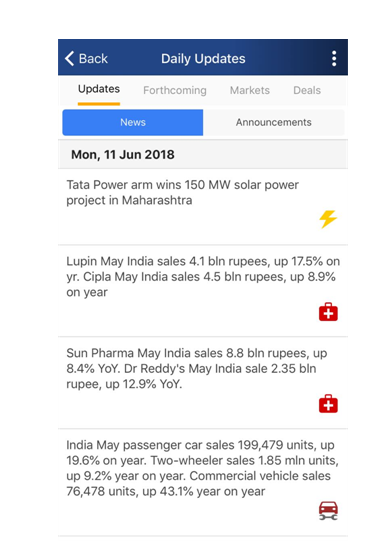

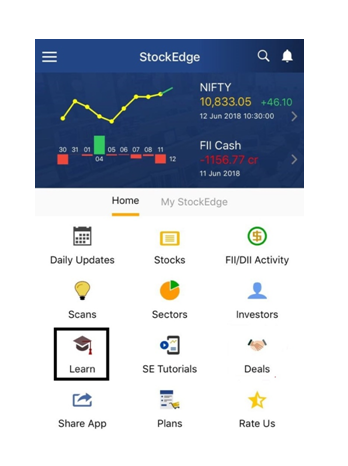

1. Daily Updates :

Who doesn’t like to get all the updates about financial markets at one place in a short and crisp manner? Stock Edge provides this feature in the “Daily updates” section. You just have to dedicate 5-10 minutes of your day to this section and you are ready with all the updates for the day.

It also helps those people who do not have much time to spare and still want to keep a track of the day-to-day activities of the markets.

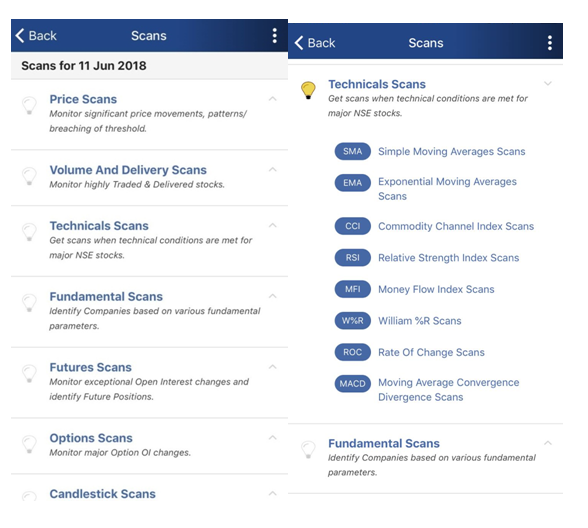

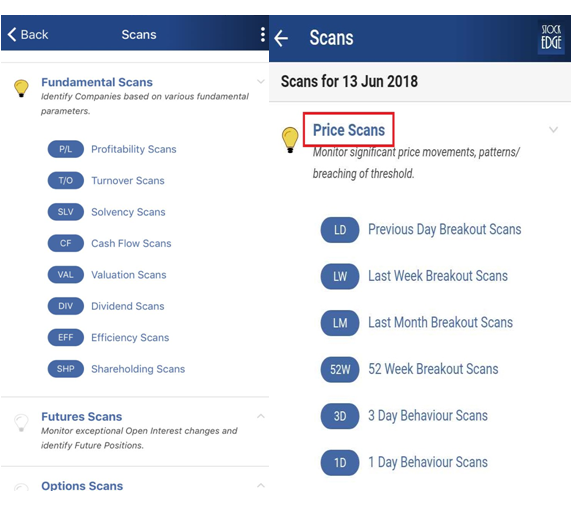

2. Scans :

Scans make it very easy for the user to filter out stocks that he wants on the different basis. For example, if the user wants to filter out stocks on the basis of profitability, he/she can use the fundamental scans, and if he/she wants to filter out stocks on the basis of technical scans like simple moving average scans, Relative Strength Index scans (RSI) etc., and he/she can do so by using the technical scans.

Likewise, there are many other scans available in the StockEdge application like price scans, volume and delivery scans, futures scans and options scans etc. The user can select the scan that he/she finds suitable and make scans accordingly.

For more detailed knowledge about each of the section of the StockEdge application, click here

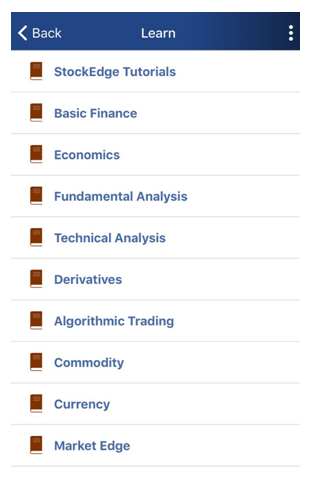

3. Learn Section :

There is even a “Learn Section” on the StockEdge homepage. In this section, many useful materials for your reference are available as shown in the image below.

These materials are free to use by anyone who is using the StockEdge application. This section is a combination of different content that has been developed to know the concepts of financial markets.

What does it include?

It includes basic and advanced levels of capital market and financial market. It includes both written material and videos by an expert.

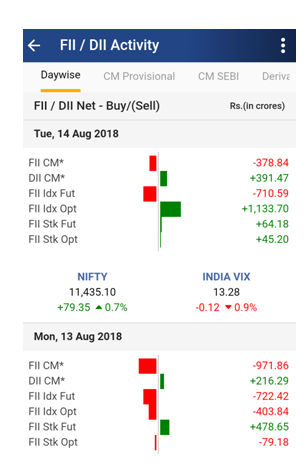

4. Tracking FII/DII activity :

Who are FIIs/DIIs?

Foreign institutional investors (FIIs) refers to people from other countries who are investing in Indian companies and Direct Institutional Investors (DIIs) are Indian Institutional Investors who invest in Indian Companies like banks, financial institutions, insurance companies, mutual funds etc.

What do they signify?

These traders trade in huge quantities so they have the capability to influence the movement of the market. This data helps in tracking the inflow and outflow of the money in the Indian market.

With the help of this data, one can track in which segment of the market, these investors are investing their money in whether cash market, futures market, stock options or stock futures.

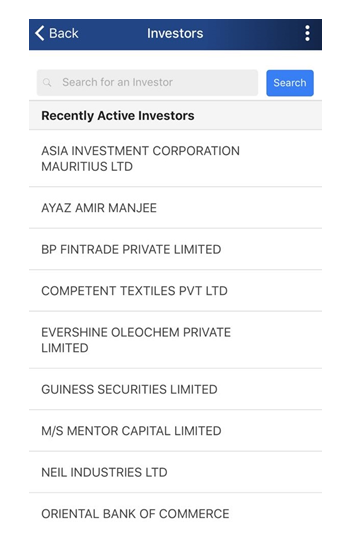

5. Tracking what big investors are doing :

This section gives you a list of all the investors that purchase shares of a company for long-term because they believe that the company has strong growth prospects in the future. Tracking these big investors helps in getting an idea of where should one invest their money in only after proper study and “doing your homework”.

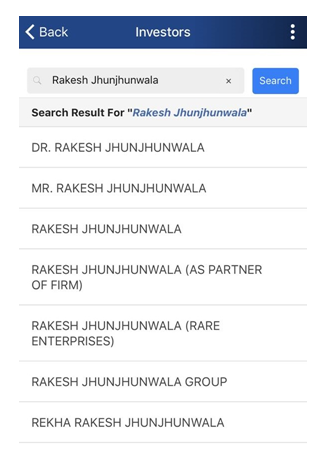

Suppose, you want to track the big bull of India, i.e. Rakesh Jhunjhunwala, all you need to do is type his name in the search box and you will get a list of people or institutions that are in any way related to Rakesh Jhunjhunwala. You can add all of them in your “investor group” and keep a track of them just by clicking on the group.

6. Search by Sector :

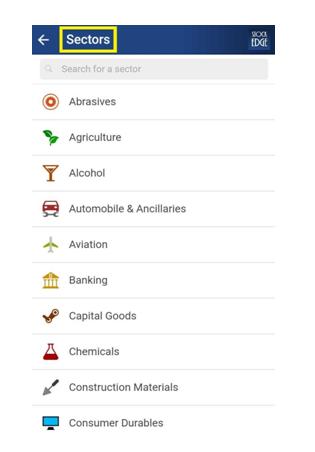

One can even search a stock by sector wise. For example, if you want to study how the automobile sector is performing, he/she can just click on the “sector” section and go to the automobile part. All the stocks are classified on the basis of the different sector which makes it easy for anyone to study a particular sector.

Bottom Line :

Stock Edge is best for anyone who does not have much time to invest in the stock market and still wants to earn returns higher than the bank deposit. StockEdge helps you to be your own analyst by providing with all the data that you need to analyze a company.

How to download the StockEdge application?

For Android (Google Play Store) users, you can click here to download the app.

For iOS users, you can click here to download the app.

You can also check out the video below for a better understanding of the application.

Link:-https://www.youtube.com/watch?v=h8ooI9Fo7Dg

Stock Edge provides you with all the analysis you required for self-research. However, if you still feel that you need a more customized learning environment, we present StockEdge club for you.

This is India’s first virtual club for stock market enthusiasts. This club will have the following features –

Access to 12 paid webinars that we conduct on a monthly basis.

Invitation to become part of one workshop in your city or in the nearby city.

Become a part of a What’s App group where there will be continuous learning, continuous doubt clearing, and continuous question and answer so that you become a more knowledgeable and learned participant of the financial market in India.

To know more about this, you can click here.

Read Also :