As businesses expand their ability to grow, customer retention, and stay competitive, outsourcing has become an increasingly popular solution. Outsourcing can help companies focus on their core strengths and reduce costs, which ultimately results in better customer experiences.

However, outsourcing is only effective when it’s done properly. Maximizing customer retention and loyalty through outsourcing requires a strategic approach that puts the customer first. In this article, we’ll explore six strategies for achieving this goal

Research The Right Outsourcing Partner

Choosing the right outsourcing partner can be the difference between success and failure throughout customer life cycle stages. When selecting a partner, it’s important to consider factors such as experience, expertise, certifications, quality of service, and cultural fit.

A partner that understands your customers’ needs and values can deliver better results. Look for a provider who has a proven track record with references from current and past clients.

Create Consistency In Your Branding While Customer Retention

One of the key factors in building loyalty is consistent branding. In today’s world, consistency extends beyond logos and colors – it encompasses messaging, tone, and channel strategy. Building loyalty means giving your customers something to believe in and messaging that resonates with them.

Ensure that your messaging aligns with your brand values and that the tone is consistent across all channels, including outsourced customer service.

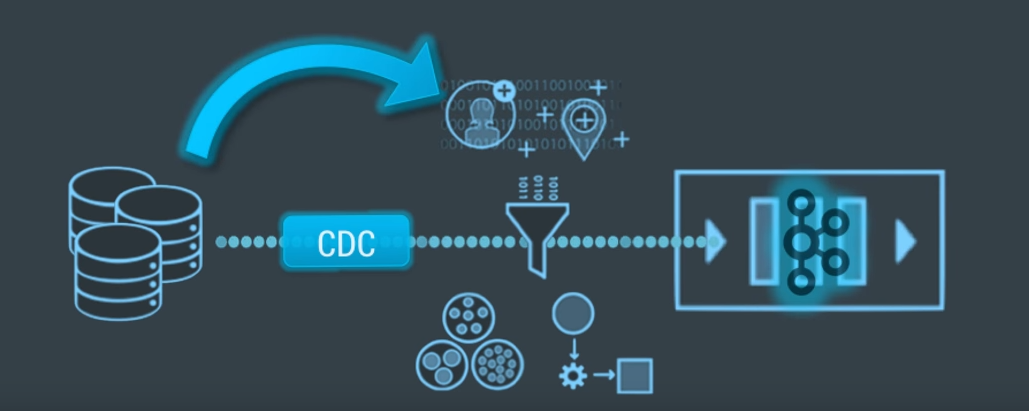

Implement Automated Communication Tactics

Automation is a powerful tool for keeping customers informed and engaged. Chatbots can provide quick and friendly responses to frequently asked questions. Automated emails can update customers on their order status, alert them to special offers, and more.

Text messages can be used to offer exclusive deals to your most loyal customers. Implementing these tactics can greatly improve customer retention, and your outsourcing partner can manage them.

Monitor Social Media Platforms

Social media platforms are an essential tool for engaging with customers, but monitoring can be overwhelming. Outsourcing providers can manage your social media accounts, including responding to customer feedback, complaints, and concerns.

With 73% of customers using social media for quick responses from businesses, outsourcing can ensure that you’re engaging with your customers in real-time.

Utilize Loyalty Rewards Programs

Loyalty reward programs can be incredibly effective in driving customer retention and loyalty. By offering discounts, exclusive content, or early access to products, companies can boost customer engagement while rewarding loyalty.

Your outsourcing partners can manage loyalty programs, providing an added value to their service, and delivering meaningful insights for improving customer retention and satisfaction.

Analyze Customer Data

Data analysis is crucial in understanding customer behavior and preferences. Through data analysis, companies can tailor their products and services to meet customer needs and preferences.

Outsourcing partners can gather and analyze customer data, such as customer feedback, surveys, and online reviews, to provide actionable insights for improving the customer experience.

Conclusion

Outsourcing is a cost-effective way to increase efficiency, but it’s also an opportunity to improve customer retention and loyalty. Through careful planning, communication, and execution, outsourcing can help your business grow and succeed.

Read Also: