How to become an entrepreneur?

What are the characteristics of entrepreneurs?

What do the characteristics of successful entrepreneurs include?

All these questions hover on the internet here and there. Read this blog till the end to put an end to all of your doubts……

What Is An Entrepreneur?

I am gonna kick start this blog with a quick answer to “what is an entrepreneur?” before jumping on to the characteristics of entrepreneurs.

So, according to Investopedia, the entrepreneurship definition is…

“A person who undertakes the risk of starting a new business venture is called an entrepreneur.”

An entrepreneur is a person who creates an entity to understand and imply their idea of aggregating capital and labor to produce services or goods for profit.

What Does An Entrepreneur Do?

“All our dreams can come true, if we have the courage to pursue them.”

You may think the answer to this question to be very simple, but it varies from one entrepreneurial mindset to the other. This makes the entrepreneurship definition as well as the characteristics of entrepreneurs much more complicated.

Well, it won’t be anymore because here is a perfect answer to “ what does an entrepreneur do? ”

In simple words, an entrepreneur creates a new business, bearing the majority of the risks and cherishing most of the rewards. He/she is the source of goods, services, ideas, and business or procedures.

Read More: 7 Startup Ideas for Young Entrepreneurs

Ans: It was Ferrucio Lamborghini who made tractors before entering the sports car business.

Types Of Entrepreneurs

“Inhale Confidence, Exhale Doubt”

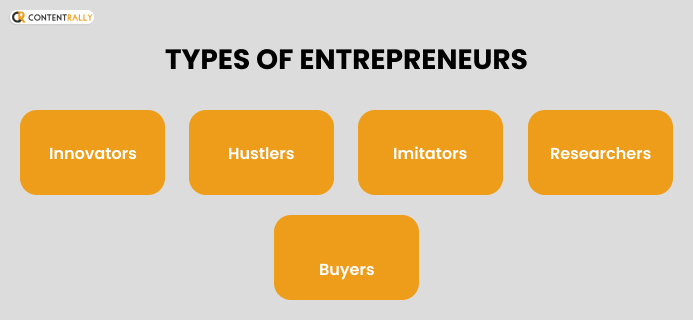

Entrepreneurs turn all the bold ideas into reality, and when it comes to the types of entrepreneurs, the divisions are 5. These categories go hand in hand with the characteristics of entrepreneurs.

Take a look👇

1. Innovators

They come up with completely innovative and out-of-the-box ideas and turn them into viable businesses. While innovators create the rules in business, they often face resistance from the shareholders.

Hustlers

Hustlers basically start with small goals and make them bigger achievements in the future. On the one hand, they outwork the most and tend to burn out on the other.

2. Imitators

Imitators are those entrepreneurs who copy existing business ideas and build them by putting in their own efforts and strategies. They make a business idea less stressful although keep comparing to the original idea.

3. Researchers

Researchers take time to gather all the relevant information that might help in the business and to boost its brand awareness. They are the ones who are responsible for figuring out the right strategies that would work for the company.

4. Buyers

Needless to say; these 5 types can also be regarded as 5 different types of mindsets entrepreneurs have.

What type of mindset do you have?

Let us know in the comment box.

What Should Be The Most Dominating Characteristics Of Entrepreneurs?

“If you don’t have big dreams and goals, you’ll end up working for someone that does.”

Have you ever thought about why the characteristics of successful entrepreneurs are somewhat similar? It’s because their final objectives are more or less the same – magnifying their ideas.

And that’s why there are 7 common characteristics of entrepreneurs which are seen as 7 Thumb Rules to be an entrepreneur.

1. Versatile

Versatility comes first to describe the characteristics of successful entrepreneurs. You have to think a lot and do a lot to make your career successful as an entrepreneur.

2. Flexible

How to become an entrepreneur?

Be as flexible as possible when required.

Stay in touch with the industry trends, current business requirements, ongoing consumer behaviors, and devise flexible plans to cover these areas.

Click Here To Read: What Is Scalable Startup Entrepreneurship: Definition & Examples

3. Money Savvy

As an entrepreneur you have to raise your business, and manage everything; from top to toe. You have to monitor every corner of your business at least in the initial days.

4. Resilient

This is one of the most crucial characteristics of entrepreneurs. A successful entrepreneur has to show resilience to all the obstacles on the road.

5. Focused

Entrepreneurship is all about staying determined and focused on your end goal. Eliminate the doubts and always hold on to why you have started.

6. Business Smart

To shine in the field of entrepreneurship, your business idea and management procedure have to be smart enough. Coordinating the revenues/costs and knowing your strengths and weaknesses will keep your business alive.

7. Communications

Communication is the most crucial key to succeed as an entrepreneur. Be it conveying the ideas or sharing B-plans with employees, communication moves your business forward.

Some Remarkable Characteristics Of Successful Entrepreneurs Around The World

“You Have To Believe It Before You See It.”

Well, enough of the speeches on characteristics of entrepreneurs. It’s time to talk about the real entrepreneurial characteristics of some successful personalities across the world.

We have considered the CEOs of Tesla, Facebook, Amazon, and Microsoft to highlight the characteristics of successful entrepreneurs.

Take a quick look and see if you can adapt some of them.

| Successful Entrepreneurs | Characteristics of successful entrepreneurs include |

| Elon Musk | Strong risk tolerance Believes in an “Always Keep Learning” attitude Has a tendency for vertical integration. Puts most of the faith on the team. |

| Mark Zuckerberg | He is an aggressive and encouraging leader. Moves fast and breaks things Follows the feedback approach Has a drive to turn ideas into reality. |

| Jeff Bezos | Highly competitive Extreme frugal Highly experimental Calculated risk-taker Highly generous. |

| Bill Gates | He considers “Time” as the most valuable in the world Loves to take calculated risks Never gives up Learns from the past mistakes Thinks ahead of the time. |

Frequently Asked Questions (FAQs):

Examples of some best entrepreneurs are: Bill Gates, Steve Jobs, Mark Zuckerberg, Elon Musk. Pierre Omidyar, And Caterina Fake.

The steps of how to become an entrepreneur are as follows:

1. Network.

2. Sell your idea.

3. Plan the business.

4. Market.

5. Find the target audience.

6. Determine whether you should earn a special degree.

7. Find out the perfect business for yourself.

The 4 types of entrepreneurs are as follows: small business, large company, social entrepreneurship, and scalable startup.

While starting as an entrepreneur, you need to make at least a small monetary investment. Be it from your friends or family, a minor investment is required.

“Remember Why You Started”

Now that you know the foremost characteristics of entrepreneurs, it’s just the beginning. Discover yourself more and keep finding that zeal within you. You do not have to be another Elon Musk Or Jeff Bezos, but you can also rule the world by being yourself.

What’s your thought on the characteristics of entrepreneurs? Do not hesitate to tell us in the comment section below.

Read Also:

- 7 Startup Essentials Entrepreneurs Should Know About

- Large Company Entrepreneurship: Definition, Pros, Cons, And More

- What Is Scalable Startup Entrepreneurship: Definition, Examples, And More