One of the common reasons why small businesses fail is the lack of working capital. Poor financial decision-making can be detrimental to your small business.

This will not scare you or put you off the idea of starting your very first business. However, it is to convince you how important it is to draft a financial plan for your small business.

The importance of predicting your financial health is not just to maintain a steady cash flow but also…

Understand how lucrative your business is in the long run.

How long will your business be at break-even (no profit, no loss)?

When can your business start making a profit?

Most importantly, what is the contingency plan of any financial hurdle?

In this blog post below, we will be discussing the following:

- Importance of a financial plan for your small business.

- Elements of a financial plan for your small business.

- A template to create a small business plan (for any business).

Importance Of A Financial Plan

Here is why you should begin creating your very first-ever financial plan for your small business.

1. A Business GPS?

Imagine yourself driving to a new destination without knowing where you are or in which direction you should proceed.

This is what it is like to open a business without having a financial plan.

A financial plan will give you a clear roadmap to your business journey, and determine how much to spend on each destination.

2. Where Is The Goal Post?

We all have a vague idea of what a startup goal should be. However, getting overwhelmed is common without a clear picture.

A financial plan will provide you with a clear goalpost. I am talking about tangible, measurable, and achievable goals.

Whether you want to expand your business, increase profits, or reduce costs, a financial plan gives you a clear path.

3. What Ifs & Risks!

It is given that your business won’t be smooth sailing forever!

Businesses often face unexpected expenses. It could be something as simple as equipment breakdowns or sudden major market changes!

As a business owner, being financially ready is a crucial step!

A financial plan can help you set aside emergency funds, so you’re prepared for these surprises.

4. A Long-Lasting Impression

Want investors early on for your business? Then, it would help if you offered them a steady financial plan.

Remember, lenders and investors want to see a well-thought-out financial plan before they commit their money.

Therefore, having a solid plan shows them that you understand your business’s financial health, its cash flow, and the potential profit opportunity. Hence, we are serious about making your business a success.

5. Improves Financial Decision-Making

With a financial plan, you better understand your cash flow, revenue, and expenses.

This knowledge helps you make informed decisions, like when to invest in new equipment or whether to cut costs.

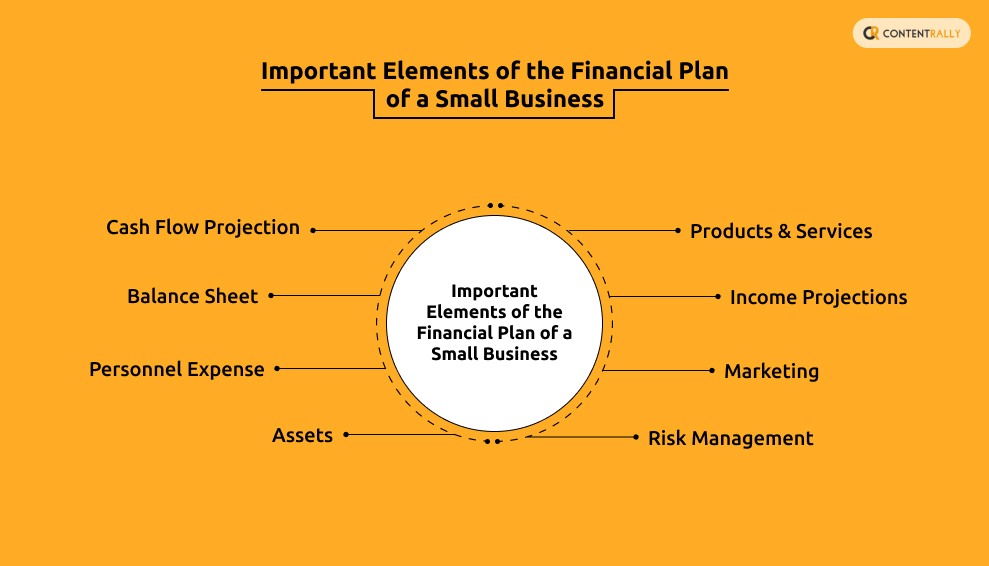

Important Elements Of The Financial Plan Of A Small Business

Before you begin your financial planning, you should be aware of the different financial jargon for a business.

1. Cash Flow Projection

This includes predicting the market, what effect your product will have on the market, and how much you can earn from it.

Now, taking the potential amount you create capital expenditure for each month. The function of a cash flow projection is to ensure you have enough (at the end of the month) in terms of expansion.

It is common for a business to live month by month with no profit for the first six to eight months of the business. Essentially you are establishing your business.

However, if it crosses the one-year mark with just a break-evens, the following could be the reason:

- Your business is not making money because of the lack of demand.

- The expenditure is way over your income. You must start some cost-cutting methods.

- There is a lack of marketing, and your small business is not reaching the target audience.

- You do not have enough investment for the small business you are starting.

Keep these points in mind when starting your cash flow!

2. Balance Sheet

A balance sheet is a financial estimation of your small business’s current state. Here are some of the important items your balance sheet will have:

- Income & Expenditure

- Total owning & total owing (personal debts or small business loans).

- Assets that are currently under collateral.

Upon reading it might sound simple. However, when it comes to a balanced business sheet, you will require a finance professional to craft one.

3. Personnel Expense

This brings us to the next point in any financial plan for a small business. The personnel expense, or the amount you are spending on hired personnel.

It doesn’t always have to be your employees. In fact, the number of employees for a small business will hardly reach 15 in the very first year.

A personnel expense includes individuals working as consultants for the business, and the different professionals you hire to help with the internal work (e.g. Finance officer to create the balance sheet).

Some of the common elements of a personnel expense are:

- Cost is based on the positions each professional is holding.

- Personal insurance plans for your workers (at least medical insurance).

- Expenses are spared for other professionals working externally with the business.

4. Assets

The tangible assets that your small business owns:

Current Assets: What the business currently owns. These include inventories, machinery & tech devices, prepaid expenses (for example, digital tools), and other office supplies.

Tangible Assets: The one that physically exists under the name of your small business. Real estate (This will not include rented warehouses or offices. These will go under the expenditure section), land inventory, tangible investment (gold & bonds), and saleable merchandise.

Non-Tangible Assets: These are assets that are not in a physical form. Intellectual property, pre-paid tools, investments (stocks, Cryptocurrency, mutual funds).

Non-Operable Asset: Assets under your small business but from which you are not getting any income. For example, land you have an investment in but not yet open for any business-related functions.

Operable Asset: Assets that your business owns currently, and that are bringing some income. For example: produced goods, factory space, warehouses, and office space.

5. Products & Services

The products and services you are planning to offer will also come into the financial planning for small businesses.

These include the following:

The raw materials are required to create the goods.

- Factory costing.

- Warehouse costing.

- Transport & Drop shipping costing.

- Worker’s salary & insurance.

- Contingency management funding. (In case of any accident or unpredictable situation).

The summation will give you the total cost of production. With which you can create and understand the market value of your product.

This step is very important to assess the profit and loss of each item.

6. Income Projections

Another crucial part of small business finance planning is prediction. This is how you can predict whether your income will have any substantial income.

Here is how you can protect your business income (before starting it):

- Check business income projections of competitors through several data analyses.

- Is your small business subject matter trending in the market? What is the current market share of such companies?

- Are investors willing to invest in a business venture as such? In fact, check some of the Shark Tank successes, and analyze which business venture seems more profiting by investors themselves.

- The inflation rate of the past decade regarding the product or service you are about to sell also matters.

7. Marketing

You cannot spend everything on logistics and not worry about marketing.

One cannot ignore this matter, especially in today’s day and age when small businesses are reaching new milestones by a simple influencer shoutout, or social media virality!

Here are some of the factors in which you will need to spend in marketing:

- Social media marketing tools.

- Influencer marketing.

- Small ad-films over YouTube.

- Website building and digital marketing (Website domain and SEO tools).

8. Risk Management

No business is protected from the risks that come to every business in its lifespan. However, the contingency plan is not getting ambushed by a sudden change.

Here are some of the financial risks/uncertainties your new business could face:

Market Risk: The ups and downs of the current & dynamic economy. In fact, after the pandemic, things have become a little less predictable.

Reputation Risk: Social media is indeed bringing customers and businesses closer. However, the downside of such connectivity is the risk of a tampered reputation, especially when audiences jump to conclusions upon hearing anything on the internet.

Competition Risk: This is a common risk every business faces. When your competitors launch something new & exciting, there could be a significant shift in sales numbers for you.

Environmental Risk: One good example of environmental risk that has previously impacted businesses majorly is the pandemic.

Political Risks: The political scenario of your country can have a considerable effect on your business, especially in terms of export-import & business expansion.

This is one of the reasons why having a financial contingency plan for managing sudden risk is one of the crucial components of a business financial plan.

Business Template For A Startup

As promised, we have a business template that will help you take that very first step for your startup.

Financial Plan For Startup (Template)

Table of Contents

1. Financial Overview: A Financial Overview will consist of a financial overview of your business’s current state. Also, please provide the key points and takeaways of the financial data that you will provide.

4. Assumptions – Market Research: This is the step for market research and predicting the business’s profit potential.

5. Break-Even Analysis: A table or graph which provides information on the number of units your business needs, and how much you need to sell to make a profit.

6. Financial Statements: This will include the following charts.

– Profit & Loss (Optional if you have a startup)

– Cash Flow Statement (How the monthly cash flow will look)

– Balance Sheet (Monthly/Quarterly/Yearly Income & Expenditure)

Elements For Your Balance Sheet

The following is what your balance sheets should include based on items required: monthly, quarterly, and yearly income & expenditure.

Operational Financial Plan

- Business Location and Facilities

- Technology and Equipment

- Key Operational Processes

- Supply Chain and Inventory Management

Management and Organization Financial Plan

- Organizational Structure

- Key Management Team

- Roles and Responsibilities

- Hiring and Training Plan

Financial Plan

- Start-up Costs (for new businesses like loans, downpayment; collateral, and personal investments)

- Revenue Projections

- Expense Projections

- Cash Flow Statement

- Profit and Loss Statement

- Break-even Analysis

Funding Requirements and Strategy

- Funding Needed

- Purpose of Funds

- Potential Funding Sources

- Funding Timeline

Key Risks

- Risk Mitigation Strategies

Financial Tools to Ease Your Job

In the modern age of technology, you can always lean on tools to automate some of the financial tasks.

So, if you need that digital assistance when

Begin Your Journey!

This is a sign for you to begin your journey as a first-time business owner. Yes, it is overwhelming, and yes it can be intimidating (hence the long procrastinating period!).

Creating a financial plan for even a startup can be intimidating. Here is how you can make this journey a little easier.

Start with defining your business first. The executive plan is a must. You should know what your business is all about.

Then, move through the basic income and expenditures.

Take help from professionals in tax advice and create a detailed balance sheet.

Finally, consider seeing your whole financial plan in a timely manner. It is important to take one step at a time.

Hopefully, we can give you enough answers about a business financial plan. How is your journey going? Please let us know in the comment section below.

Read Also: