Mobile trading apps represent a great complementary tool to the web-based trading platforms and other financial portals. There are more than 40% of all traders at a global scale using mobile trading platforms on a constant basis. The quality of these apps could have a significant impact on a trader’s performance. This is the reason we will make a brief comparison of some of the most popular ones.

No trader can afford to be glued to his laptop or computer screen at all times. Most people are on the go, working with clients, going to meetings, traveling half their days and so on. This is where Mobile Trading Apps have become such lifesaver. They are important not only for people who are working as brokers but also for normal human beings.

Saxo Bank Mobile App:

A Danish investment bank, providing online trading and investments for retail and corporate clients, Saxo Bank is currently one of the most popular choices among traders. Its mobile trading had been developed inside the company, available both for Android and iOS free of charge and it is also one of the most appreciated mobile platforms on the web.

Among its main functions, we should mention trade execution and order management, portfolio management, chart analysis, and portfolio performance indicators. Some of its strengths are good search function, a great variety of order types, price alerts, order confirmation, and a user-friendly interface.

Two of the weak points of the Saxo Bank mobile app are no fundamental data and no two-step authentication login.

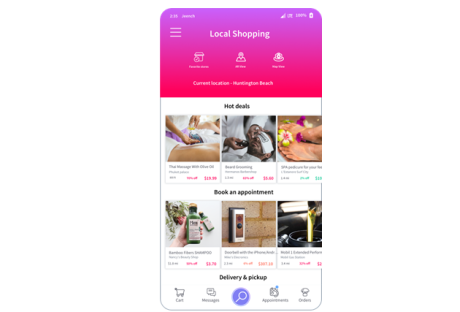

Find Mobile App:

Although developed by a relatively-new brokerage company, the FINQ mobile trading platform is being used by 70% of the company’s clients. Finq.com is a growing online broker in the Asian markets and one of the reasons for that has to do with its proprietary platform, both Web-based and mobile.

The mobile trading app offers access to the full functionalities of any real account, with features like account verification, deposit, and withdrawals, seen with very few other companies. Customer support, Traders Trend Bar, and Trending Now asset list are just a few of the features that are available in the app. Finq.com clients also have access to all the 2,100+ assets available for trading using the mobile app.

Robinhood Mobile App:

One of the companies that optimized its services for millennials, Robinhood has an intuitive and well-designed mobile trading platform available for its clients, with additional security features like using fingerprint sensors for accessing the app.

Among its main features, we could mention trade execution and order management, market information about the assets, watchlist, interactive charts, and fundamental information. It stands out when it comes to the user interface and login authentication methods + price alerts and order confirmation. The main downside of the Robinhood platform has to do with the basic interactive charts.

Conclusion:

A Mobile Trading App helps ease the understanding of the market and encourages quick decision-making. Sometimes a deal needs fast reaction times. Reacting now and one hour later could means loss of millions. This is why you always need to be on the go when it comes to the market.

Read Also: