“Is real estate investment trusts a good career path?” The answer to this question is absolute ‘Yes.’ This business is already attracting lots of beginner investors into the market because it offers a high return on investment.

REITs are actually companies that own income-producing real estate across various sectors, and investors get huge benefits from this. However, there are a number of requirements to qualify as real estate investment trusts (REITs).

The main purpose of this company is to help communities grow, revitalize, and thrive. This real estate investment trust is located in every state and is considered a crucial part of the United States economy. Now, discuss this in detail.

Now, what do you think? Is real estate investment trusts a good career path? Let’s Find out!

What Is A Real Estate Investment Trust (REIT)?

As already discussed above, a real estate investment trust or REIT is an investment property that funds income-generating real estate assets.

This fund is managed by a firm of shareholders who invest funds in properties such as timberlands, hotels, shopping centers, hospitals, warehouses, apartment buildings, etc.

A REIT is similar to an exchange-traded fund (ETF) or mutual fund. A mutual fund aggregates some securities or stocks into a single group.

Then, rather than purchasing individual fund shares, investors can purchase shares of a mutual fund.

In a similar way, investors can acquire shares or partial ownership in a real estate investment trust to reap the financial benefits of investing in multiple pieces of real estate or other securities simultaneously.

An advantage of real estate investment trusts is that they offer good investment returns to the investors. This factor is attracting many to invest in this asset.

How Does A Company Qualify As A REIT?

There are some requirements for a company to qualify for real estate investment trusts, and these requirements are listed below:

- You need to have at least a hundred shareholders.

- Fifty percent of the shares should not be held by five or fewer individuals.

- The company should be managed by trustees or a board of directors.

- Be an entity that is taxable as a corporation.

- The company must pay at least ninety percent of its taxable income as shareholder profits each year.

- Obtain a minimum of 75% of its gross income from rents, mortgages, or sales of real estate.

- Lastly, invest at least 75% of its total assets in real estate.

How Can You Invest In Real Estate Investment Trusts? An investor or a company must buy stocks just like public stock.

The investors may buy shares in an exchange-traded fund or REIT mutual fund. On the other hand, there are many jobs available in real estate investmenttrusts, and these include asset management, property management, development, and much more.

How Do The REIT Companies Generate Revenue?

Now, you must understand how these companies generate their income.

Their primary income streams are leasing space. Additionally, they collect rents on the real estate under their control.

Dividends are distributed to shareholders by the authorities. Equity REITs focus on owning and managing properties.

In addition, they also generate income through rent and the appreciation of those properties.

On the other hand, Mortgage REITs specialize in financing real estate transactions, making money from the interest on their assets.

If you’re considering investing or building a career in real estate, it’s essential to understand REITs.

They present a unique chance to get involved in the market. So, they offer both challenges and exciting opportunities for investors and professionals alike.

Is A Real Estate Investment Trust A Good Career Path: Analysing The Pros And Cons

Well, you must analyse well how the REITs are acting towards your advantage. Additionally, you must also keep a check on their cons.

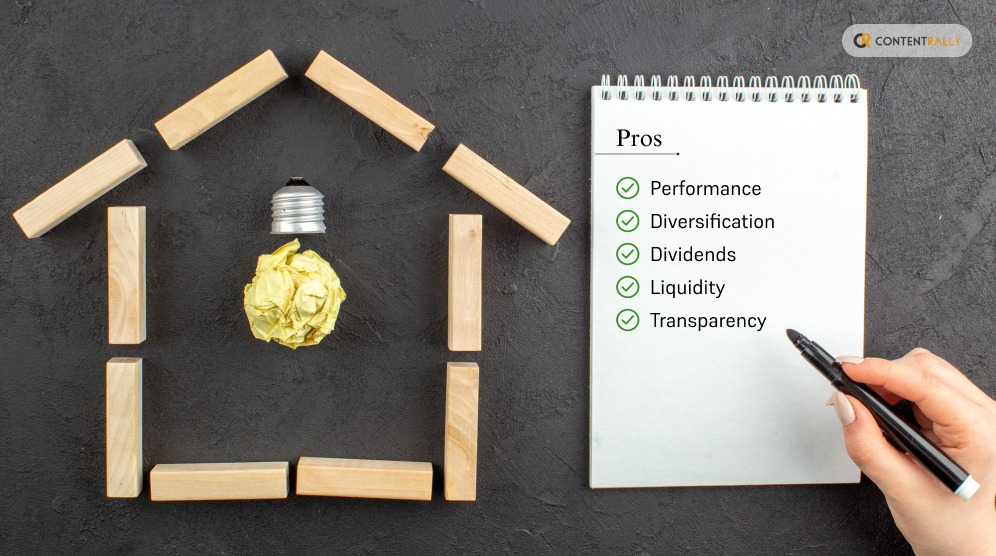

1. Pros Of Real Estate Investment Trusts (REITs)

There are some pros and cons of REITs that you need to consider before choosing a real estate investment as a career path.

Have a look at the following pros of real estate investment trusts:

i). Performance: This is proven to perform well due to the appreciation of commercial properties.

ii) Diversification: Investing in REIT is regarded as an investment portfolio where the securities and other stocks are down.

iii). Dividends: Provide a stable income stream for investors.

iv). Liquidity: You can easily buy and purchase shares in the market.

v). Transparency: This investment trust is traded on vital stock exchanges that operate under the same rules.

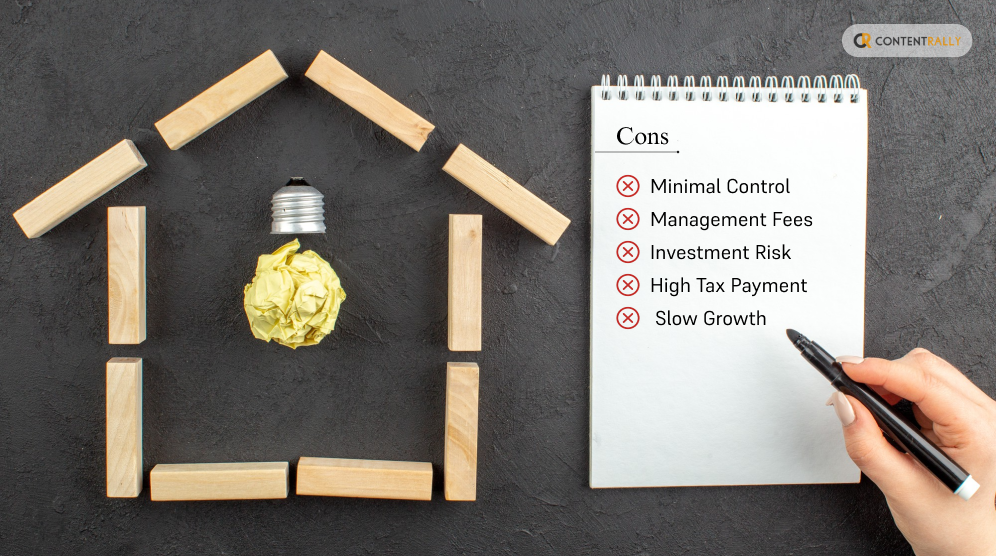

2. Cons Of Real Estate Investment Trusts (REITs)

Now, let’s know the major cons related to real estate investment trusts, and these are described below:

i) Minimal Control: If you are investing in this firm, then be prepared because you cannot control operational decisions, such as plans and strategies.

ii) Management Fees: You may be charged with high transactions and administrative fees.

iii) Investment Risk: There are some factors that can affect your investment, and these include tax laws, geography, debt, interest rates, and property valuation.

iv) High Tax Payment: The dividends can be taxed the same as normal income, and this is the drawback of REIT.

Here, you may have some clarity on your question, “Is real estate investment trusts a good career path?”

v) Slow Growth: More than 90% of profits are given back to investors, and only ten percent are reinvested.

What Are The Different Types Of REITs?

There are actually five types of real estate investment trusts, and these are described below:

1. Mortgage REITs

There are only ten percent of REIT investments in the mortgage sector, and this is regarded as being very low risk.

For diversifying your portfolio, you must consider this investment for your firm.

2. Office REITs

The name of this investment trust itself signifies that these are investments in office buildings.

Office real estate investment trusts get income from the rental income. However, there are some major factors, such as vacancy rates, employment rates, capital, etc., that you need to consider if you are interested in office rent.

3. Healthcare REITs

Healthcare REITs are an excellent choice, as in the US, healthcare costs are rising rapidly.

This type of trust includes nursing homes, retirement homes, medical centers, hospitals, etc. Hence, it is directly involved in the development of the healthcare system.

4. Residential REITs

Residential REITs include several kinds of rental properties like PGs, jobholders, etc.

However, before considering this, know the economic growth, vacancy rate, job opportunities, and the population.

5. Retail REITs

It is estimated that around twenty-four percent of the total REITs are owned by retail.

Therefore, investing in these real estate investment trusts can be the best decision that you can consider in 2024.

How Do The REIT Companies Work: A Detailed Operational Analysis

Real Estate Investment Trusts, or REITs, are structured to manage properties and share earnings with investors.

To really understand how REITs function, it’s helpful to look at their framework.

This covers everything from acquiring properties to distributing income.

1. Structure And Formation

First, let’s talk about how a REIT is formed. A REIT comes into existence when a company collects funds from investors to buy and manage income-generating real estate.

They have to follow certain legal and tax regulations, one of which requires them to pay out at least ninety percent of their taxable income to shareholders as dividends.

Most REITs are publicly traded on stock exchanges, but there are also non-traded and private options available.

2. Capital Raising

Next, REITs raise capital by issuing shares to investors, similar to how companies offer stock.

This helps create a pool of funds that the REIT uses to invest in different properties.

3. Investments In Property

When it comes to property investment, the REIT uses the capital raised to buy various real estate assets like office buildings, retail centers, apartments, and hotels.

A smart strategy for REITs is to diversify their portfolio so they can spread risk across various types of properties and locations.

4. Property Management

Once properties are acquired, the REIT manages them. Also, they handle tasks like leasing and maintenance.

In addition, they are making improvements to maximize income.

Some REITs have in-house management teams, while others hire third-party companies to take care of these responsibilities.

5. Income Generation And Distribution

The main source of income for equity REITs is the rent. The authorities collect them from tenants living or working in their properties.

On the other hand, mortgage REITs earn income through the interest charged on loans they provide to property owners.

After covering operating expenses and taxes, any remaining income is distributed to shareholders as dividends.

6. Expansion And Growth

Even though they must pay out a significant portion of their income, REITs also reinvest some of their earnings.

This can be used to purchase additional properties or upgrade existing ones.

Successful REITs often look to expand their portfolios by entering new real estate markets, allowing them to diversify their investments even further.

7. Regulatory Compliance

Lastly, REITs have to stay compliant with various regulations. They must maintain a certain percentage of their assets in real estate and have a diverse shareholder base.

Being public entities means they must provide regular financial reports to both their shareholders and regulatory bodies.

What Are The Important Certifications For A Career In Real Estate?

When it comes to enhancing your real estate expertise, there are plenty of courses and certifications beyond formal degrees that can really make a difference.

These are particularly helpful if you want to train agents or strengthen your knowledge in the REIT sector.

1. Argus Enterprise.

One important certification to consider is Argus Enterprise. This software is widely recognized for its role in real estate financial analysis and valuation, and many REITs and investment firms highly value proficiency in it.

2. Chartered Financial Analyst program

The Chartered Financial Analyst program, while not specifically focused on real estate, is well-respected in the investment management world.

Earning this designation shows that you have a solid grasp of financial analysis and portfolio management.

3. Chartered Alternative Investment Analyst

If you are interested in alternative investments, including real estate, the Chartered Alternative Investment Analyst designation might be right for you. It prepares you for roles in portfolio management.

4. Financial Risk Manager

For those focusing on risk assessment and management within REITs, the Financial Risk Manager certification can be very useful.

5. Certified Commercial Investment Member

The Certified Commercial Investment Member designation is another option.

While it leans more towards commercial real estate brokerage and investment analysis, it provides a solid foundation in principles that are applicable to REITs.

6. National Association of Real Estate Investment Trusts

The National Association of Real Estate Investment Trusts, or Nareit, offers a range of educational resources and programs.

Their courses, like the Introduction to Real Estate Investment Trusts and the Executive REIT Masterclass, dive deeply into the REIT industry.

7. University-Affiliated Courses

Additionally, many universities provide executive education, graduate certificates, or specialized courses related to real estate investment and finance.

For example, the Harvard Extension School has a Real Estate Investment Graduate Certificate that could be quite relevant.

What Are The Best Paying Jobs In Real Estate Investment Trust?

Now that you know the answer to “Is real estate investment trusts a good career path,” it is time for you to know about something important!

Before you can figure out how many jobs are available in real estate investment trusts, you need to know which REIT jobs pay the best.

Our research indicates that sales representatives, leasing agents, broker positions, fund managers, and a variety of other positions in real estate investment trusts (REITs) are the ones with the highest pay.

The advantages will increase more when you own your own land ventures. Presently, we should talk about the top divisions that get the most significant pay in the land investment trusts.

1. Asset Manager

The Asset Management department of REITs is in charge of monitoring the portfolio’s financial and operational performance.

They manage client assets in accordance with investment preferences and goals. Additionally, these managers create, manage, and organize client portfolios.

It is quite possibly the most lucrative work, with compensation going from $70,000 to $1,000,000.

They must keep an eye on the business’s financial and operational success. They are also in charge of marketing, finding investors, and checking the returns.

Asset management can be a lucrative career choice, particularly for students of investment banking, finance, and economics with strong performance.

BlackRock was the largest asset management company in the world at the end of 2019, managing approximately 7043 trillion dollars in assets. Subsequently, this is actually a colossal sum!

2. Property Manager

You might be surprised to learn that there are currently approximately 15,000 property managers employed in the United States, and this number is increasing.

A property manager’s duties include communicating with customers and negotiating the best prices for the sale or rental of property.

They handle everything, from leasing to collections and property upkeep. The best part is that applicants need not meet any minimum requirements to apply for this position.

This job pays anywhere from $55,000 to $65,000 per year, and one of the best things about it is how quickly it can grow.

3. Acquisitions

Because they have to find and evaluate potential acquisition targets, working for this job profile requires a lot of analysis.

There are many job opportunities in this sector, and the good news is that it pays well—about $80,000 per year.

They must be adept at problem-solving and aware of new revenue-generating investment opportunities. This position is one of the best in the real estate investment trust industry.

Securing divisions gives paying positions in land speculation trusts. However, this is a real estate industry position with a lot of finance.

4. Investor Relations

This department of real estate investment management manages all communication with REIT shareholders who face the outside world.

A typical administration financial backer procures up to $150,000. This is huge. Additionally, the officials regard it as the REIT’s highest-paying job position.

This is your opportunity to work in the finance and accounting division. The best thing about it is that it pays well and has good potential for growth.

In addition, organizing and preparing for the annual meeting, which includes writing a proxy statement and an annual report for the business, is part of the job of investor relations.

Presently, to land this position, you will need a college degree with a foundation in accounting or bookkeeping.

5. Real Estate Investor

This is quite possibly the best work in the land venture trust industry in light of the fact that, notwithstanding the significant compensation, there are great possibilities of headway in this industry.

Their primary function is to help people become financially independent by investing in real estate.

Before investing and trading, this job requires extensive market research, which takes time.

It will be mentally and physically demanding. This is because your work will demand that you carry out a variety of tasks regarding the properties, such as:

- Inspecting

- Maintaining

- Flipping

- Purchasing

- Restoring

They can increase the value of their investments as a result of all of this.

You really want a degree in bookkeeping, money, or business to turn into a genuine financial backer since you want to think of ways to improve ventures for you as well as your clients.

A land financial backer procures somewhere in the range of $15,000 to $15,000 each year.

Bottom Line: Real Estate Investment Trusts Is A Good Career Path

You might have got the answer to your question, “Is real estate investment trusts a good career path?”

Consider the pros, cons, and types of real estate investment trusts (REITs), and then you can decide whether it is good for your career path or not.

However, according to the experts, REITs are considered a good career path!

Frequently Asked Questions (FAQs)

Yes! REITs are important when building a portfolio of stocks or bonds. They can help diversify your investments, provide higher returns, and lower risk.

Their ability to pay dividends and appreciate makes them a great balance against stocks, bonds, and cash.

Real Estate Broker is definitely one of the high-paying jobs in real estate.

A career in real estate can be a good fit for people. You must have strong interpersonal skills. Additionally, you must be self-motivated and hard-working.

However, it may not be a good choice for those who need a steady income. In fact, if you feel uncomfortable with rejection, it’s best not to go.

REITs in India can be a valuable addition to a diversified investment portfolio, particularly if you seek regular income and exposure to the commercial real estate market without the burdens of direct ownership

A career in REITs usually requires a bachelor’s degree in finance, real estate, business, or economics.

Many entry-level jobs are available with these degrees. However, getting advanced degrees and professional certifications can help you move up in your career more quickly.