The success of the firm depends on the employees and the ones to whom they are accountable, i.e., Managers and Supervisors. These are the two most important positions in an organization, but there are some differences between the two roles (Supervisor Vs Manager) and this we will discuss in this article.

One of the most important tools that a leader can use is leadership communication and these leaders can add some layers to your company’s structure.

Besides, when writing a job description, confusion arises about whether to hire a manager or a supervisor. So, now let’s proceed to know the key differences and similarities between them.

Supervisors And Their Job Responsibilities – All You Need To Know

A Supervisor is a leader who makes the decisions after it is approved or confirmed by the manager. In a company, if any issue or problem arises related to the employees or customers, then supervisors are the initial point of contact for the same.

If the issue is serious and deserves high attention, then the supervisor presents it to the manager. Besides, the primary duty of a supervisor is to have a constant eye on the employees and analyze their performance & productivity in the workplace. The job responsibilities of a supervisor are described below. Have a look!

- Train new employees

- Analyze the productivity and performance of the employees

- Collecting and submitting performance reports to the department manager

- Maintaining and keeping track of personnel records and employee’s schedule

- Addressing inquiries and complaints from customers

- Training employees by giving them regular feedbacks

- Assisting employees in knowing their job responsibilities

- Creating deadlines and goals that match with the company’s plan.

Managers And Their Job Responsibilities – All You Need To Know

A manager is an individual in a high-level administrative who manages the resources of the organization and makes all the important decisions that affect all areas of business operations. They plan the desired amount that should be spent on resources, and they allocate the same to each department to reach their business objectives.

Managers have the decision-making capabilities, and they manage the department as a whole. Some of the primary responsibilities of a manager are described below. Have a look!

- Communicating department information to employees through team meetings or one-on-one.

- Provides work schedules to employees

- Assigning tasks to employees and gives feedback to the employees constantly

- Evaluating employee performance and set goals for employees

- Organizing training and professional development opportunities for all employees

- Collaborating with the human resources department

- Organizing the firm’s management structure to streamline performance, communication, and workflow.

Supervisor Vs Manager – Differences Between Them

The key differences between managers and supervisors are their level of authority, salary, responsibilities, and objectives. Generally, managers are higher-level and higher-level leaders in an organization. They are responsible for team management, goal setting, and strategic planning.

On the other hand, supervisors are closer to the day-to-day tasks of their teams, and they ensure that the manager’s goal (or company’s objectives) are achieved. Now, let’s get to know in detail.

1. Salary

Those individuals who are in the managerial post have a higher salary than the supervisor. Keep in mind; managers have more duties or burdens than supervisors (If you compare Supervisor Vs Manager) because they manage the company as a whole, which is why their salary is high.

2. Objectives

If you compare Supervisor Vs Manager, they both have different goals to meet. Supervisors coordinate with employees (have internal focus) and make sure that their work has been completed on time or not. Whereas managers have an external focus, they manage and represent the company as a whole. They make powerful plans and make sure it gives a good ROI.

3. Responsibilities

Supervisors enhance the productivity of the employees and position their departments for success. They understand the duties of the employees in detail, and they report the same to the managers about their performance and productivity. Whereas managers meet with supervisors to understand the structure of the employees and their responsibilities. Managers oversee the budget and attend meetings for the same.

4. Level Of Authority

There is no doubt that managers are the higher-ranking employees within the organization. A company can have many supervisors, and managers can promote the employee to become a supervisor. On the other hand, the level of authority of a supervisor is generally low as compared to managers.

Supervisor Vs Manager – Similarities Between Them

The job role of a manager and a supervisor can differ, but the responsibilities that they carry out are almost the same. It is because the main objective of both (supervisor and manager) is to meet the company’s objectives.

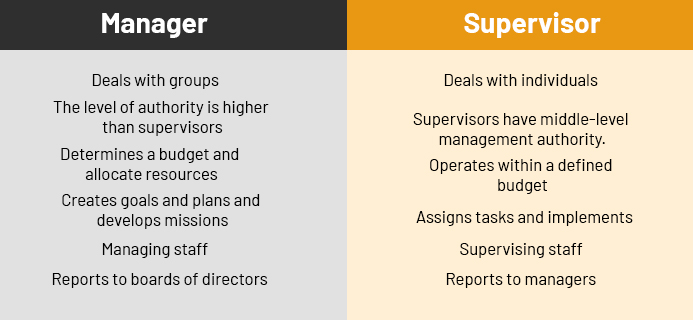

Manager Vs Supervisor – With Comparison Chart

If you compare Manager Vs Supervisor or Supervisor Vs Manager, there are some key similarities and differences between the two. So, to make your efforts easy, we have discussed this in a comparison chart below.

Closing Thoughts

The above information represents Supervisor Vs Manager job responsibilities in detail, and you must be aware of the same if you are willing to hire any for your own company. Besides, you can also describe your doubts, if you have any, in the comment section below.

FAQ( Frequently Asked Questions)

How Are Supervisors and managers are similar?

Both the positions are supervisor and manager resemble the managerial position in the organization. Both are the sole embodiment of the strategic role in a company.

What is the difference between manager and supervisor?

Supervisory experience is internally focused while managerial experience is externally focussed.

What is the difference between Supervisor and an assistant manager?

The assistant manager does the hiring process and keeps you informed about it for the overall development in the organization. Work out the plans that can work well for you.