. 2. Supplies. Customarily, you will need an adequate stock of organic, hypoallergenic creams, lotions, and massage oils. You will also need towels, sheets, and pillows. 3. Décor You should get a good music player, a nice selection of calming music, and aromatherapy candles. As your business grows, you can improve the décor, but you should offer a few things to provide your clients with a sensory, relaxing experience. Finding Clients For Your Massage Therapy Business 1. Decide on your ideal clients. Although you may be skilled in helping all sorts of people with a wide variety of needs, you do need to develop a focus. Decide if you want to specialize. For instance, you may only want to work with athletes, on one particular type of problem, or specialize in one particular school of therapy. By specializing, you will be able to fine-tune your marketing. Instead of being a generalist, you will be a specialist. For instance, if you specialize in lower back pain or only work with athletes, then you will be the go-to-person for people who have those needs. Don't worry, you will have more than enough clients. Moreover, you will be able to charge a higher fee than massage therapists in your local area who have not specialized. You will attract clients who want to pay you for the quality of your work, and not clients who are looking for bargain-basement prices and discounts. 2. Learn how to advertise. You must learn how to advertise. Create business cards, brochures, and flyers. Put ads in newspapers and magazines. 3. Get good at networking. Go to health clubs, salons, etc. and talk to people who could recommend your services to others. You may also be able to meet people via business and networking events. Although it may not seem so at the time, the most challenging part of your new career may not be the educational or business setup process. It may be finding new clients! Here's the thing, unless you get good at finding new clients, you will be unsuccessful, even if you did really well in school and have set up a well-equipped massage clinic. Your biggest challenge will not be becoming an excellent massage therapist, as that is a fairly structured process. It will be learning how to be a good business person, which is a highly creative, unstructured aspect of your new adventure.

READ MOREDetails

Get the Details on How Sferic Protect Can Benefit Your Business & Its Safety

There are several tools in the market that can aid your brand in many ways. The challenge is that most business owners don’t understand some of these tools. This article sheds light on the benefit of Sferic to your enterprise. This tool is used as one of those instruments that you can use to gain a competitive advantage in the market. When you own a business, your number one priority is protecting the investment. Protection comes in many forms, including remaining weather alert. By remaining aware of the weather, you will be better able to make decisions about employee safety as well as make changes to protect your property when needed. One product to try is Sferic Protect. The benefits of Sferic Protect are vast, including the provision of essential information to stay weather aware. Weather is critical because it affects nearly all businesses in one way or another. Here are some of the ways Sferic can help you to prepare your business for the upcoming weather conditions. Quality Weather Tracking Software To run your business effectively, you must be weather aware. Knowing when severe weather will strike will help you to decide on closing operations for the day, adding protection measures such as boarding up windows due to high winds, etc. With this special storm tracker software, you can easily monitor the daily weather patterns, making decisions for your business operations. Several entrepreneurs make great losses because they are ignorant of the weather. This weather monitoring system provides excellent benefits so that business owners can remain aware of the impending weather, especially severe storms or the potential for a natural disaster. One benefit of Sferic Protect is real-time storm tracking. With this feature, business owners can easily view the weather portal to see what is taking place at the present moment, as well as what type of weather is on the way. With this feature, business owners can decide to shut down operations for the day due to serious weather threats and ensure employees can get home or to shelter before a major weather occurrence takes place. Customized mobile alerts are another benefit to the Sferic Protect product. With these alerts, each business owner can tailor their weather updates to their specific needs. Weather affects every business differently, so having a customized option allows one to be alerted to weather patterns that can affect operations. This knowledge helps to streamline what each enterprise needs to be aware of without annoying interruptions every few minutes. With this product, a business can easily protect employees and property. With so many features, including outdoor audible alerts, businesses will be able to stay weather aware at all times. There is nothing that is as important as making sure that your property and staff are safe. In conclusion, Sferic is one of the most important tools you can find it the market. It will give you insights that will help you to plan for your business. This, in itself, will help you to avoid losses and enhance the productivity of your enterprise. Read also: Make Your Business Popular Online Building a Brand for Your Small Business

READ MOREDetails

7 Proven Marketing Tactics to Increase your ROI in 2018

The digital marketing landscape has become more diversified than ever in 2018 because consumers are generating their own content and marketers are searching for more ways to create product awareness and interest. Since the digital space is highly competitive, marketers are ready to do whatever they can for gaining a competitive advantage. However, instead of dipping your hand in all the pies, it is best if you use marketing strategies that are bound to increase your ROI in the form of more leads, higher traffic, increased conversion, and sales. In a nutshell, you want to use tactics that add something to your bottom line. Listed below are 7 of those marketing tactics that do exactly that and can be used to boost profits in 2018: Tactic 1: Instagram Ads After Facebook, Instagram has become the newest force in social media. Just like Facebook Sponsored Posts and Twitter’s Promoted Tweets have given results, Instagram Ads can also be immensely powerful. They are like digital chameleons because they are able to blend in with the audience’s feed for increasing awareness and driving traffic to your website. While the demographics of the social network is similar to that of Facebook, Instagram has distinguished itself with a greater level of engagement and creativity and gives you exposure to the right audience. Tactic 2: Reviews The online reputation of a business can be hugely influenced by customer reviews. Businesses with no reviews, no recent reviews or with negative ones are at a significant disadvantage as opposed to their competition. As a matter of fact, more than 80% of people have stated that their buying decisions are influenced by negative customer reviews. Thus, it is essential for every business to get positive customer reviews and should also respond to them in a timely manner. Positive reviews can be showcased on the website and on social media and negative reviews can be addressed before they go viral. Improving the customer review score boosts SEO ranking and improves online reputation. The best way to get reviews from your customers is by contacting them directly. By using a tool called GMass, you can email all of your customers at one time asking them to write a review of their experience. They would be more likely to write a review if they are already online checking their emails than having to remember to write one after they got home from their shopping trip. Tactic 3: Evergreen Content This is content that stays relevant and interesting for a long time, regardless of any cultural change. This can include industry resources, tutorials, tips, and product reviews. While this usually refers to white papers and blog content, evergreen content can also be used for video content, infographics, and email marketing. Tactic 4: Crowdsourced Content Yes, the statement ‘content is king’ might be getting old, but it remains true still. Content remains very powerful in today’s competitive market and can turn the tide for a business. The problem is that turning out heaps of creative and useful content requires lots of resources and time. Therefore, it is not surprising to see a new trend emerge; businesses have begun to collaborate and crowdsource because this allows them to get access to meaningful and relevant content. By soliciting ideas from others, a business is able to get the best quality content and save a ton of its valuable time without making any compromises on quality. With crowdsourcing, you leave the idea and word generation to someone else, mostly in your industry. This enables a business to get insights it may not have come up on its own. Also, using this content allows you to reach a greater audience because the ones who created the content will also share it out. Read also: Improve Your Local SEO Via Content Marketing Tactic 5: Retargeting Ads You just checked out an amazing new camera on Amazon and now when you visit Facebook, YouTube or any other website, you can see ads about cameras. This is a feature of Google Adwords and ad serving networks of other search engines, which is called retargeting or remarketing. When you check a business’s website, they can serve you with relevant and interesting ads wherever you go. Marketers are thrilled with this tactic whereas customers feel a bit creeped out. The best part? Your business already knows what the customer is looking for and targeting them with similar products will actually bring them back to you. Tactic 6: Video Content Marketing Traditionally, video marketing for dispersing content was termed unfeasible and getting an ROI from the video was quite difficult. However, this is the era of smartphones that have spectacular cameras and video streaming services that show you videos in just a few taps. This means that now the benefits of video content marketing can go beyond its cost. Every business needs to use video for product launches, Vlogs, tutorials, and tips because they provide value to the viewers. Videos allow a business to use humor, appeal to emotion and aid apprehension for relating to your customers in a better way. The same cannot be achieved with a written blog. Tactic 7: Custom Landing Pages Simply put, landing pages are webpages describing a piece of content, which require users to enter their information to unlock the said content. It is regarded as a lead capture tool because you want to be able to convert the readers into leads and customers when they go over your content. Otherwise, it is only a waste of time and resources. Landing pages linked from an email or blog should be connected to digital marketing content. Also, the featured content can be an eBook, white paper or anything else, but it has to be valuable enough for people to give their contact info. Using these 7 proven marketing tactics will help a business in increasing its ROI in 2018 effectively. Read also: Building a Brand for Your Small Business Avoid these 5 Mistakes before Starting an SEO Influence Marketing Tool to Move from Local to Global Market How to Write and Design an Article that Attracts New Customers to Your Business

READ MOREDetails

How to start living off the grid

With things like global warming and climate change becoming increasingly serious topics for discussion, the question of what we can do as individuals to make a difference is being asked more and more frequently. Sometimes it seems futile and the idea that one person can make a difference seems impossible. But the truth is that if lots of individuals are switched on to change then suddenly it’s not just a single person making a difference, it’s a community or a nation and at some point hopefully a world. But what can you do to make a difference and to start using natural resources more sparingly and sustainably? Make informed choices : Just because it is available and it’s cheap, doesn’t mean that it is good. While it might fit your pocket in the short term if it means that your choice is going to contribute to global warming or the rise of the oceans then maybe you need to think twice. Ask questions and tell suppliers what you want. Use a company like Econnex who broker energy solutions across a range of suppliers and make sure you tell them what you want. Price is important, but look to make use of suppliers who use solar and wind as a way of generating electricity, stay far away from old-school fossil fuel solutions. It is possible. Re-use your water : If you collect your used water you will be amazed how much you get through on a daily basis. And unless you have implemented a grey-water solution to collect the used water it all just runs into the drains and disappears. Washing machines and showers and dishwashers. Brushing your teeth. Washing the car. These all use water and lots of it. And there is no need for your water to disappear down the drain after one use, it’s not environmentally friendly and it’s expensive. Water needs to be used as often as possible and with a few simple systems implemented it can be done easily. Solar is real : The sun has all the energy that we need and it is free. Traditionally storing solar energy has been the biggest problem preventing larger-scale rollouts of solar solutions. But on an almost daily basis, the technology that makes solar power effective is getting better and cheaper. Panels are much cheaper than they were ten years ago and batteries and other energy storage system are getting smaller and cheaper while increasing their capacity to store energy. Solar is the way of the future and it is something that can be done on a home-by-home basis. It is even possible to contribute electricity to the national grid and be a supplier rather than a consumer. Collect rainwater : Much like the sun in the paragraph above, rain is another resource that comes from the sky for free. It is clean and free and if we just put in place ways to store it, we could very quickly free ourselves from the need to buy water from the government. It might cost a bit to buy some tanks at the start of the process, but if your plan is to go off-grid and be totally independent then it’s a small price to pay for independence and sustainable living. Read More : What Are Renewable Sources And How To Introduce Them Into Your Household? Create A Stunning Outdoor Space With These Residential Landscape Lighting Tips Close Look At Top 5 Roofing Materials – Pros And Cons

READ MOREDetails

Best Essential Tips While Renting a Warehouse in Mumbai

If you are planning to sell physical products through your company, you might require an industrial or warehouse space. Buildings in Mumbai are all industry ready and usable for the purpose of warehousing as well as manufacturing. These big spaces can be used for the production of product or goods, storage, for distribution purposes, etc. Take a look at the essential tips for how to go about looking for, industrial space that includes what to do for how to find out the right space and to determine the renting needs along with the basics of industrial, commercial rentals listed below. What Is Your Best-Fit? Determining the commercial, industrial space needs : To determine whether a property is able to accommodate your business needs depends on the business itself. Space usually falls under one of the below-listed categories: Warehouse space. Manufacturing space. Flex space or a multi-purpose property. Each one of these industrial space has a different purpose. The work of a warehouse is to store the goods and most probably also do the distribution of the products. If you want to rent a warehouse in Mumbai, you should know all the consequences of leasing a warehouse. The process is too risky and fairly troublesome which is why you need to understand all the requirements for renting your warehouse. In places such as Mumbai, you need to keep in mind a lot of things before renting the space for warehouse purpose. When you look at the manufacturing space, you will understand that this is that space where one creates, build, and assembles all the goods and products. This type of space might be needed for special zoning or special types of construction depending on the manufacturing needs, for example, reinforced floors, high-volume power sources, or a specific type of ceiling height. A flex space is a mixture of a warehouse and a manufacturing space. It’s easy to manage your warehousing as well as manufacturing needs. You need to determine whether you are searching for a manufacturing space for the products, or storage space, or for packaging and shipment purpose or you need all the things to be done in one place. How can you locate the best property? To start with your search, right at the comforts of your home, check out all the online portals that offer you great deals when it comes to commercial properties. When you shortlist the property types that fit your business, you can take the help of online databases to make comparisons of the relevant properties that will meet your criteria while you rent a warehouse in Mumbai. Visiting industrial properties : Making appointments to see the commercial properties is the next step. A warehouse might be perfect online, but once you get through each of the properties, you will be able to know whether or not the properties meet your needs. If you want to stay organized, the professionals suggest that you keep the tabs of your preferred options of warehouses. The best way to do so is by creating a spreadsheet and mentioning all the details of the spaces you like. The bottom line : Finding and leasing a warehouse is certainly not a very easy task. However, it is a major step while establishing a successful business. Make sure that you take your time to get access to multiple properties and work with the real estate professionals to consider your options. This will ensure that you have considered the important steps while you rent a warehouse in Mumbai. Make sure it is the best for your business, and all your legal rights and assets are well protected. Read More : 6 Things You Must Know Before Selling Your Home Additional Ways To Keep Your Home Warm What Makes A Strong Foundation For Your Home

READ MOREDetails

4 Tips for Dealing with a Family Business in Divorce

Divorce brings a lot of problems in every part of your life. However, it makes the situation by dividing a family business particularly complicated. Therefore, you have to be prepared and get the necessary help before you start any legal proceedings. There are no avoiding problems when managing a family business in a divorce. However, you can minimize them if you go about it right. 1. Study your papers very closely : The first and most important thing to do is to get a professional lawyer to examine your business paperwork. They’ll need to see all agreements, contracts, and other papers that have some bearing on defining the ownership of the business. Note that these examinations might prove to be very surprising. For example, you might find out that some of your distant relatives become stock owners of the company. To prepare for any nasty surprises and develop a strategy for managing possible problems, you need to determine what those problems might be beforehand. 2. Consult as many different lawyers as you need : Employing the assistance of a divorce lawyer is essential when going through this process. However, in the point mentioned above, you might also need to consult a company lawyer with experience in family businesses. You’ll also be facing other issues that might require specialized legal assistance. For example, the division of assets during a divorce usually means you’ll need to get a lawyer specializing in foreclosure. If your family business is home-based, you’ll need all three experts’ help. Therefore, it’s usually best to employ a law firm with a versatile team. In case you already have a company lawyer, connect them with your divorce attorney. 3. Talk to a counselor before making any major business decisions : Roughly 95% of people who received marriage counseling state that they were extremely satisfied with the results. Note that this doesn’t mean they solved all their problems and chose to remain together. What counseling offers is assistance with finding the right direction to move on. When it comes to managing a family business in divorce, partners usually need to decide whether one will buy out the other’s share or if they can work together. Many people are able to maintain a successful business relationship even after a divorce. A counselor is a person who can help you determine if that would be the right choice for you. 4. If keeping the business, do not make any changes right away : If you are the partner who gets to keep the business, it might be tempting to ‘bury yourself in the work’. However, you should abstain from making any major changes or improvements until your divorce is legally complete. Otherwise, you’ll increase (or decrease) the value of your assets. This will make it necessary to renegotiate the entire ‘division of assets’ balance and can prolong the legal proceedings. This might also lose you a lot of money in the future and at the very least increase the lawyer’s fees. Managing a family business in a divorce is always a struggle. That’s why you shouldn’t rush and let your emotions dictate your decisions. Instead, focus on working through your current problems and get professional assistance whenever it’s needed. Read More : 1. Why Your Business Should Care About Social Responsibility 2. Why Lead Generation Is Essential For Business? 3. Resolutions To Help The Small Business Owners To Avoid Being Bankrupt

READ MOREDetails

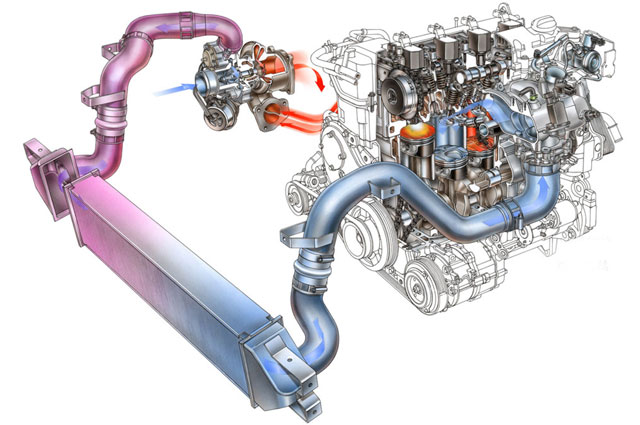

How to Improve Internal Combustion Engine Efficiency

Nowadays there is a lot of concern over increasing combustion engine efficiency. There are many methods, which have been devised by engineers like turbocharging, regenerative banking, VIT and direct fuel injection, which can help improve the internal combustion engine efficiency. For example, with the help of Tribotex, you can increase the internal combustion engine efficiency. Before we delve into the ways of improving the energy efficiency of an engine, we need to know what is meant by combustion energy efficiency and how can it be calculated. The energy efficiency of the engine is simply the ratio of the fuel supplied to do the work in a specified time to the amount of work done or the output received after all the losses. When you measure the heat balance sheet of the different engines, you can easily find out the engine efficiency. Factors That Limit Internal Combustion Engine Efficiency : There are certain factors, which limit the efficiency of the combustion engine. They are Heat loss during cooling or in exhaust gases Friction loss Loss in transmissions like clutches, fluid couplings, and brakes Friction loss in tires Incomplete and imperfect combustion Loss due to the thickness of viscosity of lubricant in the engine The drag of the vehicle Imperfect valve timing Compression ratio Energy consumed by auxiliary equipment like water pumps and oil pumps So, now that you know about the ways in which the internal combustion engine efficiency can be reduced, let’s have a look at how you can improve it. Regenerative Braking : Whenever you apply the brakes of a car, you waste some fuel due to deceleration and friction, in addition to heat from your combustion engine. In order to avoid that, regenerative braking should be used. The process is similar to you controlling the speed of the vehicle while going downhill, or slowing your car first before you press the brake. You can also use electromagnetic braking, in which the motors will absorb the energy and use it for recharging your battery cells. Direct Injection : If you do not use direct injection, the fuel is mixed with the air outside, making it more prone to getting wasted. However, when you use direct injection, the fuel is mixed with the air inside the cylinder or injected directly in the cylinder, which allows better control of the fuel being used. This also makes your engine more efficient. Cylinder Deactivation : When you have an internal combustion engine with a special feature, you can deactivate some cylinders when the power requirement is less. This reduces the total volume of engine cylinders temporarily and also reduces your fuel combustion, increasing the efficiency in return. Turbochargers : Turbochargers are equipment used to increase pressure inside the fuel cylinders, and generate more air, and allowing the combustion to occur so that more power can be generated. Although this doesn’t make the engine more economical, it helps in the generation of more power with a small amount of fuel. This, in turn, helps you to downsize other costs. Variable Valve Timing : Inside the combustion cylinder, valves open and close at frequent intervals to allow air to enter the cylinders, and the combusted air to exit. Different valve timing is required to produce different results. In theory, you cannot vary the timing, because it is an automatic mechanism that depends on several other factors, and the choice has been made when the engine was designed. However, with some modern engines, the option to vary the valve timing is there. It can be changed by changing the rotations per minute or even allowing maximum power, and fuel to pass through. Twin Spark Plug : When the flame front starts from the spark plug, the plug proceeds outward and some part of the fuel remains unburnt, which is then ejected out as a waste. However, when you use a twin spark plug cylinder, the flame front also uses the remainder of the fuel, increasing the fuel efficiency of the engine in general. When it comes to building energy-efficient cars, the first step is taking care of the efficiency of the engine, along with certain other factors. For example, when you use a lubricant with less viscosity, your energy efficiency increases to some extent. At the end of the day, make sure you check the above-mentioned factors if you are planning to improve the internal combustion engine efficiency. Read More : 1. Car Leasing Tips: How Leasing A Car Has Changed? 2. Injured At Work? Claim Your Compensation! 3. Important Things To Transport During A Relocation

READ MOREDetails

How Smartphone Tracking Programs assist Parents in Controlling their Children

Attack on the child’s privacy is no doubt one of the most debatable parenting topics. There are these concerns and then there is the news reporting an alarming number of kidnapping reports, teen suicides, child depression cases cyberbullying and online predator assaults. Noticing all these, many experts now hold the opinion that monitoring a child’s phone is a really good parenting habit. Careful parents should download a free spy phone app such as Hoverwatch Android Spy to protect their children. Now there will be people who will tell you that installing such applications and tracking your children cellular devices is unethical, but they only think that way because they don’t know the following stats. 42% of teenagers having internet access were cyberbullied in 2017. 3 million kids are absent from school every month across the country due to bullying. 20% of cyberbullied kids are known to consider suicide In every 40 seconds, a kid goes missing or is abducted in the US, according to the FBI. 50% of high school seniors are drug abusers. 43% of high school students have admitted using marijuana. This is why it is really important that parents should be knowing what goes on in their children’s smartphones in order to ensure that they are not being bullied or exploited. A good method tracking smartphones is downloading free spy phone apps such as Hoverwatch Android Spy and installing it on their cellphones. This will enable you to easily observe your kid’s online activity without even them being informed about it all. Overwatch is a dependable spy app that can be used to record contacts, SMS, call history, visited locations, camera, audio, Skype, WhatsApp, Instagram, Viber, Facebook, Telegram, and similar internet activity. You can easily install it on your child’s cellular device and it will go totally discreet. Such apps work in the background and send you all tracked data through an online portal that can only be accessed using a secure account. Without giving any kind of notifications to the user, this unique application records and uploads all the requested data on to the cloud and places it in a secure place from there you can retrieve it. The app even creates an online dashboard which allows you easy accessibility at any time and from anywhere. Since there are no notifications produced by this app, it shows no traces of recording data that might alert your child. Many parents have used this application and have reported their immense satisfaction with it. If you are interested in using this application for free, you can Download Hoverwatch, on the official website. Once this app is installed and starts working in the background, parents can rest assured knowing that they have an eye on their child at all times. This will also allow parents to know whether their children are with the right company or now or an online predator is exploiting them in any way. This will further assist you in keeping your children from being bullied. Read More : 1. Google Getting Into Phones – And It’s Changing The Mobile Internet 2. Best iPhone Spy Apps Without Jail Breaking 3. Top 5 Digital Wallet Apps For Android

READ MOREDetails

6 Things You Must Know Before Selling Your Home

There are 101 things to know before selling your house. However, you cannot possibly take care of everything, but there are very important things that you ought to bear in mind. Getting cash for your home must be your main goal and knowing the following things will help you get the best value for your home. Read also: How To Sell Your House Fast?! Five Must-Know Tips To Move Your Property! 1. People Want To Envision Themselves Living Inside The House That is right, so go ahead and get rid of all of your personal items from the house. Make it as neutral as possible so that other people who want to see the house can envision themselves living there in their mind. You cannot take chances with this. To remove your personal effects, but you can maybe leave a curtain, a few things just so you can stage the home for the buyers. You want them to see how they would fit in the home. 2. Homes Sell Faster When Sold By Realtors Only 10% of all the homes for sale by owner are going to be sold. And this is on a higher side. The rest 90 percent will have to be handed over to real estate agent to sell them. You could think that yours will be among the ten percent that sells, but in most cases, this is not true. Therefore, you should enlist the assistance of a real estate agent if you would like to make some good money out of the home and if you would like to sell it faster. If you still want to sell your site by yourself, know the normal steps in the home selling process. 3. Buyers Know The Prices Of Similar Properties In The Area That is right, buyers know the prices of similar properties in the area and therefore overpricing your home is not going to help at all. Because you will buy another home after selling the current one, are you going to just pop into the market and take the first one you come to? Apparently not. You will do research, find the market rates and then you will be crazily determined not to pay a dime more than you should pay. Now, set the price right, after you know that. 4. Non-Disclosure Can Cost You A Lot In Future If you do not disclose any issues that the house may be suffering, you may have a legal tussle in the future. Of course, buyers know that house have effects and they will not be unreasonable when pushing you to disclose the issues in your house. Hire a house inspector to do a full report so that you can take care of any repairs to make more money, or make sure to disclose them to the buyer. 5. Buyers Are Not Going To Buy A Dirty Home When There Is A Clean One No buyer wants to buy a dirty home and in any case, any buyer wants to visualize a home for sale just the way they think they will be living inside the home. Thus, do take the time, or pay someone to spruce up the house. If you know you will sell your home in the near future, you ought to give it a touch of paint. That is the only way that you are going to get some good money out of the home. Remove your trash, get all the junk out of the garage, and dust the place up. 6. Some Buyers Are Not Really Buyers Many people get annoyed when so many people turn up to see home but it soon becomes clear that they do not intend to buy. However, be courteous, it comes with the business. Many people just pass by to see what is on offer, or just because they are in the neighborhood. Read also: 6 Expert Tips For Finding The Right Home To Buy

READ MOREDetails

Why Lead Generation Is Essential For Business?

Lead generation is the effective marketing process or technique that helps any business to reach its target without any complications. It is the best way to create interest among the target audience about any service or product offered by a particular company. With the help of this method, a business can generate potential sales leads. Lead generation is the ideal way of stimulating interest in developing sales and since it also uses digital channels. Due to the increasing needs, most lead generation call centers and companies are also providing businesses with powerful and most effective solutions. Currently, most industries and business use lead generation because it could work for any business including education institutions, insurance agencies, furniture store, office suppliers, etc. Of course, lead generation will get great popular in the future, it is perfect for service-oriented businesses. To generate quality leads you must approach the expert services and also visit the official website to understand a lot about Lead Generation. How To Generate Sales? With proper expertise, experts help any organization or businesses to empower their sales pipelines via proper interactions. Due to the increasing competition, many businesses are struggling a lot particularly when it comes to generating sales. This problem will be arising due to the poor economy. Without quality leads, a sales team cannot be successful, overall, generating good leads is always important for any successful business. Generation of high quality or new sales leads becomes an essential factor for any business because a lead is a person or company that has shown interest in any particular product or services. Day to day the buying process has also changed so that marketers need to spot some new ways to reach buyers because it is important to stand among the increasing competition. Instead of doing mass advertising it is better to build continuous relationships with prospective buyers. Lead Generation really works for any products or services of any business. With the lead generation, a business can experience a lot of benefits Brings Positive ROI: Lead generation provides a better Return on Investment. Through quality leads, you will get a great chance of squaring your ROI. Improved Sales & Profit: Using lead generation is the best way of increasing sales in your services or products. Overall, lead generation is also a must in the competitive market. Desired Customers: Lead generation is the key factor to attract your targeted customers at different demographic locations. Cost-Effectiveness: However, the proper advertisement is an important requirement for any business to reach its successful position. For this most business goes with a convenient marketing strategy like lead generation. Unlike any other methods, it works effetely at the same time it is cost-efficient at the same time allows you to generate better produce results. So it is better to hire best lead generation services by visiting its official website. On the whole, lead generation is one of the effective options for business so lead generation is much important for any business. If you need to give a new dimension to your business you must generate leads with the help of professionals this allows you to get awesome results. Read More : 1. Six Low-Investment Business Ideas You Can Start Today 2. Building A Brand For Your Small Business 3. 5 Ways To Reduce The Packaging Cost In Your Business

READ MOREDetails