Binaryx is one of the best digital asset trading platforms that has emerged in the last few years. It offers a number of simple, progressive, and functional solutions for everybody who wants to exchange bitcoins or buy and sell digital and fiat currency.

The cryptocurrency exchange was created in 2019, with headquarters in Tallinn. It is authorized by law and has a European legal license for trading and other crypto operations. The scalable and intuitive interface of the trading and exchange modules delivers convenience for every user, who can exchange bitcoins or other assets from the comfort of their home or office.

The Key Features Of The Binaryx Cryptocurrency Exchange

Often, the bitcoin and the forex traders can not find an authentic platform to exchange Bitcoin. The cryptocurrency as the platform’s authentication and trustworthiness makes the platform unique and reliable. While you are doing the cryptocurrency exchange, the requirements of the authentic platform are high.

When you are doing transactions on many types of cryptocurrency, it is quite absurd that you are going to use individual platforms for the individual types of cryptocurrency. The Binaryx is the all square platform.

Binaryx suits both novice traders and savvy investors. Go to https://www.binaryx.com and start making money on trading and exchange right now!

- The project’s main idea is to implement a trading platform for customers who want to exchange money for bitcoins or sell and buy digital assets, regardless of their experience or expertise.

- This is a comprehensive project with a smooth-running ecosystem incorporating trading services, educational products, and opportunities for making money on crypto skills. The cryptocurrency exchange offers a range of useful tools and provides broad functionality.

- Platform users appreciate a user-friendly website, profitable trading terms, professional support, high security, and extensive functionality. Binaryx means good trading limits, low commissions, minimum registration requirements, and the availability of the exchange bitcoins process for everyone.

- The developers of the cryptocurrency exchange, inter alia, are constantly working on improving the current offers to provide the best solutions to exchange bitcoins and more.

Step-By-Step Guide: How To Sell And Exchange Money For Bitcoins

Are you a beginner in cryptocurrency trading? Take a look at the step-by-step guide to perform the cryptocurrency exchange in the Binaryx. This platform is quite a comfortable place for beginners. Follow these steps and start with the registration.

1. Registration:

The registration process is twofold — you can log in via your social media account or create an account using your email. Whichever method you choose, following the registration process, you will be able to sell, buy, exchange bitcoins, and perform any trading operations.

2. Verification:

To complete registration, you must go through the basic stages of verification. First, it’s confirmation of your email. Then, you will need to undertake extended verification to trade and exchange money for bitcoins without any restrictions.

3. Account replenishment and withdrawal of funds:

Replenishment of the cryptocurrency exchange account is carried out in wallets. After crediting money to your wallet, you can move on to trading or exchange bitcoins operations.

4. Trade and exchange money for bitcoins:

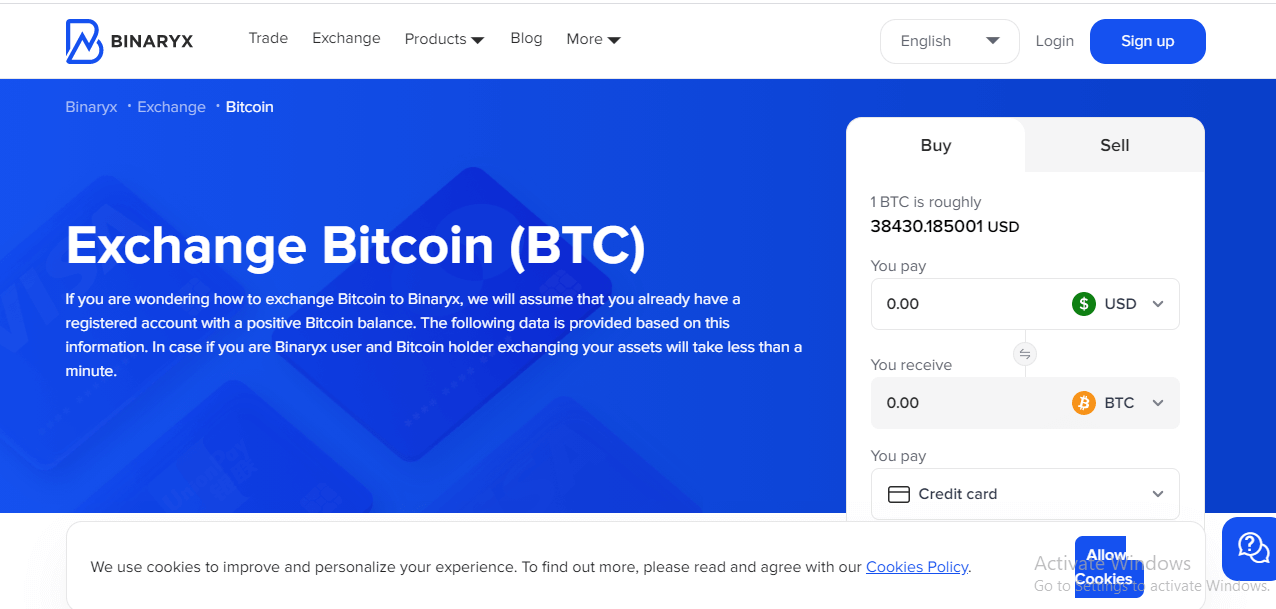

Binaryx has a great multifunctional trading terminal and exchanger that allows you to buy or sell coins quickly.

Conclusion:

For bitcoin traders, secure platforms are the only authentic platform to exchange bitcoins. When you are using this platform, you will understand how the platform is made easy. Join Binaryx and experience all the benefits of this advanced and innovative cryptocurrency exchange!

Read Also: